Tech stocks are out of favor — 5 reasons to shop alongside the contrarians

Life may be returning to normal for most people. But not for die-hard tech stock fans.

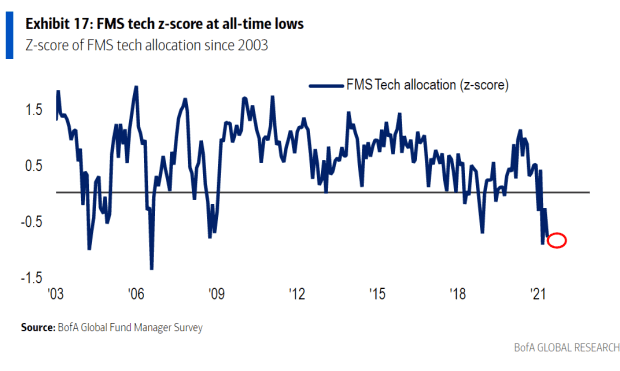

Their stocks are among the least liked by other investors, according to a recent Bank of America fund manager survey. It found that fund managers have the lowest level allocation toward tech since 2003.

How can this be?

Tech has a growth issue. That seems odd, but it makes sense if you think it through. Cyclical companies in areas like energy, industry and basic materials caught in the doldrums during the pandemic are now seeing a Phoenix-like reversal of fortune.

In contrast, sales and earnings at a lot of tech held up OK during the pandemic. So the updraft they get from a rebounding economy looks sort of ho-hum, relatively speaking.

“Because of COVID, a lot of tech companies saw a lot of growth,” says Vlad Rom, a senior investment analyst at Thrivent, a Minnesota-based money manager. He noted that the pandemic pulled forward tech spending as companies looked for new ways to reach consumers and run meetings.

“This was not the case for non-tech companies,” he says. Now, as the economy picks up, those non-tech companies are seeing a big growth rebound. “A tech company growing at 30% last year will grow 30% this year. A non-tech company with zero growth last year will grow 50% this year. That is what a lot of investors are focused on.”

In other words, it’s all about the cyclical trade you’ve been hearing so much about. “The incremental change for a more cyclical business looks better,” says Joseph Chin an analyst at Cambiar Investors in Denver.

Another problem is that emerging tech companies – think recent initial public offerings – expect their big payoff in profits in the distant future. So they get hit hard when investors fear rapid inflation will send interest rates higher. This reduces the present value of future profits in valuation models.

In short, tech is out of favor, which makes it a place to shop for contrarians like myself. Indeed, tech has already been putting in a rebound over the past several trading days. The Nasdaq Composite COMP,

“Big tech looks very attractive today especially given the recent underperformance,” says Todd Lowenstein, chief equity strategist at HighMark Capital Management. “It’s a unique opportunity to upgrade your portfolio to quality in big tech, it’s where some of the best value is in the market today.”

Here are five reasons why.

1. Insiders are buying

For my stock letter (Brush Up on Stocks, link in bio below), I’ve tracked insiders daily for over a decade, and one thing is always clear: Insider buying at tech companies is exceedingly rare. But that’s changed in the past few weeks – which brought an unusually high volume of tech insider buying.

I just published an issue of my stock letter focusing solely on tech for the first time ever and featured 10 names that look very attractive. I highlighted several others in my letter earlier this month. I single a few out below. Bottom line: The widespread insider interest tells me tech is a buy.

2. Tech’s ‘growth problem’ will go away

The pandemic pulled forward a lot of tech adoption among companies. That makes year-over-year comparisons at tech look challenging as we move through 2021, says Matt Miskin, the co-chief investment strategist at John Hancock Investment Management. ‘But as we go into 2022, we believe the street is underestimating the growth in technology relative to the overall market. We would look opportunistically at tech in the next couple of months.”

