Here’s your chance to buy bank stocks before rising interest rates boost profits

Shares of the largest U.S. banks have staged a recovery following the stock market’s pandemic low point last year.

But they have lagged behind the broader market. A recent pullback in prices sets up what might be an entry point for long-term investors as earnings season begins next week.

Below is a summary of analysts’ opinions about shares of the 12 largest U.S. banks, followed by tables showing consensus estimates for important items.

JPMorgan Chase & Co. JPM,

Trailing the broader market

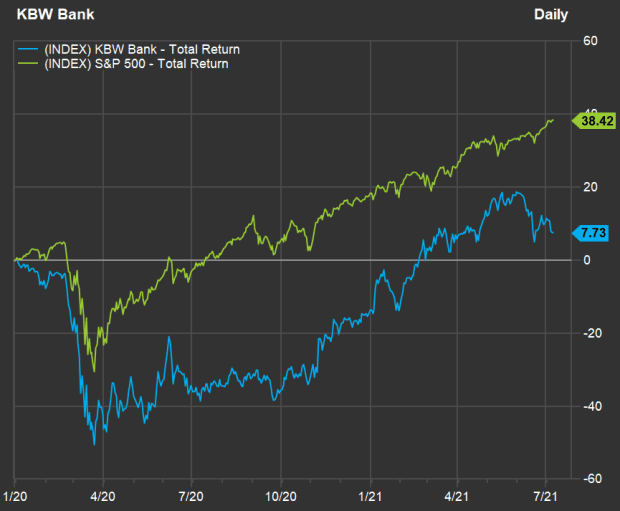

Bank stocks were hit hard during the early part of the pandemic in 2020. Decisive action by the federal government and the Federal Reserve helped set up a speedy recovery and significant subsequent gains for the broad stock market, but not for the banks as a group.

Or not yet. Here’s a chart comparing the performance of the KBW Bank Index BKX,

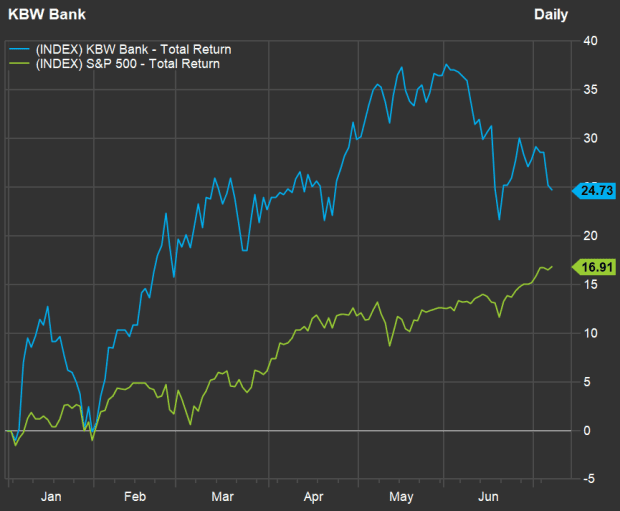

Now let’s look at a year-to-date chart through July 7:

The banks were surging until June 1. Since then, the KBW Bank Index has fallen 9.4%, while the S&P 500 has risen 3.9%.

One likely reason for the bank stocks’ decline is fear of narrowing net interest margins. Through June 1, the yield on 10-year U.S. Treasury notes TMUBMUSD10Y,

With short-term interest rates remaining near zero, any decline in long-term interest rates is bad news for banks, as spreads narrow between what they earn on loans and what they pay for deposits. (There are always loans with adjustable rates that are affected by rate swings, and commercial loans, which tend to have short maturities, are renewed at the prevailing rates.)

John Buckingham, the editor of the Prudent Speculator newsletter and portfolio manager of the Al Frank Fund VALUX,

During an interview, Buckingham said he expected the recent decline in long-term interest rates to be “temporary.”

Then, referring to a successful round of regulatory stress tests and a return by most large U.S. banks to the deployment of excess capital, he added: “I like JPM being able to buy back stock lower than they might otherwise have, if investors were infatuated with the company.”

