Stocks, Futures Up as China Angst Eases; Oil Drops: Markets Wrap

(Bloomberg) — Asian stocks and U.S. futures rallied Monday as some of the concerns over China’s regulatory crackdown eased and progress on a U.S. infrastructure spending plan aided sentiment. Crude oil slid.

Equities jumped in Japan and Australia, where Afterpay Ltd. surged after digital-payments platform Square Inc. agreed to acquire the buy-now, pay-later company. S&P 500 and Nasdaq 100 contracts climbed as a $550 billion infrastructure package steps closer to passage in the Senate this week. European stock futures advanced.

Hong Kong and China stocks rose, paring some of last week’s rout sparked by Beijing’s clampdown on everything from technology to private education and property. The nation also faces a Covid-19 spike and signs of slowing economic growth, spurring bets on monetary easing and a rally in sovereign debt.

Ten-year U.S. Treasury yields were steady and the dollar dipped. Investors are debating whether a months-long rally in Treasuries points to a slower phase ahead in the recovery from the pandemic.

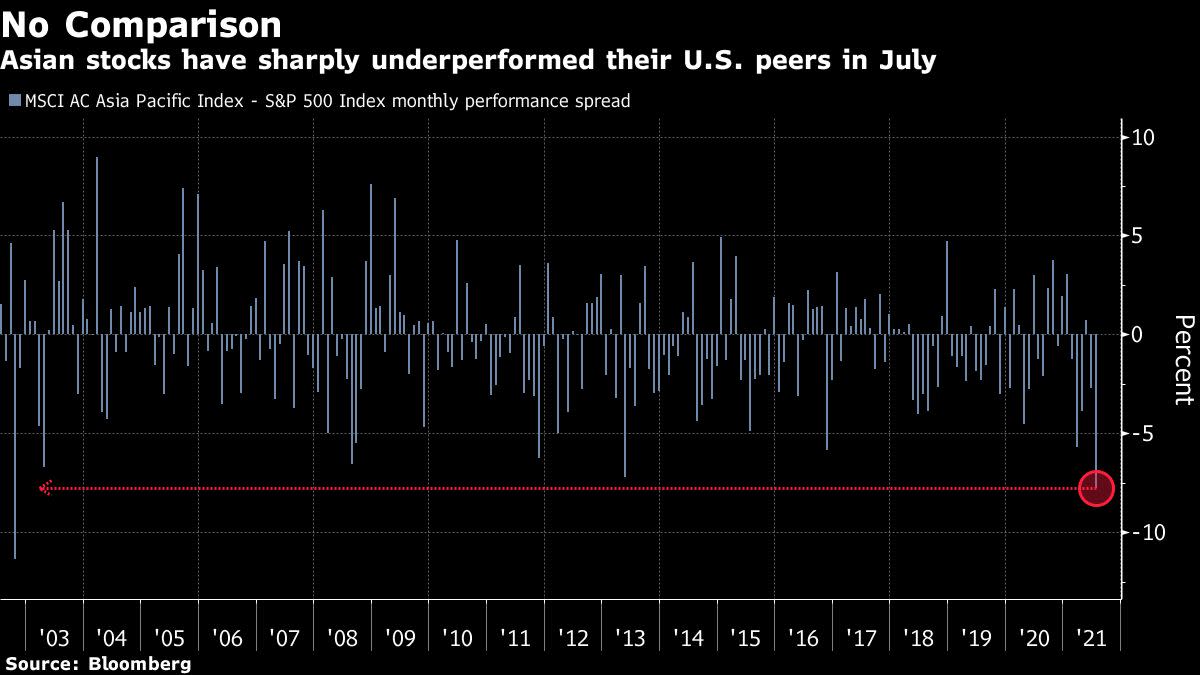

Global stocks in July completed their longest winning streak since 2018 but the pace of gains was the slowest in the six-month winning stretch. Corporate earnings have generally aided equities, bit risks include the impact of elevated inflation and the delta virus strain on the world economy, as well as China’s push for more control over some of its major companies.

Read More: Xi Jinping’s Capitalist Smackdown Sparks a $1 Trillion Reckoning

“Shares remain at risk of a short-term correction or volatility as coronavirus cases rise globally, the inflation scare continues and as we come into seasonally weaker months, but surging company profits in the U.S. and lower bond yields are providing support,” Shane Oliver, head of investment strategy and chief economist at AMP Capital, said in a note.

The latest batch of manufacturing reports were mixed. Purchasing-manager readings from China implied a steadier recovery ahead, and the nation’s much-watched Politburo meeting on Friday signaled more targeted support for the economy to cushion growth in the face of resurgent pandemic risks.

Separately, China’s securities regulator called for talks with its U.S. counterpart after the Securities and Exchange Commission boosted disclosure requirements for initial public offerings of Chinese companies.

Elsewhere, Minneapolis Fed President Neel Kashkari said the Covid-19 delta strain could keep some Americans from looking for work, potentially harming the U.S. recovery. The latest updates on U.S. jobs are due later this week.

Crude oil retreated as traders weighed the China outlook and monitored a rise in tensions between Iran and the U.S. Bitcoin slipped back below $40,000, reversing a weekend rally.

Here are some key events to watch this week:

Earnings are due this week from Alibaba, BP, Toyota, Uber, Roku, Moderna, KKRReserve Bank of Australia policy decision TuesdayBank of England is expected to keep its benchmark interest rate and its bond-buying target unchanged ThursdayReserve Bank of India monetary policy decision, briefing FridayThe U.S. jobs report is expected to show another robust month of hiring Friday

For more market analysis read our MLIV blog.

Here are the main moves in the markets:

Stocks

S&P 500 contracts rose 0.5% as of 7 a.m. in London. The S&P 500 fell 0.5%Nasdaq 100 futures added 0.5%. The Nasdaq 100 fell 0.6%Japan’s Topix index rose 2.1%Australia’s S&P/ASX 200 Index rose 1.2%South Korea’s Kospi index climbed 0.5%Hong Kong’s Hang Seng Index added 0.9%China’s Shanghai Composite Index rose 1.7%Euro Stoxx 50 futures increased 0.5%

Currencies

The Japanese yen traded at 109.66 per dollar, up less than 0.1%The offshore yuan was at 6.4662 per dollarThe Bloomberg Dollar Spot Index dipped 0.1%The euro traded at $1.1872

Bonds

The yield on 10-year Treasuries was at about 1.22%

Commodities

West Texas Intermediate crude fell 1% to $73.22 a barrelGold was at $1,810 an ounce, down 0.2%

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.