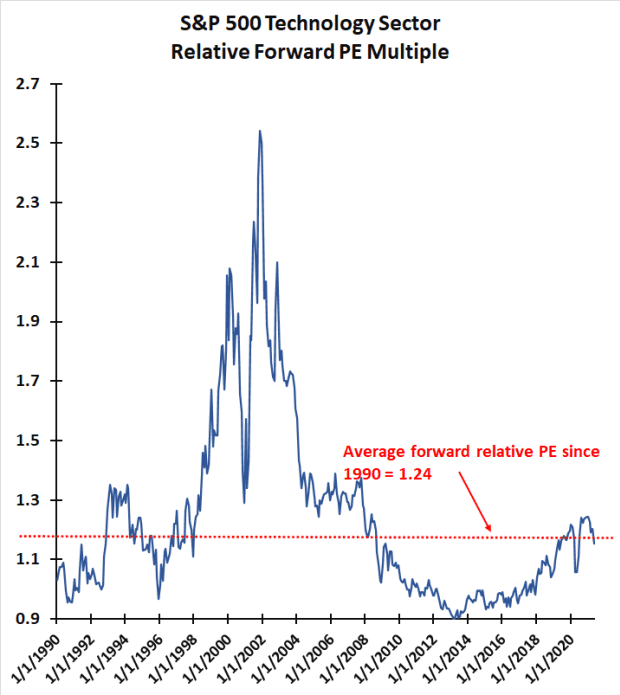

3. Tech looks reasonably priced

The chart below shows the relative value of S&P 500 tech stocks compared to the valuation of the S&P 500 itself. As you can see, tech’s price earnings ratio was recently traded at its average 1.24 times the price earnings multiple of the comp.

4. Tech has an edge when labor costs are rising

While companies in retail, restaurants, hotels and other service sectors will suffer a hit to margins because of rising labor costs, tech companies typically do not have this problem. They employ relatively fewer people.

“Perhaps the best way to play the uncertainty surrounding labor costs is technology,” says Leuthold Group chief investment strategist James Paulsen. “Historically, the relative investment performance of this sector has been largely invariant to such pressures.”

5. Interest-rate and inflation fears are overblown

Ironically, tech companies will come to the rescue – and literally save their own stocks. Why? Capital spending rose a lot in the past year. This tells us productivity will continue to increase. That makes it easier for companies to avoid passing higher labor costs on to consumers in the form of price hikes.

“Long-term growth of this economy is going to have to be driven by productivity growth, and technology will be the key to create that productivity,” says Miskin.

What to buy

The arms dealers in chips

Chip and chip manufacturing companies look underpriced, says Chin at Cambiar Investors, and he singles out Applied Materials AMAT,

Chin cites four reasons to favor Applied Materials: the ongoing chip shortage; the reshoring of chip manufacturing to the U.S.; demand from trends like autonomous vehicles, artificial intelligence and data analytics; and competition among chip makers to improve chip computing power. “We believe Applied Materials and the industry are entering a period of much higher growth,” he says.

“It will take another four to six quarters for supply to catch up with demand and inventories,” says JP Morgan analyst Harlan Sur, who has an overweight rating on Applied Materials, KLA KLAC,

Names that insiders favor

In the past several weeks I’ve suggested Microsoft MSFT,

Early in big economic rebounds, investors flock to growth, regardless of the quality of companies. But as we move into the mid-cycle, investors favor quality tech names, says Lowenstein, characterized by things like high margins, stable earnings growth and strong balance sheets.

“If you are screening for quality that is going to lead you to tech,” says Lowenstein.

This will favor Microsoft in cloud computing and software. Microsoft does not look cheap but the premium valuation is warranted because of its rapid growth, says JP Morgan analyst Mark Murphy.

Intel shares have been held back by manufacturing issues, but by now the stock looks relatively cheap compared to the market with its price earnings ratio of around 12, says Hendi Susanto a portfolio manager and technology analyst at Gabelli Funds. “Intel is fixing the issue,” says Susanto.

Intel will also benefit from strong chip demand, and chip shortages. “The industry is only 30%-40% through the current up-cycle,” says Sur, at JP Morgan.

Snowflake is all about data. That’s its mission. The company offers a product called Data Cloud that helps customers share, explore and unlock the value of data. A big part of the pitch here is that Snowflake helps customers break down data silos inside various pieces of hardware, apps, networks, and clouds. BlackRock and MasterCard agree. They are customers, among dozens of other Fortune 500 companies.

Security software companies

The recent Colonial Pipeline ransomware attack that caused widespread fuel shortages on the East Coast reminded us all of the ongoing need for better security software.

Gabelli’s Susanto favors firewall company Check Point Software Technologies CHKP,

RBC Capital Markets analyst Matthew Hedberg has an overweight rating on Palo Alto, citing in part the Colonial Pipeline ransomware attack, as well as the “Sunburst” hack affecting businesses and governments last December, and the Microsoft Exchange Server malware attack in March.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned SNOW. Brush has suggested NVDA, MCHP, MSFT, INTC, SNOW, BLK, MA and PANW in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.