Technology Metals Snapshot: Eight juniors with properties to watch

In May it signed an option agreement with GeoXplor Corp. to acquire a 100% interest in 64 claims encompassing about 1,280 acres and consisting of the CC, CCP, JR and SX placer claims, together known as the Clayton Valley project, about 306 km from Las Vegas. Once ACME Lithium completes the earn-in, GeoXplor will retain a 3% gross overriding royalty; ACME may buy back one half of the royalty during the three years following the start of commercial production for $1.5 million.

In June, the company added 58 new claims to the project, encompassing about 1,160 acres contiguous to the CC, CCP and SX claims.

The Clayton Valley property’s claims are located directly south of Albemarle’s (NYSE: ALB) Silver Peak lithium mine, the only lithium brine operation in production in North America. To the east, the project borders Pure Energy Minerals’ (TSXV: PE; US-OTC: PEMIF) Clayton Valley project, which it is developing with strategic investor Schlumberger Technology.

Historic drilling and geophysical surveys show that ACME Lithium’s claims cover basin-fill sediments and aquifers similar to the sediments currently producing lithium brines in the area. The company is interpreting geophysical survey data and results, and is developing drill targets to test indicated and prospective aquifers.

The Fish Lake Valley project consists of 81 claims (1,620 acres) and is about 40 km from the Clayton Valley project, and about 274 km from Las Vegas. The company notes that geophysics have found that the fine sediments at Fish Lake Valley are the same age as the occurrences at Clayton Valley and that some beds are enriched in lithium. Initial mapping and sampling on the property in 2016 returned values of up to 600 parts per million lithium in mudstones, and sampling in 2018 returned values of up to 370 ppm lithium.

This year the work program at Fish Lake Valley includes drilling to test the economic potential of the lithium claystone and identify new targets for further exploration, as well as mapping, sampling and geophysics.

The company says it is also looking to acquire and develop additional projects.

ACME Lithium has a market capitalization of C$21 million ($16.7m).

First Cobalt

First Cobalt’s (TSXV: FCC; US-OTC: FTSSF) flagship asset is the only permitted refinery in Canada that is undergoing an expansion to produce cobalt and other battery materials. Permits and building infrastructure are all in place and the refinery could be operational as early as 2022. First production is scheduled for the fourth quarter of 2022, at which time the refinery will produce 25,000 tonnes of battery grade cobalt sulphate per year, or about 5% of the world’s total cobalt production. The company says it also intends to process black mass from recycled batteries.

In March, First Cobalt signed a five-year offtake agreement with Stratton Metal Resources for the sale of future cobalt sulphate. That deal followed one in January with Glencore and China’s IXM, a subsidiary of China Molybdenum Company, under which the two companies will supply the refinery with 4,500 tonnes of cobalt a year over five years from their two mines in Africa — KCC and Tenke Fungurume.

The refinery, located north of Toronto in Ontario, is about 600 km from Canada’s border with the United States, and is accessible by road and rail. It operated from 1996 to 2015, producing cobalt, nickel and silver. Last December, Canada’s federal government and the provincial government of Ontario jointly announced a $10 million investment towards the capital costs of the project.

In the US, the company is advancing its Iron Creek cobalt-copper project in Idaho, one of the few primary cobalt deposits in the world. An updated resource estimate in November 2019 outlined indicated resources of 2.2 million tonnes grading 0.26% cobalt and 0.61% copper (0.32% cobalt-equivalent) for 12.3 million lb. contained cobalt and 29 million lb. of contained copper. Inferred resources add 2.7 million tonnes grading 0.22% cobalt and 0.68% copper (0.28% cobalt-equivalent) for 12.7 million lb. cobalt and 40 million lb. copper.

The company kicked off a $2.5 million (4,500-metre) exploration program in June with the objective of doubling its resource over the next two drill seasons. The deposit remains open to the east and west along strike as well as down-dip. Historic underground development at Iron Creek included 600 metres of drifting from three adits.

On May 11, First Cobalt acquired claims to the west of Iron Creek, along strike with mineralization, boosting its land package by more than 100% to more than 1,600 hectares. That transaction was followed on May 25 with an earn-in agreement with Phoenix Copper for 224 hectares of property, expanding its land position at Iron Creek to over 1,820 hectares.

