Here’s what could turn a ‘breather’ for stocks into a bigger correction

After the Fourth of July holiday, equities look set to pause from a record-busting run. The world’s biggest oil cartel may have something to do with that, after it called off talks on a supply increase.

One line of thinking is that if the situation doesn’t resolve and oil prices keep climbing, that will pile pressure on inflation and then the Federal Reserve to tighten up policy.

As for stocks, our call of the day points out that they are looking expensive and yes, a correction could be coming.

Led by a 15.8% gain for the S&P 500 SPX,

Maley expects the stock market to take a “breather” over the very short term to digest those first-half gains, and given equities are looking overbought and a bit expensive, he said the question to ask is what would turn a “breather” into a full-blown correction?

Look to chip stocks — a sector that has seen huge demand from the reopening trade — for answers, he suggested.

He pointed to the VanEck Vectors Semiconductor exchange-traded fund SMH,

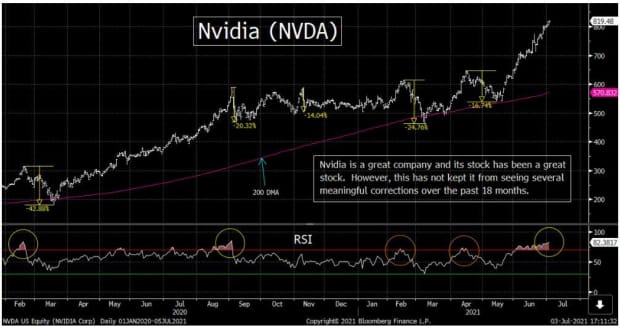

Maley also looked at specific activity for a handful of chip stocks, such as Nvidia NVDA,

While Nvidia is a great stock, it has also seen four sizable corrections in the past 18 months, he said.

“When you combine the fact that NVDA has become a somewhat vulnerable after its big run over the past seven weeks…with the poor performance in MU last week…there are reasons to think that the chip group might fail to break above its all-time highs in a meaningful way (much like it failed to do in April). If (repeat, IF) the SMH rolls-over in any significant way over the near-term, it’s going to be tough for the broad market to rally a lot more,” said Maley.

Read: Is the market pricing in ‘peak growth’? These charts suggest as much, says a leading strategist.

Chinese apps in trouble and a stalemate for OPEC +

Stock futures ES00,

More on that as U.S. shares of Chinese app makers are dropping in premarket trading, after probes by China’s cybersecurity regulator. Shares of ride-hailing group Didi Global DIDI,

Crude prices CL.1,

On the data front, the Institute for Supply Management’s service index for June is coming after the market open.

There has been yet another China crackdown on bitcoin, it seems. The cryptocurrency BTCUSD,

Israeli health ministry data reportedly showed vaccine effectiveness against the highly contagious delta coronavirus strain dropping from 94% to 64%, with 55% of new infections found among fully vaccinated people, though vaccines are still preventing serious illness. The country uses Pfizer PFE,

Travel to Canada for Americans may now be opening back up, while a surge in COVID-19 cases in Springfield, Missouri has led to a ventilator shortage.

Random reads

The staycation industry can get stuffed, says the U.K. man who was told it would cost his family £71,000 (just over $98,000) to stay a week in Cornwall.

Iceland’s four-day workweek trial has apparently been a huge success.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.