ESG bond funds now manage 600% more in assets than three years ago

The debt world has quickly embraced finance that aims to improve environmental, social and governance outcomes, according to a new Goldman Sachs report.

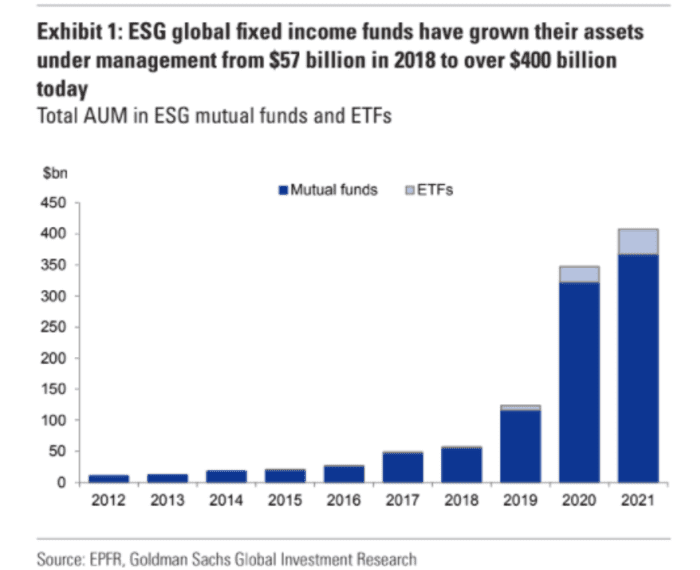

Assets under management at fixed-income funds focused on ESG, the shorthand for a host of efforts to promote more responsible forms of finance, has ballooned by more than 600% to $400 billion since 2018, the report says.

Here’s a graphic to show the steep climb in assets tied to ESG:

Rise of ESG debt funds

EPFR, Goldman Sachs

“In early 2020, we argued that demand for ESG assets would continue to create its own supply within fixed income markets,” a Goldman credit research team led by Lotfi Karoui wrote, in a weekly note, adding that “a year and a half later,” the pace has surprised to the upside.

In a recent example, Manhattan office landlord SL Green Realty Corp. SLG,

The building is one of eight buildings that SL Green tied to its pledge with tenants to reduce greenhouse gas emissions by 30% over 10 years. SL Green had no immediate comment.

Green bonds and others debt with a stated ESG purpose often reduces borrowing costs for companies, in part as investors increasingly hunt for assets that match their ESG mandates.

Historically low 10-year Treasury yields TMUBMUSD10Y,

But lax enforcement mechanisms also have emerged as a key criticism of the sector, particularly when companies that fall short in reporting on how ESG-dedicated funds were used and if their stated objectives were met or not.

Several bond investors told MarketWatch that the most powerful tools at their disposal in terms of enforcement if something goes awry would be to sell the debt after issues crop up or by avoiding an issuer’s future debt offerings.

The boom in debt issuance has led the U.S. Securities and Exchange Commission to set up a climate and ESG task force in March in its enforcement division to police for potential violations in the sector.

The focus on ESG comes as the 40-year toll of major U.S. climate and weather disasters reaches $2 trillion and as parts of the West Coast grapples with record heat, extreme wildfires and drought.

The European Union this week also released its “Fit for 55” program to cut carbon emissions by 55% by 2030. A Reuters report said the plan will “consign the internal combustion engine to history,” while BofA researchers in a new report call it “the most ambitious multilateral climate strategy ever attempted.”