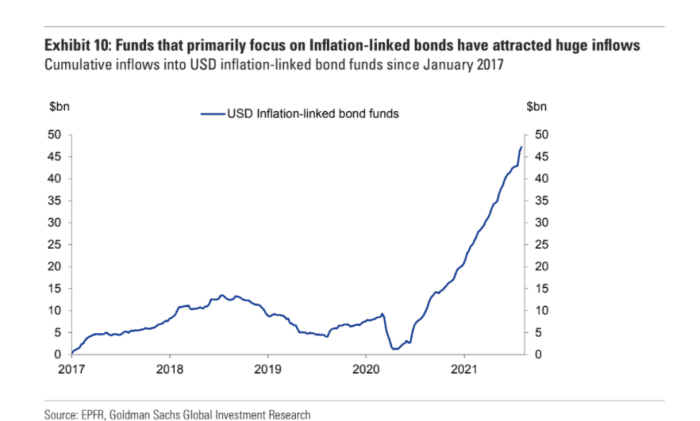

Nearly $50 billion floods into inflation-linked U.S. bond funds. Why more could be on the way.

Investors aren’t just worrying about higher costs of living. They also have poured some $46 billion into inflation-linked bond funds over the past 15 months, with an eye to protecting their wealth from higher prices.

Two weeks ago, a $3.2 billion flood of funds poured into U.S. inflation-linked funds “by far the largest one week inflow on record for the asset class,” Goldman Sachs analysts wrote, in a weekly report.

This week, another $1 billion streamed into the sector. “The recent chunky inflows follow what has been an unprecedented run for inflation-linked bond funds since April 15 of last year,” the Goldman team wrote.

More inflows could be in the cards too, as investors worry that inflation could stick around for longer than the Federal Reserve — and markets — have been expecting.

“It is dramatic,” said Chip Hughey, managing director of fixed income at Truist Advisory Services, of the inflation-linked fund inflows. “If you are looking at a portfolio in a fixed-income-specific context, you have limited tools to use to protect against inflation, particularly if it’s higher than the market is positioned for.”

This chart shows the dramatic rise in assets under management for U.S. inflation-linked bond funds since the spring of 2020, or the early phase of the pandemic when mass business shutdowns hit the U.S. economy.

Record inflows hit U.S. inflation-linked bond funds

EPFR, Goldman Sachs Global Investment Research

The Goldman team pegged the inflows as a 60% increase in assets under management for the funds since mid-April of last year.

Rising fund flows into the niche sector follow more than a decade of low inflation. As the U.S. economy has staged a rebound since the pandemic’s first wave of devastation, so has interest in finding ways to protect wealth from the erosion of higher prices.

U.S. inflation in June rose sharply again, booking a 4% increase over the past year and reaching a 13-year high.

Hughey said the recent “big pop” into inflation-linked bond funds likely signals a shift in investor thinking that the recent red-hot pace of inflation may not be as transitory as many initially thought.

Instead of two to three months, higher prices look more likely to last six to nine months, particularly with upward pressure on rents and wages, he said, in a phone interview with MarketWatch.

“Our take is that while we certainly expect inflation to cool from the really high readings over the past few months,” Hughey said, the Truist team expects it to settle above the average 1.6%-1.7% annual range seen for much of the past decade.

Fixed-income investments can be particularly vulnerable to inflation since higher costs can chip away at the sector’s modest returns relative to stocks, including as already low yields have slid globally, along with extreme support from the world’s major central banks.

See: What the world’s rising pile of negative-yielding debt means for U.S. Treasurys

The 10-year Treasury yield TMUBMUSD10Y,

The S&P 500 index SPX,

One way for investors to offset the risks of higher costs of living, can be to own inflation-linked securities, including those through offered through mutual funds and exchange-traded funds, like the iShares TIPS Bond ETF TIP,

Earlier this week, the U.S. Treasury said it would gradually increase the size of its inflation-protected securities, or TIPS, auctions by $1 billion, starting in August, September and October, resulting in expected gross issuance in 2021 of $20 billion.