At the end of April, First Cobalt and the Colorado School of Mines were awarded funding from the US Department of Energy’s Critical Materials Institute (CMI) for research on mineral processing techniques. The funding consists of $600,000 over a two-year period.

First Cobalt has a market capitalization of C$151 million ($120m).

Graphite One

Graphite One (TSXV: GPH; US-OTC: GPHOF) is working on its Graphite One project, which is expected to produce coated spherical graphite (CSG) for the lithium-ion batteries used in electric vehicles.

The graphite would be mined from its Graphite Creek project, a large flake graphite deposit on the Seward Peninsula, about 55 km north of Nome, Alaska. The material would be processed at a processing plant on the Graphite Creek property. Coated spherical graphite would then be manufactured from the concentrate at a separate graphite manufacturing facility.

A preliminary economic assessment (PEA) completed in 2017 outlined a mine life of 40 years producing 60,000 tonnes per year of graphite concentrate at 95% total carbon in graphite form (Cg) once in full production. The manufacturing plant would then convert 60,000 tonnes per year of concentrate into 41,850 tonnes per year of coated spherical graphite (CSG) and 13,500 tonnes per year of purified graphite powders.

At a sales price of $6,200 per tonne for spherical coated graphite and $1,500 per tonne for purified graphite powders, the PEA estimated the mine would generate an after-tax net present value at a 10% discount rate of $616 million and an internal rate of return of 22%. Capital costs of $363 million could be paid back in the fourth year of production.

In June the company said it plans to complete a preliminary feasibility study in the fourth quarter of the year.

Graphite Creek has measured and indicated resources of 10.95 million tonnes grading 7.8% Cg (total carbon in graphite form) for 850,534 tonnes of contained graphite, and inferred resources of 91.9 million tonnes grading 8% total carbon in graphite form for 7.3 million tonnes of contained graphite.

The deposit is characterized by coarse, crystalline (large flake) graphite within graphite bearing schist and the mineralization is exposed at surface along the Kigluaik Mountain Range front. The host schist is continuous over a strike length of 18 km, based on mapping, sampling and airborne geophysics.

In January the U.S. government’s Federal Permitting Improvement Steering Committee (FPISC) designated the Graphite Creek project as a high-priority infrastructure project (HPIP).

Graphite One has a market capitalization of C$71.4 million ($56.6m).

Grid Metals (TSXV: GRDM; US-OTC: MSMGF) is focused on palladium, nickel and copper exploration in Canada. In Ontario, it is advancing its 100%-owned East Bull Lake (EBL) palladium project, about 80 km west of Sudbury. It has owned the project for more than two decades and amassed a large exploration database, including the results of geophysical surveys and results from 5,000 samples.

EBL consists of a 22-km long by 4 km layered intrusion that includes near-surface palladium mineralization along its southern and northern margins. The prospective structures at EBL cover a strike length of 30 km with potential for vertical feeder structures with higher grade palladium-rich sulphide mineralization.

In May, the company reported drillhole EBL 21-09 intersected three zones of palladium-rich sulphide mineralization including a footwall copper sulphide vein grading 37.6 grams per tonne palladium, 6.68 grams per tonne platinum, 1.46 grams gold per tonne, 21.3% copper and 0.60% nickel (68 grams palladium-equivalent) over 0.54 metres within a 2-metre-interval averaging 10.7 grams per tonne palladium and 5.87% copper.

Other drill results from EBL released this year included 54 metres averaging 1.05 grams per tonne palladium equivalent, including 3 metres of 3.04 grams per tonne palladium-equivalent in hole EBL21-01, and 40.3 metres averaging 1.15 grams per tonne palladium equivalent in hole EBL21-03, including 2.30 metres of 3.23 grams palladium equivalent.

Elsewhere in Ontario, the company owns the Bannockburn nickel project, about 100 km south of Timmins. Grid Metals commissioned a technical report on the property last year to summarize historical data, which included geophysics and more than 84 drill holes. The report concluded that the project has the potential for developing both low-grade, large tonnage, and high-grade, low tonnage cobalt, platinum, palladium and iron resources. Drill results from Bannockburn released at the end of June included 296.5 metres averaging 0.28% nickel, including 112 metres of 0.32% nickel in hole GBN21-02.

