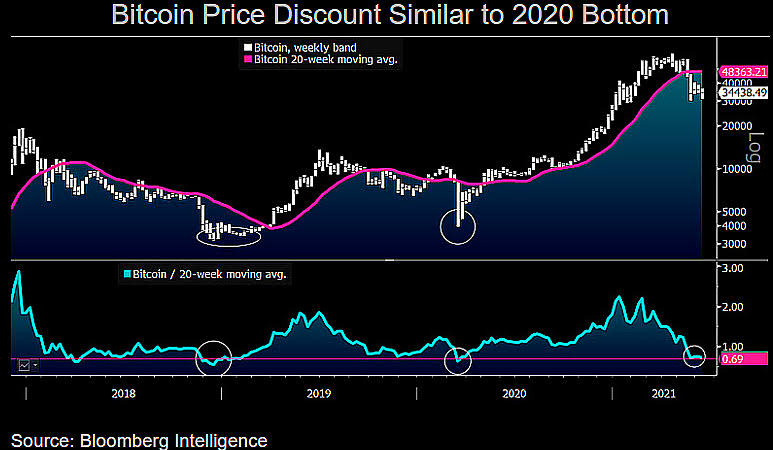

Bitcoin’s Steep Price Discount Seems Similar to March 2020 Bottom

Bitcoin traded at a significant discount to its long-term moving average earlier this week, implying an overstretched bearish move and potential for reversal higher.

The cryptocurrency dropped to nearly $30,000 on Tuesday, pushing the ratio to its 20-week simple moving average (SMA) down to 0.61, the lowest since the March 2020 crash.

Historically, bitcoin has carved out major price bottoms with the ratio near 0.60.

Related: Bitcoin Holds Short-Term Support; Faces Resistance at $40K

“Our graphic depicts bitcoin at the steepest discount to its 20-week moving average since the March 2020 bottom around $4,000,” Bloomberg’s Mike McGlone said in a research note published on June 9. “A more enduring discount at the end of 2018 marked the low closer to $3,000.”

If past data is a guide, Tuesday’s low near $30,000 could also turn out to be a bear-market bottom. Bitcoin has bounced up slightly over the past three days to near $37,000, but remains well under the 200-day SMA at $42,000.

According to McGlone, the sentiment has turned a little too bearish, a feature that is often observed at market bottoms.

“Calls for $20,000 and technical patterns such as ‘death crosses’ are often triggers for the more fundamentally focused and longer-term bulls to be responsive buyers,” McGlone noted.

Related: SEC Again Warns Investors Against Bitcoin Futures Funds

A death cross, or the bearish crossover of 50-day and 200-day SMAs, is widely taken to represent a long-term bearish shift in momentum. Bitcoin’s 50-day SMA is trending south and looks set to cross below the 200-day line in the next few days.

Some analysts are worried that could bring in more profound losses. However, these indicators often trap traders on the wrong side of the markets as they are based on past data and tend to lag prices.

In other words, by the time the crossover happens, the asset is oversold and primed for a bounce. The last two instances of death crosses, March 2020 and Oct 2019, turned out to be bear traps.

Blockchain data shows large investors continue to accumulate coins, shrugging off the recent China crackdown on crypto mining or the death cross fears.

McGlone remains optimistic about bitcoin’s long-term price prospects. “Early days of price discovery, plus mainstream adoption and the inevitability of U.S. ETFs, keep $100,000 resistance on our radar,” McGlone said.

Also read: Gold Tokens Take Off as Inflation Accelerates, Bitcoin Retreats