16 short-squeeze targets in the stock market, including Canoo, Tootsie Roll and a prison operator

In the world of meme stocks, the most important factor for traders looking for quick gains is probably the concentration of comments about companies in Reddit’s WallStreetBets channel and other social media outlets. But numbers can also point to stocks that may be set up for short squeezes that can be lucrative for traders with excellent timing.

Below is a list of stocks that may be good targets for short squeezes. Consider it a tool that traders can use as part of their own research. But first, a quick refresher.

Short-selling and short squeezes

- Short-selling is when an investor borrows shares and immediately sells them, hoping to buy them back later at a lower price, return them to the lender and pocket the difference. When short interest for a stock is very high, short-sellers have to pay high-double-digit interest rates to borrow the shares.

- Covering is when a person with a short position buys the shares to return them to the lender, to profit if the shares have gone down in price since they were shorted, or to limit losses if they went up after being shorted.

- A short squeeze is when many investors looking to cover short positions begin buying at the same time. The buying pushes the share price higher, making short investors accelerate their attempts to cover, which sends the shares spiraling higher in a frenzy.

This is what happened earlier this year when traders as a group decided to take on professional short-sellers by purchasing shares of heavily shorted stocks, including GameStop Corp. GME and AMC Entertainment Holdings Inc. AMC

The move has paid off for at least some of them. This year through June 17, shares of GameStop had skyrocketed 1,087%, while the company’s stock-market value had surged to $16.06 billion from $1.31 billion at the end of 2020. AMC Entertainment’s stock has leapt 2,765% for 2021, while its market cap has increased to $30.47 billion from $348 million at the end of 2020.

Both companies were able to take advantage of all their new popularity by selling more shares to the public.

Potential new short-squeeze targets

The buying of GameStop and AMC Entertainment shares was so significant that the short-squeezes caused hedge funds to change their ways by reducing their use of leverage to short stocks, according to Brad Lamensdorf, CEO of investment adviser ActiveAlts. Lamensdorf also manages the co-manages the AdvisorShares Ranger Equity Bear ETF HDGE,

In discussing his own method for selecting potential short-squeeze candidates, Matthew Tuttle, CEO of Tuttle Capital Management in Greenwich, Conn., said he begins with “a 10/10 rule”. That stands for short interest of at least 10% and at least 10 days needed for short-sellers to cover their positions in a stocks, if all decided to do so, based on average daily trading volume. Days to cover might reflect low trading volume for a stock, creating a special opportunity for a squeeze.

Tuttle, who recently established the FOMO ETF FOMO to seek to take advantage of any market trend, including sector shifts, short squeezes and the “meme stock” phenomenon, said this is one of “multiple screens” he does before considering purchasing a heavily shorted stock. He also looks at other factors, including social-media buzz.

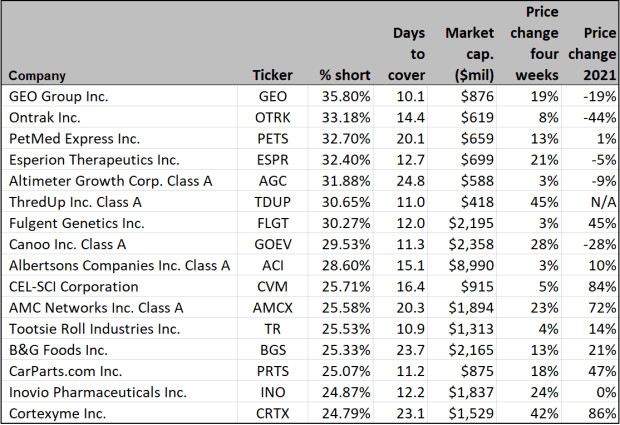

Lamensdorf said it would be useful to see a list of stocks with at least 25% short interest and 10 days to cover.

To put this list together, we began with a group of 4,394 stocks listed in the U.S. and Canada of companies with market caps of at least $300 million. Among these companies, 263 hit Tuttle’s “10/10” threshold.

Here are the 16 with short interest of at least 25% (rounded up) and at least 10 days to cover:

GameStop and AMC Entertainment didn’t make the new list. Short interest for GameStop is high at 20.96%, but that is dramatically lower than the 138% on Jan. 26. It would now take short-sellers only 1.5 days to cover.

For AMC Entertainment, short interest is 22.81% and it would take only half a day for all the short-sellers to cover.

FactSet’s data on short positions as a percentage of shares available for trading is updated twice a month, depending on when the data provider receives information from stock exchanges.

On the list you can see some stocks have shot up this year, or over the past four weeks. Big gains don’t mean there cannot be another short squeeze.

GEO Group Inc. GEO,

Canoo Inc. GOEV,

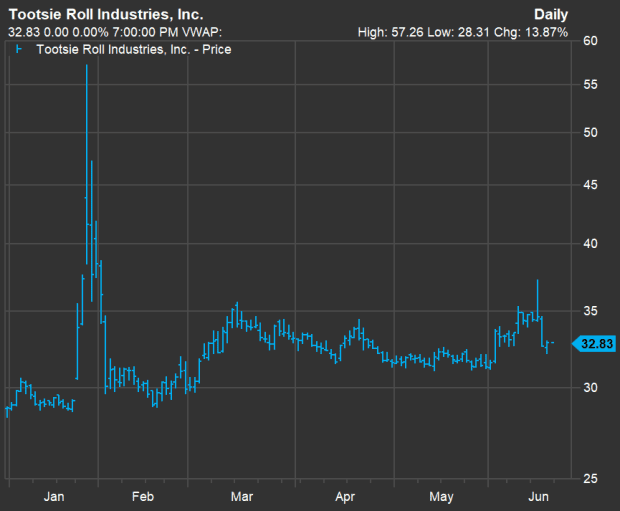

Tootsie Roll Industries Inc. TR,

The Tootsie Roll action illustrates the potential for tremendous gains or losses for short-sellers and those who attempt to create or benefit from short squeezes. It can happen again for Tootsie Roll and any of the companies on the list above. But you have been warned.

The list can help traders but it only includes two of the short-selling data points. Data on the cost for short-sellers to borrow the shares isn’t available. You can try to gauge internet-chatter volume for meme stocks on your own, or through a service, such as HypeEquity, which tracks “social sentiment analysis,” as MarketWatch has previously described.