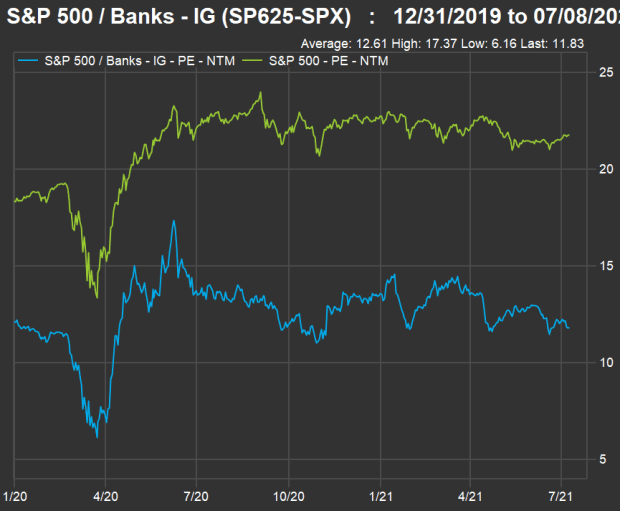

Here’s another chart showing forward price-to-earnings valuations for the S&P 500 bank industry group against the full index, since the end of 2019:

The weighted aggregate forward P/E ratio for the S&P 500 has increased to 21.8 from 18.4 at the end of 2019. Meanwhile, the forward P/E for the banks has declined slightly to 11.8 from 12.1.

We may still be at an early stage for an upward cycle for bank stocks as the U.S. economy continues to recover from the coronavirus pandemic.

Wall Street’s opinion of the big banks

Here’s a summary of opinion among analysts working for brokerage firms for shares of the largest 12 U.S. banks. All the tables in this article show the 12 sorted by total assets:

| Bank | Total assets ($bil) | Share “buy” ratings | Share neutral ratings | Share “sell” ratings | Closing price – July 7 | Consensus price target | Implied 12-month upside potential |

| JPMorgan Chase & Co. JPM, |

$3,689 | 64% | 25% | 11% | $154 | $166 | 8% |

| Bank of America Corp. BAC, |

$2,970 | 63% | 26% | 11% | $40 | $44 | 10% |

| Citigroup Inc. C, |

$2,314 | 68% | 32% | 0% | $68 | $85 | 24% |

| Wells Fargo & Co. WFC, |

$1,960 | 59% | 41% | 0% | $43 | $50 | 15% |

| Goldman Sachs Group Inc. GS, |

$1,302 | 64% | 29% | 7% | $368 | $408 | 11% |

| Morgan Stanley MS, |

$1,159 | 79% | 17% | 4% | $90 | $99 | 10% |

| U.S. Bancorp USB, |

$553 | 52% | 48% | 0% | $56 | $63 | 13% |

| Truist Financial Corp. TFC, |

$518 | 52% | 44% | 4% | $54 | $64 | 19% |

| PNC Financial Services Group Inc. PNC, |

$474 | 44% | 52% | 4% | $187 | $201 | 8% |

| Bank of New York Mellon Corp. BK, |

$465 | 61% | 39% | 0% | $49 | $54 | 10% |

| Capital One Financial Corp. COF, |

$425 | 79% | 21% | 0% | $155 | $170 | 10% |

| State Street Corp. STT, |

$317 | 50% | 50% | 0% | $81 | $94 | 15% |

| Source: FactSet | |||||||

You can click on the tickers for more about each company.

Capital One Financial Corp. COF,

You might wonder why Citigroup has more “buy” ratings than JPMorgan Chase. A quick look at price-to-tangible-book ratios and forward price-to-earnings ratios may shed some light on this:

| Bank | Price/tangible book value | Forward P/E |

| JPMorgan Chase & Co. | 2.34 | 12.7 |

| Bank of America Corp. | 1.91 | 13.0 |

| Citigroup Inc. | 0.90 | 8.8 |

| Wells Fargo & Co. | 1.27 | 11.7 |

| Goldman Sachs Group Inc. | 1.50 | 9.7 |

| Morgan Stanley | 2.31 | 13.2 |

| U.S. Bancorp | 2.59 | 12.7 |

| Truist Financial Corp. | 2.15 | 12.9 |

| PNC Financial Services Group Inc. | 1.93 | 14.5 |

| Bank of New York Mellon Corp. | 2.17 | 11.8 |

| Capital One Financial Corp. | 1.52 | 9.3 |

| State Street Corp. | 2.12 | 11.0 |

| Source: FactSet | ||

Citigroup is the only stock listed here trading below its March 31 tangible book value. (For banks, tangible book value nets out the value of intangible assets, such as loan-servicing rights.) Citi also traded at the lowest forward price-to-earnings ratio.

All the banks passed the Federal Reserve’s stress tests that were completed in June, meaning they are now free to increase dividends and resume stock buybacks.

