Stocks, Futures Fall as Traders Brace for Powell: Markets Wrap

(Bloomberg) — U.S. stock-index futures fell and the dollar rose amid signs of faltering growth and investor nervousness in the run-up to the Federal Reserve’s Jackson Hole symposium in late August.

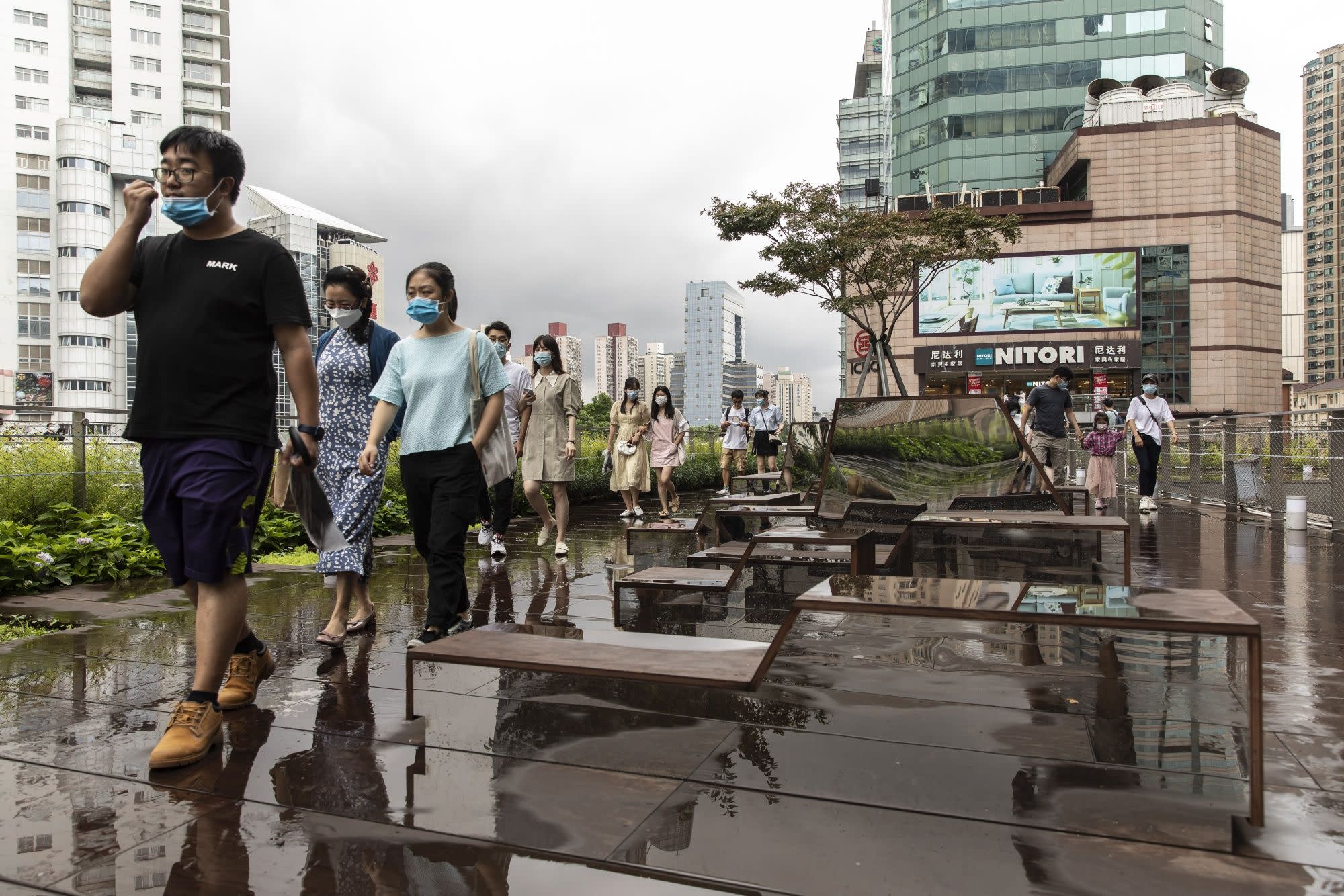

September contracts on the S&P 500 Index declined 0.2% after the underlying gauge notched up another record high on Friday. Treasuries pared gains, with the 10-year yield pulling back from a drop of three basis points. Commodities declined after China’s retail sales and industrial output data showed activity slowed more than expected.

Investors awaited a town hall by Fed chair Jerome Powell on Tuesday for clues on whether a recent string of strong economic data qualified as adequate progress for the central bank to consider tapering stimulus. Speculation about an announcement at the Jackson Hole meeting deepened even as data Friday showed U.S. consumer confidence plunged to a near-decade low.

“Shares remain vulnerable to a short-term correction with possible triggers being the upswing in global coronavirus cases, the inflation scare and U.S. taper talk,” said Shane Oliver, head of investment strategy and chief economist at AMP Capital.

Traders will also be monitoring the Federal Open Market Committee’s latest minutes this week as competing views on the persistence of inflation spurs volatility in Treasuries.

Equities in the U.S. and Europe hit records last week, bolstered by vaccine rollouts. But the continued risk from the delta variant pushed European stocks lower on Monday. The benchmark Stoxx Europe 600 Index broke a 10-day streak without a loss, with energy and commodity stocks dragging the gauge the most.

Crude oil dropped for a third day as the resurgent pandemic hurt prospects for global demand, just as drilling data from the U.S. pointed to increased activity. Bitcoin was trading around $47,400.

Also, dominating the headlines is the alarm in Congress as the Taliban take control of Afghanistan in the vacuum left by departing U.S. and NATO forces.

Here are some events to watch this week:

U.S. Federal Reserve Chair Jerome Powell hosts a town hall discussion with educators TuesdayChina’s top legislative body, the National People’s Congress Standing Committee, begins a four-day meeting in Beijing TuesdayU.S. retail sales are due TuesdayReserve Bank of Australia minutes are scheduled to be released TuesdayReserve Bank of New Zealand policy decision and briefing by Governor Adrian Orr WednesdayFOMC minutes released WednesdayBank Indonesia rate decision and Governor Perry Warjiyo briefing Thursday

For more market analysis read our MLIV blog.

These are the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.4% as of 9:06 a.m. London timeFutures on the S&P 500 fell 0.2%Futures on the Nasdaq 100 fell 0.1%Futures on the Dow Jones Industrial Average fell 0.2%The MSCI Asia Pacific Index fell 0.7%The MSCI Emerging Markets Index fell 0.4%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%The euro fell 0.1% to $1.1783The Japanese yen rose 0.2% to 109.42 per dollarThe offshore yuan was little changed at 6.4784 per dollarThe British pound was little changed at $1.3860

Bonds

The yield on 10-year Treasuries was little changed at 1.27%Germany’s 10-year yield was little changed at -0.47%Britain’s 10-year yield was little changed at 0.57%

Commodities

Brent crude fell 1.6% to $69.44 a barrelSpot gold fell 0.3% to $1,774.45 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.