In Manitoba, Grid Metals is working on its Makwa-Mayville nickel-copper-palladium project, about 145 km from Winnipeg. The property consists of the nickel-dominant Makwa holding and the copper-dominant Mayville holding, and the two sit about 40 km apart.

A 2014 preliminary economic assessment envisioned two open-pit mines, and proposed an 8,300 tonne-per-day, 14-year operation. The study estimated initial capex of C$208 million, with a post-tax net present value at a 7.5% discount rate of C$97 million. The project is envisioned as a blast and haul open-pit operation, with mineralized material hauled to a mill at the Mayville site. A flotation circuit would produce separate copper and nickel concentrates.

The combined indicated resource for both properties stands at 33.8 million tonnes grading 0.27% nickel, 0.37% copper, 0.06 gram platinum per tonne, and 0.19 gram palladium per tonne. Inferred resources add 5.9 million tonnes grading 0.19% nickel, 0.43% copper, 0.06 gram platinum per tonne and 0.15 gram palladium per tonne.

Grid Metals has a market capitalization of C$19.3 million ($15m).

Neo Lithium

Neo Lithium (TSXV: NLC; US-OTC: NTTHF) is advancing its 100%-owned Tres Quebradas ( 3Q) lithium project, a lithium brine lake and salar complex in the southern end of Argentina’s “lithium triangle” in Catamarca province, about 30 km from the border with Chile. According to the company, the high-grade core of 3Q makes it the third highest-grade project worldwide and fourth based on the average grade of the project.

The company expects to complete a final feasibility study for 3Q in the third quarter of this year. A prefeasibility study released in March 2019 outlined a mine life of 35 years producing 20,000 tonnes of lithium carbonate a year at cash operating costs of $2,914 per tonne LCE, one of the lowest in the industry. The study envisioned a conventional evaporation pond operation followed by purification and precipitation of lithium carbonate.

The study estimated initial capex of $319 million with a payback period of just under two years, an after-tax net present value at an 8% discount rate of $1.14 billion and an after-tax internal rate of return of 50%. Life-of-mine deferred and sustaining capital costs are estimated at about $207 million, and closure costs at about $26 million, which the company says is at the low-end of the capital intensity range when compared with other development projects worldwide.

In the initial ten years of the prefeasibility mine plan, five wells would each produce 51 l/s of high-grade brine. During the subsequent ten years, the same wells would produce 64 l/s. From 20 years onward, a total of 11 wells would be in operation, with individual production rates of between 23 l/s and 49 l/s.

In June, the company updated its resource estimate with a 125% increase in the measured and indicated category to 1.68 million tonnes of lithium carbonate equivalent at an average grade of 926 milligrams per litre lithium. The revised estimate used a cut-off grade of 800 mg/l lithium.

CATL, the world’s largest battery manufacturer for electric vehicles, has invested a total of $11 million to maintain its 8% stake in the company. CATL was founded in 2011 and is based in Ningde, China.

In late June, Neo Lithium announced that it had produced 99.9% battery grade lithium carbonate at its pilot plant, and CATL considers this acceptable for battery production.

The company’s president and CEO, Waldo Perez, discovered the project in December 2015.

Neo Lithium has a market cap of C$400 million ($319m).