In a note to clients June 25, Oppenheimer& Co. analyst Chris Kotowski wrote that JPMorgan Chase is expected to achieve a return on tangible common equity of about 18% this year, while for Citi the ROTCE will be only about 10%.

“On the other hand, JPM’s stock is trading at 2.3 times tangible book and Citi’s only at 0.9, so Citi’s smaller amount [of earnings] will go a lot farther” when repurchasing shares, he wrote.

Kotowski expects JPM to reduce its common-share count by 2.7% in 2021 and 4.9% in 2022, while he expects Citi to retire 3.1% of its shares this year and 7.7% in 2022. Kotowski has a neutral “perform” rating for JPM, while he rates Citi “outperform.”

Earnings estimates

Here are consensus second-quarter estimates among analysts polled by FactSet for various important items for the largest 12 U.S. banks.

In the financial media, most coverage of quarterly results for companies focuses on year-over comparisons, in part because of the seasonality of various business. But in the banking industry, especially when the economy has been in a decline or recovery, sequential comparisons can be illuminating.

Net interest income and net interest margin

Here are consensus estimates for the banks’ net interest income (interest earned on loans and securities less interest paid on deposits and borrowings) for the second quarter and the actual results for the previous four quarters. The numbers are in millions:

| Bank | Estimated net interest income – Q2, 2021 | Net Interest income – Q1, 2021 | Net Interest income – Q4, 2020 | Net Interest income – Q3, 2020 | Net Interest income – Q2, 2020 |

| JPMorgan Chase & Co. | $13,173 | $12,889 | $13,258 | $13,013 | $13,853 |

| Bank of America Corp. | $10,477 | $10,197 | $10,253 | $10,129 | $10,848 |

| Citigroup Inc. | $10,093 | $10,166 | $10,483 | $10,493 | $11,080 |

| Wells Fargo & Co. | $8,949 | $8,798 | $9,275 | $9,368 | $9,880 |

| Goldman Sachs Group Inc. | $1,662 | $1,482 | $1,410 | $1,084 | $944 |

| Morgan Stanley | $1,902 | $2,028 | $1,871 | $1,486 | $1,600 |

| U.S. Bancorp | $3,124 | $3,063 | $3,175 | $3,227 | $3,200 |

| Truist Financial Corp. | $3,289 | $3,285 | $3,366 | $3,362 | $3,448 |

| PNC Financial Services Group Inc. | $2,544 | $2,348 | $2,424 | $2,484 | $2,527 |

| Bank of New York Mellon Corp. | $652 | $655 | $680 | $703 | $780 |

| Capital One Financial Corp. | $5,772 | $5,822 | $5,873 | $5,555 | $5,460 |

| State Street Corp. | $456 | $467 | $499 | $478 | $559 |

| Source: FactSet | |||||

Seven of the 12 banks are expected to report higher net interest income for the second quarter than for the first quarter. However, all are expected to show declines from a year earlier, except for Goldman Sachs, Morgan Stanley, PNC and Capital One.

What may interest investors more than the actual net interest income figures are the estimated net interest margins:

| Bank | Estimated net interest margin – Q2, 2021 | Net interest margin – Q1, 2021 | Net interest margin – Q4, 2020 | Net interest margin – Q3, 2020 | Net interest margin – Q2, 2020 |

| JPMorgan Chase & Co. | 1.68% | 1.69% | 1.80% | 1.82% | 1.99% |

| Bank of America Corp. | 1.68% | 1.68% | 1.71% | 1.72% | 1.87% |

| Citigroup Inc. | 1.90% | 1.95% | 2.63% | 2.03% | 2.17% |

| Wells Fargo & Co. | 2.05% | 2.05% | 2.13% | 2.13% | 2.25% |

| Goldman Sachs Group Inc. | 0.37% | 0.54% | N/A | 0.43% | 0.38% |

| Morgan Stanley | N/A | 1.00% | N/A | 0.90% | 0.90% |

| U.S. Bancorp | 2.51% | 2.50% | 2.57% | 2.67% | 2.62% |

| Truist Financial Corp. | 2.94% | 3.01% | 3.13% | 3.10% | 3.13% |

| PNC Financial Services Group Inc. | 2.31% | 2.27% | 2.32% | 2.39% | 2.52% |

| Bank of New York Mellon Corp. | 0.66% | 0.66% | 0.72% | 0.79% | 0.88% |

| Capital One Financial Corp. | 5.94% | 5.99% | 6.05% | 5.68% | 5.78% |

| State Street Corp. | 0.73% | 0.75% | 0.84% | 0.85% | 0.93% |

| Source: FactSet | |||||

For most of the banks, the sequential NIM comparisons aren’t expected to be bad, but for nearly all of them, the year-over-year numbers are expected to show a significant narrowing of margins.

