There are enough red flags that ‘investors have to start considering de-risking,’ warns star money manager

“ ‘At this incipient stage of the spread of the delta variant and slowing of economic growth, there are enough red flags that prudent investors have to start considering de-risking.’ ”

Investors may be ignoring mounting evidence that the delta variant of COVID-19 could be more troublesome than it is currently being given credit for by financial markets.

That’s the current stance of Scott Minerd, CIO of Guggenheim Investments, on the state of the U.S. stock market as COVID cases rise in some American states, fueled by the highly transmissible delta variant of coronavirus.

In a research blog published on Friday, Minerd warns that the variant may be as contagious as chickenpox and other infectious diseases, according to recent research, and could cause a fresh run of disruptions to businesses, stymying the rebound from the global epidemic.

On Tuesday, the CDC revived its recommendation that Americans wear masks indoors in public places, even if they have been vaccinated, in regions where COVID cases are rising. Public-health officials have said that COVID’s delta variant is present in the nose and mouth at levels of more than 1,000 times the original virus.

So even though vaccinated people are protected from its symptoms, they can still spread the delta variant, whose contagiousness is greater than the common cold, and on a par with the most-transmissible illnesses like chickenpox, epidemiologists have said.

Minerd, though acknowledging that he isn’t a medical expert in a CNBC interview, said that he is worried that the recent spike might see U.S. cases surge within six to eight weeks to levels not seen since last December at around 200,000.

He referred to the current surge in the pandemic as “mind-numbing,” in the interview with the business television network.

“The increase in the absolute number of cases on a weekly basis appears to be similar to what we witnessed last summer when COVID infections began to spike going into the autumn,” the Guggenheim CIO wrote in his blog.

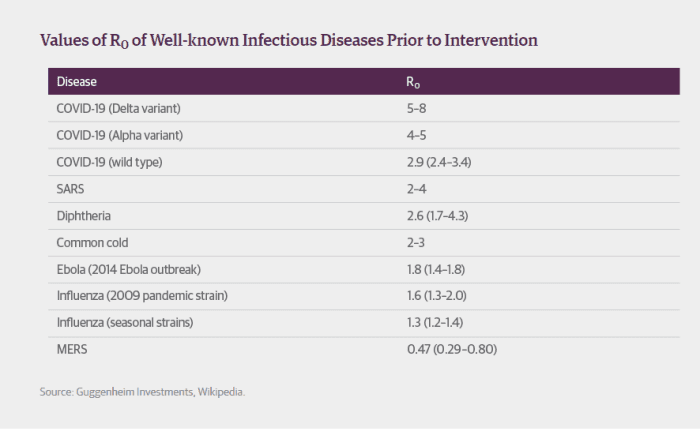

He pointed to the “R” transmission rate of the delta variant. He notes that the transmission rate of the initial strain of the coronavirus back in early 2020 “was somewhere between two and three, meaning that if someone were exposed to the virus, they would, on average, infect two to three more people.”

If the R rate of an infectious disease is less than 1, the disease will “eventually peter out,” but if it is greater than 1 it will spread, he noted.

The R rate of the delta variant is around six, “which is two to three times more transmissible than the initial COVID strain,” Minerd wrote.

Minerd speculated that the stock market could see a 10% or 20% correction, due to the economic slowdown resulting from a fresh delta-fueled rise in case counts.

“The potential resurgence of the pandemic is happening during a seasonally weak period for risk assets. This increases the probability of downside risk,” he wrote.

On Friday afternoon, the Dow Jones Industrial Average DJIA,

To be sure, a number of analysts view the market as richly valued and make the case that its current loftiness might merit a pullback, especially if American corporations have reached peak earnings and the economy has seen peak growth in the aftermath of the pandemic.

Still, Minerd told the business network that a correction, although painful for investors, could present “a great buying opportunity.”

Against his downside backdrop, Minerd also sees the possibility that the benchmark 10-year Treasury rate TMUBMUSD10Y,