Nickel Creek Platinum

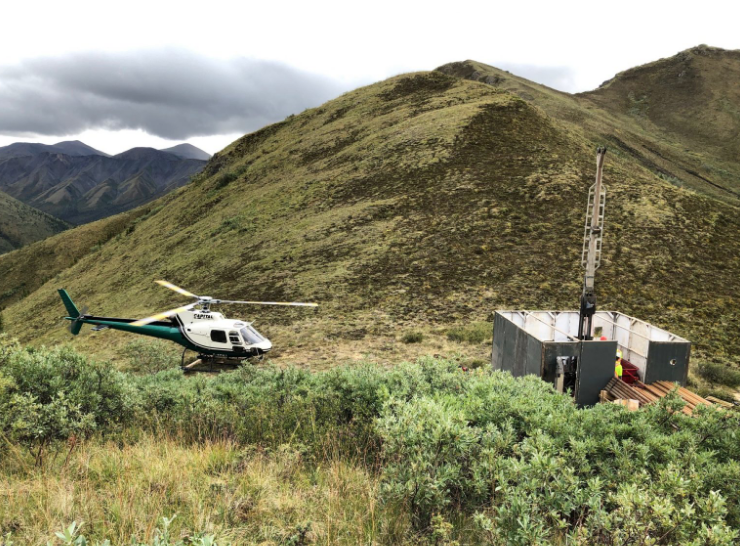

Nickel Creek Platinum (TSX: NCP; US-OTC: NCPCF) is working on its 100%-owned Nickel Shäw property in the southwest Yukon, about 317 km northwest of Whitehorse. The project is accessible from the paved Alaska Highway, which leads to year-round deep sea ports in Haines and Skagway, Alaska.

The nickel sulphide project has a mix of metals including copper, cobalt and platinum group metals, and lies within the Kluane First Nation core area.

The project contains measured and indicated resources of 323.4 million tonnes grading 0.26% nickel, 0.16% copper, 0.015% cobalt, 0.25 gram platinum per tonne, 0.26 gram palladium per tonne and 0.05 gram gold per tonne for 850,000 tonnes of contained nickel, 500,000 tonnes of copper, 50,000 tonnes of cobalt, 2.6 million oz. platinum, 2.7 million oz. palladium and 500,000 oz. gold.

Inferred resources add 108.1 million tonnes grading 0.29% nickel, 0.15% copper, 0.016% cobalt, 0.26 gram platinum, 0.28 gram palladium, 0.04 gram gold for 313,000 tonnes of nickel, 163,000 tonnes of copper, 17,000 tonnes of cobalt, 900,000 oz. of platinum, 1 million oz. of palladium, and 100,000 oz. of gold.

In December 2020, the company announced the results of its 2020 ground-based EM geophysics and drill program. It reported that a large loop transient electromagnetic (TEM) survey tested the Arch and Burwash exploration target areas, which are along trend, about 2 km to the northwest and 5 km to the southeast, respectively, of the main Wellgreen deposit. The program identified 42 conductive anomalies, including 11 anomalies determined to be potentially massive nickel-copper sulphide.

Earlier this year in April the company announced its 2021 exploration program will focus on drilling the 11 high priority targets identified in the Arch and Burwash areas.

The company’s largest shareholder is Electrum Strategic Opportunities Fund L.P., which according to the company’s corporate presentation in March this year, owns 31% of the company’s shares.

Nickel Creek Platinum has a market cap of C$40.8 million ($31.9m).

Nouveau Monde Graphite

Nouveau Monde Graphite (TSXV: NOU; NYSE: NMG) owns 100% of the Matawinie graphite project in Quebec, about 150 km north of Montreal. The company expects that Matawinie will become the world’s first all-electric open-pit mine and forecasts commercial production will begin before the end of 2023. The mine will produce high-purity graphite concentrate for the electric vehicle and energy storage market.

The project has measured and indicated resources of 120.3 million tonnes grading 4.26% carbon in graphite (Cg) for 5.13 million tonnes of contained graphite. Inferred resources add 4.5 million tonnes grading 4.43% carbon in graphite for 200,000 tonnes of contained graphite. The mineralization remains open to the north, south and at depth.

In October 2018, the company published a feasibility study for Matawinie, which outlined an operation producing 100,000 tonnes graphite concentrate a year over a mine life of 25 years at an initial capital cost of C$276 million. The associated project net present value estimate, at an 8% discount rate, came in at C$751 million, and generated an after-tax internal rate of return of 32.2%. The study used a life-of-mine average sales price for graphite concentrate of $1,730 per tonne, with a concentrate purity of over 97% graphitic carbon.

In June, Noveau Monde signed a collaboration agreement with Caterpillar under which the leading equipment maker will develop, test and produce its “zero emission machines” for the mining project.

The company also raised $59.4 million in a public offering last month in the U.S. and Canada of 7.92 million of its common shares at a price of $7.50 per share. The company listed on the New York Stock Exchange in May.

Nouveau Monde is also building a battery material plant in an industrial park near the port in Becancour, about 150 km northeast of Montreal. In January, the company started construction on the phase 1 plant and acquired the land for the phase 2 expansion.

