Ethereum and XRP Looking More Attractive as Investors Rush to Exit Bitcoin Funds

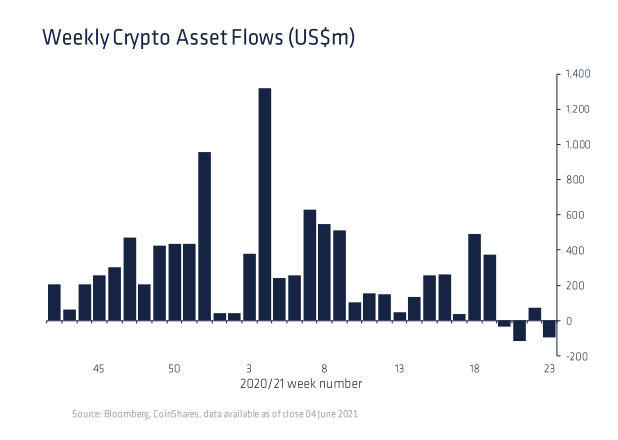

Bitcoin-focused investment funds suffered record redemptions by investors last week after May’s price drop soured sentiment on the largest cryptocurrency by market value.

Investors redeemed a net $141 million from bitcoin funds during the seven days through June 4, the highest weekly total on record, according to the report from CoinShares, a digital-asset manager. The amount represents about 8.3% of net inflows recorded earlier in the year.

In May, most digital asset funds experienced net outflows when the bitcoin price suffered a near 30% correction.

Related: El Salvador Poised to Become the First Bitcoin Country: Just How Big a Deal Is This?

Investor sentiment has remained broadly negative, although there could be signs the worst is over as investors diversify within the crypto space, according to the CoinShares report.

Investors have shown interest in funds focused on alternative cryptocurrencies including ether, XRP and cardano.

-

Investors plowed $33 million into funds focused on ether, the native cryptocurrency of the Ethereum blockchain.

-

Inflows to XRP funds totaled $7 million, the largest amount since April.

-

Cardano and multi-asset products saw inflows of $4.5 million and $2.7 million respectively, according to CoinShares.

Overall, digital asset funds suffered net outflows totaling $94 million during the week.