Why economists think bond yields are falling, slamming the S&P 500 and the Dow as the likes of Amazon benefit

Bond yields continued to fall on Thursday, with the yield on the benchmark 10-year U.S. Treasury note holding well below 1.3%, down dramatically from 1.45% at the beginning of the week and 1.6% just last month.

This has, in turn, pummeled Dow industrials DJIA,

When bond prices are high — signaling strong demand — yields, the interest paid to a bond holder, fall. Strong demand signals a decline in economic-growth expectations among investors, who wish to lock in future gains by owning bonds.

This has a knock-on effect for the blue-chip companies with earnings tied to economic growth, which populate the Dow and S&P 500. It’s a better picture for growth and tech stocks — the likes of Amazon, Apple AAPL,

Our call of the day is from Doug Kass, president of Seabreeze Partners Management, who collected analysis from economists about why yields are falling.

“The 10-year-note price has defied consensus expectations,” Kass writes. “There has been no stronger consensus view [than] that, with domestic and global economic growth rebounding, U.S. interest rates were supposed to head higher.”

But the opposite has occurred.

David Rosenberg, chief economist at Rosenberg Research & Associates Inc., argues that the focus should be on aggregate supply, not aggregate demand, because the world is “awash with inputs.” An oversupply of labor, commodities and capital on a global basis is inherently disinflationary, as is a savings glut, driving rates downward. This is exacerbated by globalization, innovation and such demographic trends as an aging population.

To economist Lacy Hunt of Hoisington Investment Management Company, it’s about math. “At the moment, each new issue of government bonds, notes, etc., has an ever-smaller incremental stimulus to GDP,” Kass says, describing Hunt’s view. Simplified: Hunt’s analysis from the Second World War onward shows that the effect of new government debt on economic growth has diminished, with each new dollar of debt leading to ever-lower percentage increases in annual growth. This curbs inflation, and causes yields to fall.

The buzz

Google, and parent Alphabet GOOGL,

On the U.S. economic front, unemployment claims rose slightly as 373,000 Americans filed for unemployment last week, while continuing jobless claims for the week of June 26 came in at 3.34 million. Later, consumer credit figures for May are due.

Elon Musk’s tunneling company had its proposal to build an underground transit system in Fort Lauderdale approved by lawmakers. The “Las Olas Loop” reportedly would carry people from the city’s downtown area to the beach in Tesla TSLA,

Children in New Zealand are falling ill in high numbers, with some blame going to “immunity debt” from COVID-19. Amid lockdowns, social distancing and sanitizing protocols, kids have avoided a range of illnesses, causing their immune systems to suffer, doctors say.

Is COVID-19 also coming home? Socialization during the Euro 2020 soccer championship may be behind a surge in COVID-19 infections among English men, according to a study out of Imperial College London. Men had a 30% greater chance of testing positive for the virus than women from June 24 to July 5, researchers reported.

The markets

U.S. stocks tumbled at the open and were on track for their worst day in months. Dow industrials DJIA,

Pressure on equity markets comes as bond yields rise, with 10-year U.S. Treasury yields TMUBMUSD10Y,

The charts

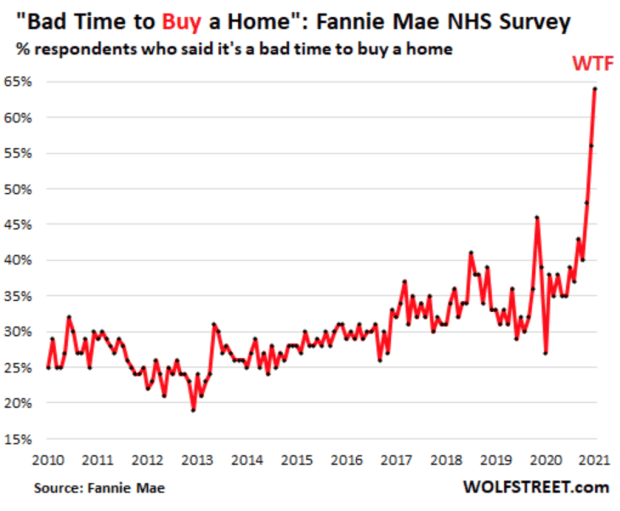

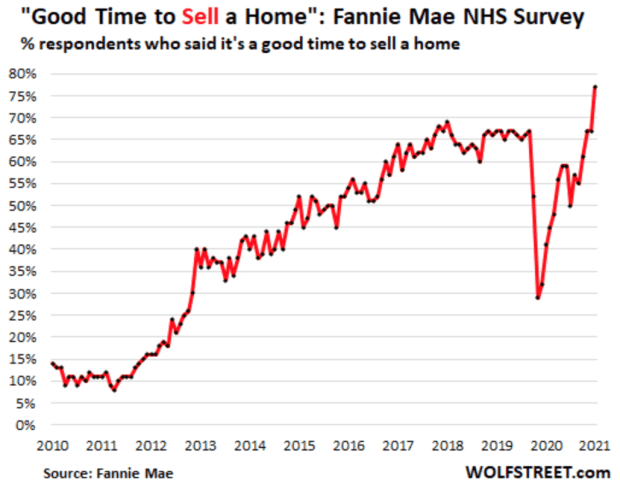

Fannie Mae’s monthly National Housing Survey notched record trend changes in June. Shown in our charts of the day, courtesy of Wolf Richter at the Wolf Street financial blog, a record 64% of people said it was a bad time to buy a home, while an all-time high of 77% said it was a good time to sell a home.

“If these sentiments become reality over time, it’s going to be a sea change for demand and supply at these crazy prices,” said Richter. “Each of these insightful and motivated sellers eager to cash out at these ridiculous prices must find a buyer of the opposite persuasion who thinks they’re getting a deal, which is what makes a market.”

Random reads

Lucky dusting: Florida man discovers a months-old Powerball ticket worth $1 million while cleaning his home on the Fourth of July.

Animal spirits: The Oakland Zoo is inoculating its big cats, bears and ferrets against COVID-19 using an experimental vaccine — part of a national effort to protect animals.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern time.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.