Financial advisers aren’t scared of Biden’s retroactive capital-gains tax hike — but they’re definitely not thrilled about it either

For millionaires rushing to take advantage of lower capital-gains tax rates, the Biden administration’s budget proposal says they’ve already missed the boat.

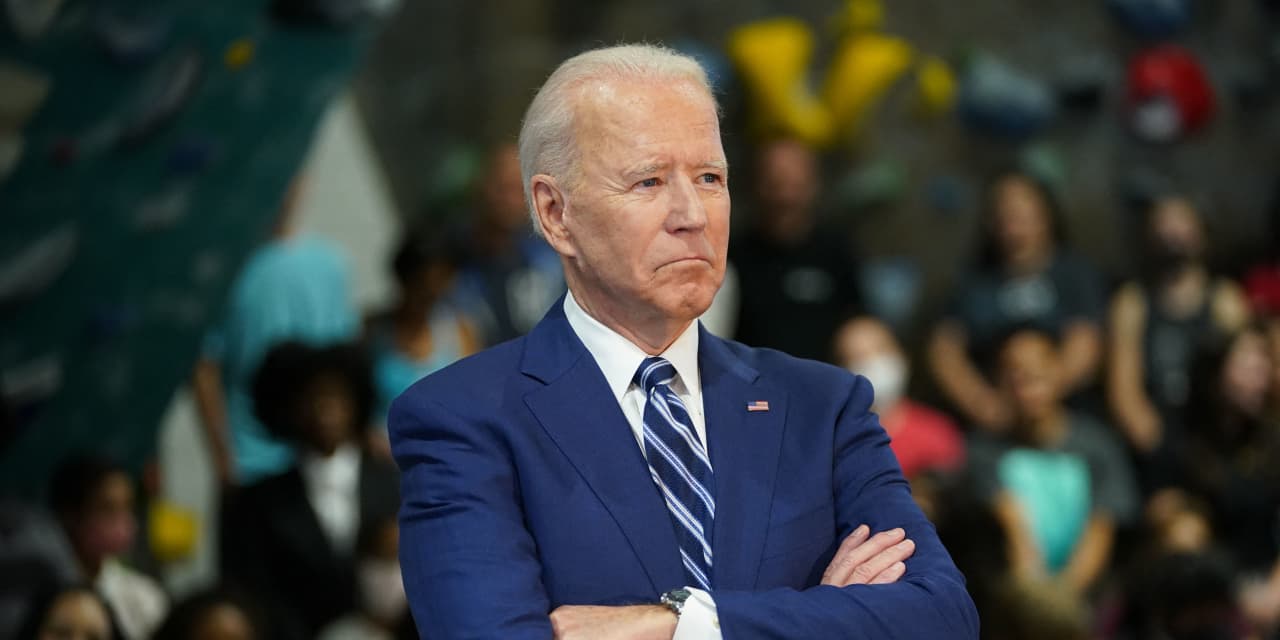

On Friday, the Treasury Department’s detailed explanations of President Biden’s $6 trillion budget confirmed the administration is seeking a retroactive effective date on a capital-gains tax rate hike from 20% to 39.6% for the sliver of households making at least $1 million.

“This proposal would be effective for gains required to be recognized after the date of announcement,” according to Treasury Department materials released Friday afternoon.

Biden formally unveiled the capital-gains rate hike and other tax hikes geared toward top earners on April 28 while addressing members of Congress. Proposed effective dates on the capital-gains tax rate were a big open question. The Wall Street Journal first reported the retroactive effective-date proposal on Thursday.

“ The prospect of retroactive tax clauses had always been on their radar — it just became a little more real this week. ”

The purpose of the backdate proposal is to avoid a sell-off window ahead of the rate hike, Treasury officials said Friday. History shows that has happened ahead of previous capital-gains rate increases.

Now financial planners advising wealthy clients are trying to figure out their next moves without panicking, as Biden tries to get his budget and its various tax-code overhauls through Congress.

“I’m not freaking out, but I can’t just put my head in the sand,” said Lisa Kirchenbauer, the founder and president of Omega Wealth Management in Arlington, Va.

“It gave me more agita,” said Leon LaBrecque, chief growth officer at Sequoia Financial Group in Troy, Mich. He received about 10 to 15 texts and emails on Thursday flagging the news.

Even before the 2020 election, financial planners and attorneys for wealthy clients had been planning for the potential tax impacts of a Biden presidency. The prospect of retroactive tax clauses had always been on their radar — it just became a little more real this week.

There’s a good chance the capital-gains rate will increase, according to a note Thursday from Brian Gardner, Stifel’s chief Washington policy strategist. But it’s likely going to be a smaller increase than what the administration wants, and the effective date could be different as well, he said.

“ A retroactive tax hike is ‘extremely unusual,’ and has other downsides: ‘It really makes people mad, and it’s really hard to administer.’ ”

LaBrecque doesn’t think retroactive tax clauses will ultimately make the cut, calling them a “bargaining chip.” A retroactive tax hike is “extremely unusual,” he said. And it has other downsides: “It really makes people mad, and it’s really hard to administer.”

Other advisers told MarketWatch potential tax-policy changes shouldn’t drive the conversation on what to do with valuable assets and money plans. So there’s a wait-and-see attitude now, but also some extra tax planning that may have to happen.

“If that date really holds, all we can do is mitigation now,” Kirchenbauer said.

For example, she said, that might mean stepping up a client’s charitable giving in order to build up the deduction that in turn reduces the tax bill.

Or if clients are hovering right around the $1 million income mark, Kirchenbauer said, she might have to look into maxing out contributions to all retirement savings accounts in order to get the income below the $1 million mark.

Another potential move is spacing out capital asset sales, or “realizations,” over several years to avoid reaching the $1 million income mark, she said.

If the capital-gains rate is increased, millionaire and billionaire taxpayers would actually face a 43.4% tax on capital asset sales, when factoring in a 3.8% tax linked to the Affordable Care Act.

Biden is also seeking to raise the top income-tax bracket to 39.6% from 37%. He would also repeal the “step up in basis” for gains above $1 million for individuals.

Currently, the step up rules say when an heir receives an asset — like stock shares — that has appreciated over time, and then sells it, the capital-gains tax is based on the time when the heir received the asset.

The tax increases are part of Biden’s $1.8 trillion American Families Plan, which would create paid family leave, free community college and an extension of the expanded child tax credit payouts through 2025.

See also: Wealthy taxpayers are bracing for more taxes under Biden, but they’re missing this key information