“As vaccination against covid-19 will be gradual in all major tin producing countries except China, the ramp-up of tin mine operations across the world will not be a smooth process. We expect sporadic tightening of lockdown restrictions in major producing countries to constrain the pace at which spare mine capacity can be utilized,” the report reads. “For instance, as of July, tin producers in both Indonesia and Malaysia were being hampered by renewed lockdown restrictions in their respective countries aimed at controlling surging domestic covid-19 cases.”

According to Fitch, the lack of competitive diversity in the tin mining landscape also plays a role in the way mining ramp-up will pan out particularly because, in major producing countries, the sector is often dominated by a single firm.

As an example, the market researcher presents the case of Indonesia where state miner PT Timah holds the most market share in tin concentrate production and was able to further consolidate the industry in recent years through the use of new technology on its concessions. In Latin America, on the other hand, Minsur in Peru is the sole tin miner in the country while state institution Comibol in Bolivia dominates output.

“The lack of a diverse crop of producers can lead to weak project pipelines as total investment in a sector is in part constrained by the number of players operating in that sector,” the report states. “As a result of both factors, the sector has a fairly small pipeline of new projects. In the long term, this will weigh on production growth as declining ore grades and a lack of replacement projects will weigh on output growth in the long run.”

In Fitch’s view, however, the most significant factor that may slow output growth will be more stringent environmental regulations in countries such as China, Malaysia and Indonesia. Two case points exemplify this assertion, and those are the moratorium on new exploration licences announced in June 2019 by the Perak State in Malaysia, which halted Australian junior Elementos’ Temengor tin project. Meanwhile, in Indonesia, protests by coastal communities threaten to disrupt PT Timah’s expansion of offshore mining for tin in the country.

Regardless of what takes place in these specific localities, Fitch believes that a favourable price outlook and concerns over tin concentrate supply lagging behind consumption demand will make projects more likely to receive management approval to move forward as the economics of the project are more likely to be realized.

“In particular, despite a weaker performance relative to the previous three years due to declining ore grades, we believe that Myanmar is showing upside potential over the medium-to-long term. The updated Myanmar Mining Law implemented in 2018 has sparked interest from foreign and domestic mining firms, increasing permit applications for new mining projects including tin,” the document states. “As of May 2020, the government has received more than 3,000 mining permit applications since its implementation and is reportedly planning to approve approximately 160 medium- and large-scale applications, consisting of both domestic and foreign firms. We expect rising tin prices will lead to improving margins among domestic producers in Peru, Australia and Bolivia, which will prompt continued production growth in these countries.”

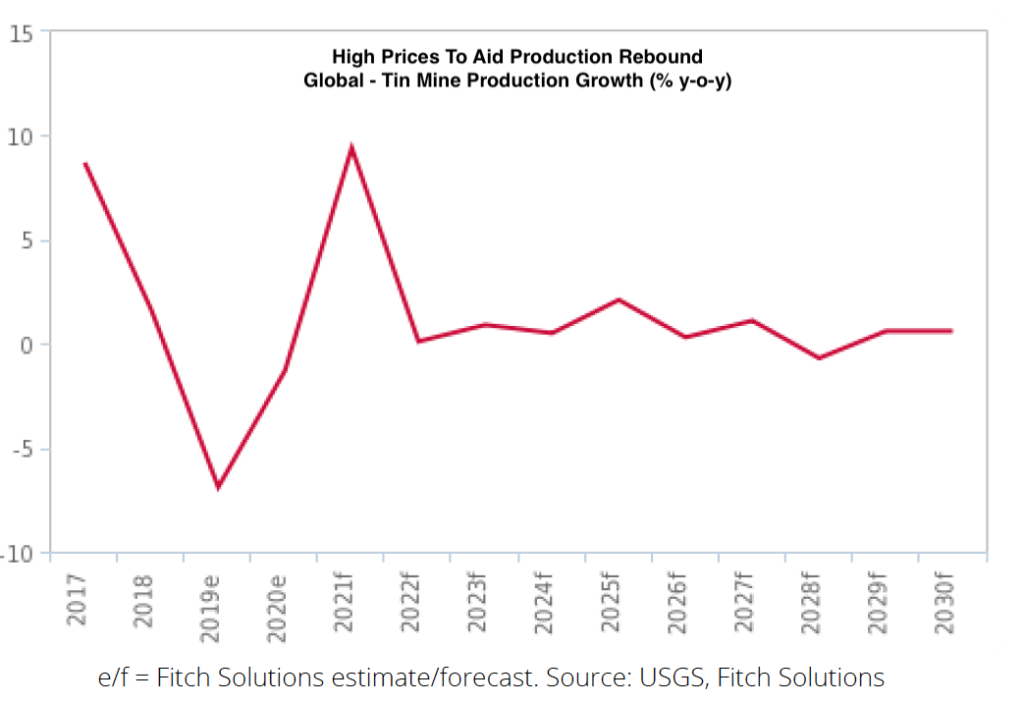

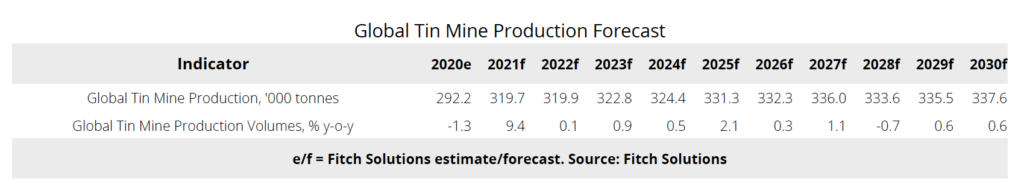

High prices may present an upside risk to the current tin mine production forecasts for the coming decade, Fitch’s experts write in the report. In fact, the firm’s aggregated, country-by-country forecasts currently imply mine growth to remain weak compared with previous years.

“Global tin mine production grew at an annual average rate of 2% y-o-y over 2010-2020 and we forecast annual growth of 1.5% over 2021-2030. This would be significantly slower than annual average growth rates for other metals including copper (3.8%), nickel (4.5%) iron ore (1.9%) and gold (3.2%),” the outlook predicts.

Country by country

Putting the focus on three major tin producers, Fitch believes that China’s output will remain stable in 2021 after three consecutive years of contraction. In the longer term, however, production is expected to stagnate, as tightening environmental standards squeeze mine profitability.

When it comes to Peru, Fitch’s numbers show that tin mine production should grow by 25.2% in 2021 as low base effects and the ramping up of the B2 tailings projects at the San Rafael mine supports growth.

In Indonesia, the rebound of its tin mine production in 2021 is expected to be hampered by renewed lockdown restrictions imposed in the country in July. For Fitch, the relatively slow vaccine roll-out means that sporadic tightening of restrictions will remain a risk throughout 2021.

“Due to stricter environmental regulations limiting investment, we forecast tin mine output to stagnate in the longer term. We forecast output at 79,300 tonnes in 2030 compared with an expected 83,000 tonnes in 2021,” the document states.