If the S&P 500 breaks above this key level, it could set off an ‘epic emotional squeeze’ not unlike 1999, strategists warn

Positive hangover from Friday’s blowout jobs data may be fading as investors greet the start of a new week with fresh concerns about the spread of COVID-19.

Goldman Sachs is warning that China’s economy will take a hit from that virus and that isn’t helping oil prices, which are getting pummeled this morning. Stock futures are mixed and gold is also limping after a so-called “flash crash” in Asian trading.

Our call of the day from BTIG’s chief equity and derivatives strategist Julian Emanuel and equity strategy associate Michael Chu predicts more drama as the pair warn of a near-term top for the S&P 500, with meme stocks the possible trigger.

They point to a so-called “Wall of Money,” made up of fiscal and monetary stimulus, that has helped drive stocks, commodities, houses and inflation, and counterintuitively bonds, sending real yields to 1970s lows.

“While not an unequivocal negative for stocks, such low real yields have invariably resulted in medium-term elevated volatility,” said Emanuel and Chu. Their base case remains that the stock market rally will pause through the third quarter as volatility rises.

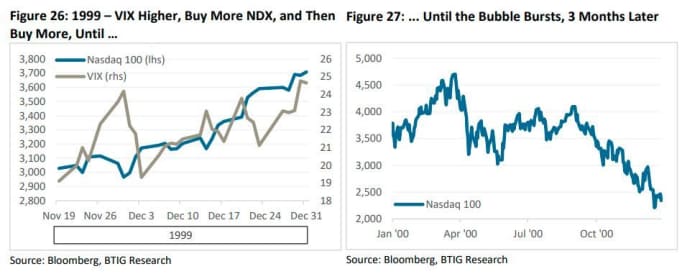

“Yet the dramatic price action in ‘meme stocks’ old and new raises the probability that higher volatility could result in an ‘altered reality’ exception — one only ever seen in late 1999, near the climax of the tech stock bubble,” they said. By “altered reality,” they mean negative real rates, record fiscal and monetary accommodation, record margin debt and higher trending inflation.

In other words, volatility and stocks can’t keep rising happily together, something has got to give. They are watching a level in particular on the S&P 500.

“We view a break above 4,500 as capable of starting an ‘epic emotional squeeze’ not unlike late 1999; it would be easy to envision a further 5%+ rally in the span of an ensuing week or two. After a year of targeted effort by social media traders, could the “meme stock” dynamic become a more mesmerizing effect, ‘forcing’ active managers and shorts to ‘chase’…echoing the climatic upside of 1999-00?”

The pair also say it’s possible the market could go the other way, dropping 10% if the S&P 500 breaks through its 50-day moving average of 4,300, a level that has held through 2021 pullback moments.

A grim U.N. climate report and Goldman sees trouble in China

The $1 trillion bipartisan infrastructure package was pushed past another hurdle late Sunday by a coalition of Democrats and Republicans, with a final vote possibly coming Tuesday.

The highlight of this week’s data calendar is likely to be Wednesday’s consumer price data (see preview), with job openings ahead for Monday.

DraftKings DKNG,

A damning U.N. report on climate change has warned of a “code red for humanity,” with a forecast for temperatures to shoot past a level of warming that world leaders were trying to prevent, in just a decade.

Goldman Sachs is warning the delta variant’s spread will hit China’s economy pretty hard in the third quarter, though a bounce is seen toward the end of the year. China has reportedly punished at least 30 officials in regions where COVID-19 has quickly spread. as Gao Qiang, China’s former health minister, warned there will be no “coexisting” with the virus.

A study in Israel shows that those who have gotten a booster of Pfizer’s PFE,

China’s ByteDance, which owns popular social media app TikTok, reportedly plans to go public in Hong Kong next year, despite regulatory pressures out of Beijing.

The chart

Gold prices GCZ21,

“Traders have been rattled by gold’s strange behavior in recent weeks when falling yields failed to boost the price, while last week’s small turnaround in yields triggered an immediate and strong negative response,” said Ole Hansen, head of commodity trading at Saxo Bank, on Twitter. He said Wednesday’s U.S. inflation data may decide the next turn for gold.

The markets

Stock futures are mixed, with Dow futures YM00,

Random reads

China’s wayward elephants head home

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.