In the initial phase, the company plans to produce 42,000 tonnes of coated spherical graphite, which is used as active anode material in lithium-ion batteries, and 3,000 tonnes of purified graphite used in hydrogen fuel cells and 5G heat dissipation foils.

Production of fully-integrated anode material in its Phase 1 plant is scheduled to begin in the first quarter of 2022. Over the next 12 months, the company also plans to deliver a definitive feasibility study for the Phase 2 Becanour plant and secure a complete financing package for the Phase 2 Matawinie mine project.

Nouveau Monde Graphite has a market capitalization of C$369 million ($294m).

Patriot Battery Metals (CSE: PMET; US-OTC: RGDCD), formerly known as Gaia Metals, has exploration properties in British Columbia, Quebec, and the Northwest Territories in Canada, and in Idaho in the United States.

Its 862-hectare Freeman Creek copper, gold and silver property in Idaho’s Lemhi County, hosts two major prospects: Gold Dyke and Carmen Creek.

Surface sample results from work in 202o at Gold Dyke included 0.72% copper, 10.9 grams gold per tonne and 80.1 grams silver per tonne, while samples from Carmen Creek, about 3 km to the northeast of Gold Dyke, included 9.75% copper, 25.5 grams gold per tonne; and 1.53% copper, 7.08 grams gold per tonne and 59.5 grams silver per tonne.

Carmen Creek is the site of a past-producing mine and mill, but few historic records exist.

In Canada, its Corvette-FCI property in Quebec, consists of 172 wholly owned claims (Corvette) and a further 111 claims (FCI East and FCI West) held under an option agreement with O3 Mining, for up to a 75% interest, for a combined 14,496 hectares. FCI West contains the Lorraine (8.15% copper, 1.33 grams gold and 171 grams silver); Elsass (3.63% copper, 0.64 gram gold and 52.3 grams silver); and Black Forrest (1.13% copper, 0.05 gram gold and 19.5 grams silver) discoveries, as well as the historic showings at Lac Smokycat-SO (1.75% copper, 1.47 grams gold and 40.5 grams silver) and Tyrone T-9 (3.36% copper, 0.82 gram gold and 38.4 grams silver), which collectively span a strike length of more than 5 km. Another discovery, the Hund Showing (3.28% copper, 0.78 gram gold and 30.1 grams silver) lies about 3 km to the southeast.

Other prospects at Corvette-FCI include its Golden Gap prospect, where historic sampling completed by Virginia Mines returned 3 to 108.9 grams gold per tonne in outcrop and 7 metres grading 10.5 grams gold per tonne in one drill hole; and the Lac Bruno prospect.

Corvette-FCI also hosts potential for platinum group elements (PGEs). An historic sample of outcrop assayed 3.1 grams gold per tonne, 1.06 grams palladium per tonne, 0.005 gram platinum per tonne, 7.5 grams silver per tonne, 0.24% copper, 0.19% nickel; and 411 grams per tonne cobalt at the Lac Long Sud showing. Samples collected by the company in 2019 included 8.15% copper, 1.33 grams gold and 171 grams silver, and 3.63% copper, 0.64 gram gold and 52.3 grams silver.

Corvette-FCI also contains 11 well-mineralized spodumene pegmatites. Discovered in 2019, eight samples were collected from the CV5 pegmatite, which averaged 3% lithium oxide (LiO2) and 154 parts per million tantalum oxide (Ta205).

In Quebec’s James Bay region, Patriot Battery Metals is exploring its 7,773-hectare Pontax property for lithium and gold; its 953-hectare Lac du Beryl prospect for lithium and gold; and its 1,109-hectare Eastmain property for lithium.

In the Northwest Territories, the junior and its joint-venture partner Far Resources, are looking for lithium on its 1,660-hectare Hidden Lake property, which covers portions of the Yellowknife lithium pegmatite belt and hosts numerous spodumene-bearing pegmatite occurrences. A drill program in 2018 intersected grades of over 1% lithium oxide in all ten holes drilled.

It is also exploring for silica at its 5,012-hectare Golden Silica property in British Columbia.

Patriot Battery Metals has a market capitalization of C$3.5 million ($2.7m)

(This article first appeared in The Northern Miner)