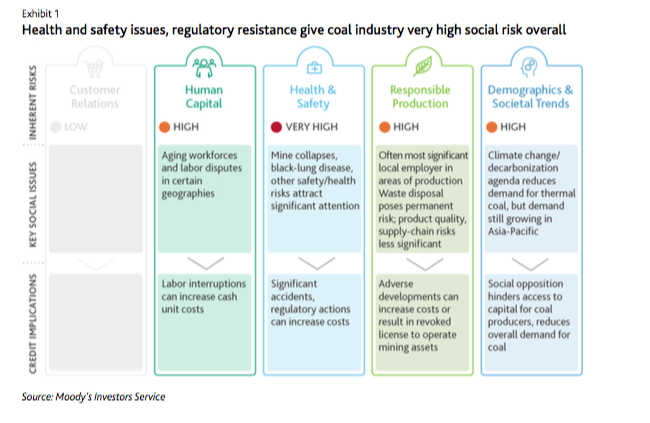

All pure-play coal companies are rated below investment-grade today. In Moody’s analysis of dozens of global sectors, researchers have determined that the coal industry has very high social risk with thermal coal facing more significant risk than metallurgical (met) coal used in steelmaking.

Access to capital is diminishing amid changing demographic and societal preferences. Social pressure to divest coal investments or refrain from making new investments is increasingly significant for producers. Moody’s notes.

A projected rebound in thermal coal demand in 2021 will be short-lived in the US, where coal demand is in long-term secular decline, and growth will likely slow in Asia-Pacific, Moody’s predicts, noting that health and safety issues associated with coal mining will remain a significant hazard for coal producers.

While health and safety records have improved, coal mining is still a dangerous occupation with notable regional differences. Moody’s categorizes the sector’s health and safety risk as very high because of high-profile safety-related issues such as mine collapses and fires, as well as health-related issues such as black lung disease that can create cash outflows and longer-term uncertainties.

Carbon-intensive industrial sectors often exhibit high exposure to responsible production issues. Moody’s considers responsible production risk high for the coal industry, which must contend with such social risks as waste disposal and local community relations, on top of environmental risks such as carbon emissions.

Coal industry will face increasing risks related to human capital

“Particularly in North America, the industry today must grapple with aging workforces, union disputes, and the difficulty of recruiting and retaining skilled workers,” Moody’s says.

A number of unfavorable conditions within the coal industry encourage capable workers to seek employment elsewhere, but in many areas coal mining is still an attractive option for employment. In the US, political issues related to the coal industry are more divisive than in other producing countries.

Moody’s took negative rating actions in 2020 for most of the rated coal producers in North America with limited improvement in 2021. As with many other hard-hit industries, US coal producers responded to the global outbreak of covid-19 and a severe reduction in demand by seeking flexibility under existing financial arrangements and obtaining new financing.

Some prominent investors have restricted or eliminated their investments in the coal industry—especially for thermal coal, a fuel source with stiff competition, contributing to that industry’s long-term credit risks, Moody’s says.

There were no new unsecured bond deals or secured term loan deals for any rated pure-play US coal producers in 2020. Instead, some companies amended existing facilities, including Alliance and CONSOL Energy (B2 stable), while others tapped other markets for financing, such as convertible and tax-exempt debt. Arch Resources (B2 stable) completed convertible and tax-exempt offerings to keep moving forward on its Leer South met coal project in the US state of West Virginia, and CONSOL also completed a tax-exempt offering in the state of Pennsylvania.

Meanwhile, Peabody Energy (Caa1 stable), which attempted and failed to refinance in late 2019, experienced severe stress in 2020 and ended up pursuing a multiparty restructuring transaction in early 2021 after receiving escalating collateral requests from surety bond providers related to environmental liabilities.

Health and safety issues include mining accidents, health problems for workers

Moody’s expects health and safety issues associated with coal mining will remain a significant hazard for coal producers. While health and safety records have improved, coal mining is still a dangerous occupation with notable regional and company-level differences in related statistics.

Moody’s categorizes the sector’s health and safety risk as very high because of safety-related issues such as mine collapses and health-related issues. Specific coal mining incidents can be highly disruptive and in some cases have significantly damaged a company’s credit quality.

There were no new unsecured bond deals or secured term loan deals for any rated pure-play US coal producers in 2020

Moody’s Investor Service

The former Massey Energy’s Upper Big Branch Mine disaster left 29 miners dead in West Virginia in 2010. Other significant examples include a fire at Peabody Energy’s North Goonyella Mine in Australia, which led to an extended shutdown of the mine, and ongoing problems obtaining the approvals necessary to restart production.

Coal workers’ pneumoconiosis, or black lung disease, has been significant and widespread enough to attract political attention, including a specific funding mechanism involving a trust fund in the US. The job-related illness stemming from long-term exposure to coal dust can cause fibrosis of the lung and industrial bronchitis, diminishing quality of life and sometimes proving fatal.

The US Federal Coal Mine and Health Safety Act of 1969 established a trust fund that helps workers handle related medical expenses, with funding from coal producers based on their production levels. The trust fund has faced political negotiations and changes in the tax rate in recent years, which increases the likelihood of a more costly permanent solution, Moody’s states.

Significant waste, pollution, accidents all intensify regulatory scrutiny

Carbon-intensive industrial sectors often exhibit high exposure to responsible production issues. Many of the sectors that scored high risk for responsible production, including coal, also scored high or very high risk for carbon regulation in our environmental heat map.

Responsible production issues surrounding these sectors tend to center mainly around waste disposal and local community relations, rather than on carbon emissions more directly. Even so, Moody’s says, all factors apply to the coal sector, considering the uses of coal and the carbon emissions associated with coal for power generation and steelmaking. As with other industrial sectors, the overlap very clearly indicates significant environmental and social exposures across their value chain.

Moody’s deems responsible production risk high for the coal industry. A coal mine is often the most significant local employer, and waste disposal can be a hazard, while product-quality and supply-chain risks are less significant.

Issues related to coal mining include on- site matters such as sludge impoundments, filled with waste material left after coal is washed before shipment to customers, as well as issues at customers’ sites such as coal ash ponds, which contain waste material after coal is burned to generate electricity, Moody’s points out.

Some rated coal companies also have a significant number of legacy sites where they no longer mine coal—an issue of increasing importance in regions where demand is sharply declining. Beyond obtaining legal permission to operate mining assets, mining companies also face increasing scrutiny that could manifest in issues related to social license to operate, as highlighted in a recent report about social license from Indigenous communities for Australian mining companies.