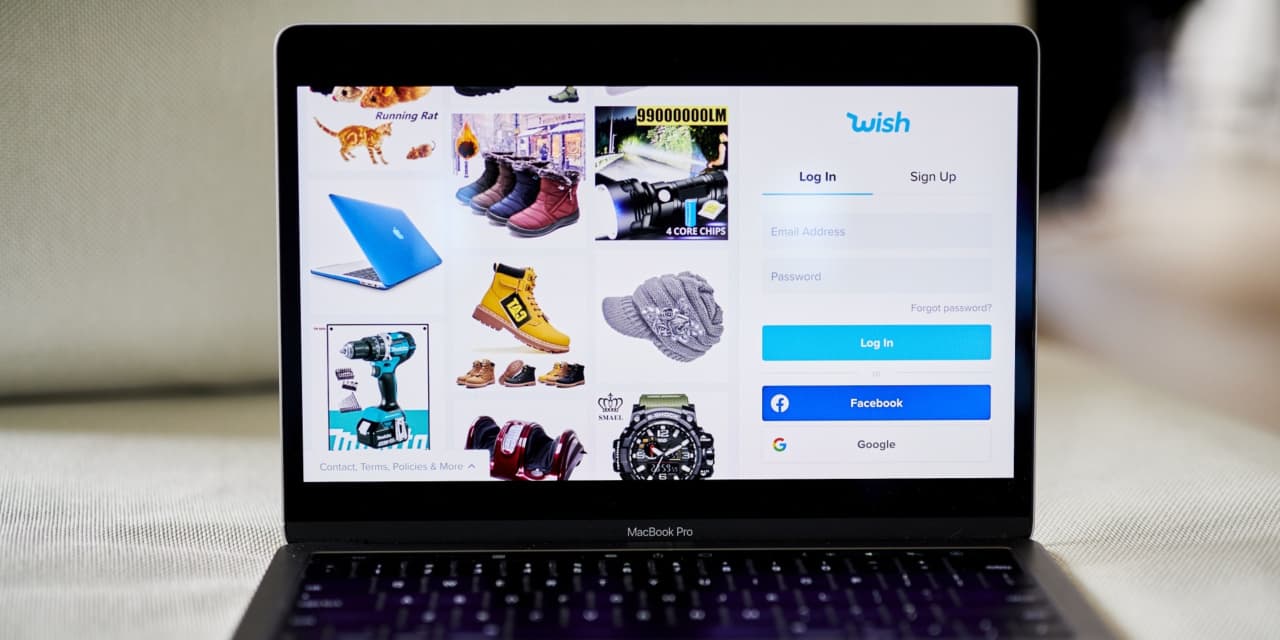

Wish stock tanks 18% as e-commerce company says demand slowed, costs rose more than expected

Shares of ContextLogic Inc. fell more than 18% in after-hours trading Wednesday after the parent of e-commerce site Wish said demand for its products slowed, fewer users and active buyers used its platform, and costs rose more than it had expected.

ContextLogic Inc. WISH,

Analysts on average expected the company to report losses of 13 cents a share on sales of $723 million, according to FactSet.

Logistics improved and “we expected user retention to improve now that we have more reliable logistics, but instead retention declined,” the company said in a letter to investors.

“While we are not satisfied with these results, the second quarter of 2021 was already going to be a challenging year-over-year comparison,” since the company benefited from a significant increase in mobile usage and less competition from brick-and-mortar stores, Wish said.

ContextLogic went public late last year, as the pandemic was pushing consumers to online purchases. ContextLogic priced shares at $24 in its December initial public offering, but the stock has been slammed since, falling as low as $7.52 in public trading this year. The stock closed Wednesday at $9.41.

Wish said the number of app installs fell 13% and average time spent on its platform fell 15% quarter-on-quarter. At the same time user engagement was dwindling, the cost of digital advertising, which Wish uses to drive demand and transactions to its app, increased more than it expected.

“In addition, the recent privacy changes for (Apple Inc.’s AAPL,

limited supply of impressions,” the company said. “Ultimately, this drove up competition for advertising bids, restrained our ability to reach more users and increased advertising costs for Wish since most of our growth marketing has been focused on Android, the preferred device for the majority of our users.”

Wish said that as a result of the headwinds it will shift focus on products and merchants that earn positive ratings and add more recognizable brand names, in addition to focusing on categories such as apparel, home goods, and gadgets “that translate well into an ‘online treasure hunt’ experience,” it said.

The actions, however, will take time to take hold and are not expected to “contribute meaningfully to positive year-over-year results before the second half of 2022,” Wish said.

Wish said it has cut back on digital advertising. It did not provide its usual quarterly revenue outlook, saying it will focus “squarely on execution and efficient expense management.”

By way of context, however, the company said quarter-to-date total revenue through July 2021 was down about 40% compared with the second quarter, while revenue from its marketplace was down about 55%.

“With the pull back in digital ad spending, we expect third quarter revenue to decline further,” the company said. Wish said it expects a third-quarter adjusted Ebitda loss between $70 million to $65 million.

Analysts on average were expecting adjusted-Ebitda losses of $74 million, according to FactSet.

Claudia Assis in San Francisco contributed to this report