These numbers also point to the specialties of the companies — for investment-banking and brokerage specialists Goldman Sachs and Morgan Stanley, NIM is less important than it is for the money-center and regional banks. The margins are also lower than most for the two listed banks that specialize in securities custody and related services, Bank of New York Mellon Corp. BK,

Provisions for loan losses

A bank’s provision for loan losses is the amount it adds to loan loss reserves to cover expected losses on problem loans. The provisions directly lower pre-tax income. Provisions were very high during the first and second quarters of 2020 because of the pandemic. But the unprecedented stimulus from the federal government, including increased and extended unemployment benefits and moratoriums on evictions and foreclosures, stifled loan losses. This provided a boost to earnings over the past three quarters, and the second-quarter numbers are expected to continue the trend.

Here are estimated second-quarter provisions for loan losses, along with actual results for the previous four quarters, in millions:

| Bank | Estimated provision for loan losses – Q2, 2021 | Provision for loan loss reserves – Q1, 2021 | Provision for loan loss reserves – Q4, 2020 | Provision for loan loss reserves – Q3, 2020 | Provision for loan loss reserves – Q2, 2020 |

| JPMorgan Chase & Co. | $567 | -$4,156 | -$1,889 | $611 | $10,473 |

| Bank of America Corp. | $144 | $1,860 | $53 | $1,389 | $5,117 |

| Citigroup Inc. | $429 | -$1,479 | -$24 | $2,204 | $7,888 |

| Wells Fargo & Co. | -$212 | -$1,048 | -$179 | $769 | $9,534 |

| Goldman Sachs Group Inc. | $124 | -$70 | $293 | $278 | $1,590 |

| Morgan Stanley | -$7 | -$98 | $0 | $0 | $0 |

| U.S. Bancorp | $65 | -$827 | $441 | $635 | $1,737 |

| Truist Financial Corp. | $112 | $48 | $177 | $421 | $844 |

| PNC Financial Services Group Inc. | $725 | -$551 | -$254 | $52 | $2,463 |

| Bank of New York Mellon Corp. | $0 | -$83 | $15 | $9 | $143 |

| Capital One Financial Corp. | $750 | -$823 | $264 | $331 | $4,246 |

| State Street Corp. | -$2 | -$9 | $0 | $0 | $52 |

| Source: FactSet | |||||

Looking back to the second quarter of 2020, you can see how large the provisions were, and how they subsided in the third quarter, even with transfers from reserves during the fourth quarter and the first quarter of 2021. Reserve activity is expected to be low for Q2, as the banks continue to be over-reserved in a recovering economy.

Noninterest income

This is an important item, especially for the largest banks that have varied trading operations. Uniform estimates for trading revenue aren’t available, so here are total noninterest income estimates, with the previous four quarters’ actual results, in millions:

| Bank | Estimated noninterest income – Q2, 2021 | Noninterest income – Q1, 2021 | Noninterest income – Q4, 2020 | Noninterest income – Q3, 2020 | Noninterest income – Q2, 2020 |

| JPMorgan Chase & Co. | $17,247 | $20,621 | $15,973 | $16,502 | $19,274 |

| Bank of America Corp. | $11,457 | $13,065 | $10,913 | $12,667 | $12,233 |

| Citigroup Inc. | $7,440 | $9,329 | $6,131 | $6,752 | $8,773 |

| Wells Fargo & Co. | $8,900 | $9,236 | $9,902 | $11,669 | $12,334 |

| Goldman Sachs Group Inc. | $10,953 | $16,189 | $11,189 | $10,012 | $12,427 |

| Morgan Stanley | $12,051 | $13,778 | $11,781 | $10,193 | $11,929 |

| U.S. Bancorp | $2,498 | $2,721 | $2,300 | $2,350 | $2,049 |

| Truist Financial Corp. | $2,187 | $2,450 | $2,283 | $2,348 | $2,545 |

| PNC Financial Services Group Inc. | $1,866 | $1,720 | $1,937 | $1,801 | $1,584 |

| Bank of New York Mellon Corp. | $3,216 | $3,238 | $3,117 | $3,117 | $3,154 |

| Capital One Financial Corp. | $1,308 | $1,261 | $1,457 | $1,806 | $1,130 |

| State Street Corp. | $2,472 | $2,241 | $2,208 | $2,142 | $2,163 |

| Source: FactSet | |||||

Following “record trading results” for the first quarter, in the words of Keefe Bruyette & Woods analyst David Konrad, the industry’s trading revenue is expected to have simmered in the second quarter and even to be below where it was a year earlier.

“{D]eclining year-over-year trading and investment banking is a headwind” for big bank stocks, Konrad wrote in a note to clients July 6.

Net income and EPS

Here are estimates for net income for the group, in millions, along with the previous four quarters’ actual results, in millions:

| Bank | Estimated net income – Q2, 2021 | Net income – Q1, 2021 | Net income – Q4, 2020 | Net income – Q3, 2020 | Net income – Q2, 2020 |

| JPMorgan Chase & Co. | $9,477 | $14,230 | $12,079 | $9,396 | $4,666 |

| Bank of America Corp. | $6,654 | $8,050 | $5,470 | $4,881 | $3,533 |

| Citigroup Inc. | $4,191 | $7,878 | $4,603 | $3,219 | $1,306 |

| Wells Fargo & Co. | $3,928 | $4,742 | $2,992 | $2,035 | -$2,379 |

| Goldman Sachs Group Inc. | $3,462 | $6,836 | $4,506 | $3,367 | $373 |

| Morgan Stanley | $2,980 | $4,120 | $3,385 | $2,717 | $3,196 |

| U.S. Bancorp | $1,685 | $2,270 | $1,513 | $1,573 | $686 |

| Truist Financial Corp. | $1,431 | $1,477 | $1,329 | $1,138 | $955 |

| PNC Financial Services Group Inc. | $1,249 | $1,808 | $1,436 | $1,511 | -$752 |

| Bank of New York Mellon Corp. | $882 | $926 | $749 | $936 | $949 |

| Capital One Financial Corp. | $1,966 | $3,301 | $2,551 | $2,386 | -$917 |

| State Street Corp. | $619 | $519 | $537 | $555 | $694 |

| Source: FactSet | |||||

Sequentially, the estimates point to a significant decline in earnings following the first-quarter spike in trading and investment banking revenue. But the year-over-year comparisons will be overwhelmingly positive for most of the banks.

Here are consensus second-quarter EPS estimates, with actual EPS for the previous four quarters:

| Bank | Estimated EPS – Q2, 2021 | EPS – Q1, 2021 | EPS – Q4, 2020 | EPS – Q3, 2020 | EPS – Q2, 2020 |

| JPMorgan Chase & Co. | $3.17 | $4.50 | $3.79 | $2.92 | $1.38 |

| Bank of America Corp. | $0.77 | $0.86 | $0.59 | $0.51 | $0.37 |

| Citigroup Inc. | $2.00 | $3.62 | $2.07 | $1.40 | $0.50 |

| Wells Fargo & Co. | $0.96 | $1.05 | $0.64 | $0.42 | -$0.66 |

| Goldman Sachs Group Inc. | $9.95 | $18.60 | $12.08 | $8.98 | $0.55 |

| Morgan Stanley | $1.67 | $2.19 | $1.81 | $1.66 | $1.96 |

| U.S. Bancorp | $1.12 | $1.45 | $0.95 | $0.99 | $0.41 |

| Truist Financial Corp. | $0.98 | $0.98 | $0.90 | $0.79 | $0.67 |

| PNC Financial Services Group Inc. | $3.11 | $4.11 | $3.26 | $3.40 | $8.43 |

| Bank of New York Mellon Corp. | $1.00 | $0.97 | $0.79 | $0.98 | $1.01 |

| Capital One Financial Corp. | $4.39 | $7.03 | $5.35 | $5.06 | -$2.21 |

| State Street Corp. | $1.77 | $1.37 | $1.39 | $1.45 | $1.86 |

| Source: FactSet | |||||

PNC’s EPS for the second quarter of 2020 was $8.43, despite a negative net income number above, because the bank sold its remaining holdings in BlackRock Inc. and booked a gain on the sale of $4.3 billion.

For the most part, the year-over-year EPS comparisons will be rosy for the big banks.

Don’t miss: Here are Wall Street’s 20 favorite energy stocks as crude oil hits a 6-year high