Iron ore price dives 13% on Fed, Chinese growth worries

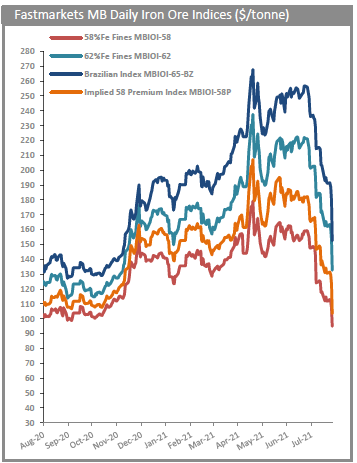

The high-grade Brazilian index (65% Fe fines) also fell 15% to $152.50 a tonne.

The most traded iron ore futures on the Dalian Commodity Exchange, for January delivery, closed down 7.2% to 763 yuan ($117.44) per tonne, after plunging to 8% earlier during the session.

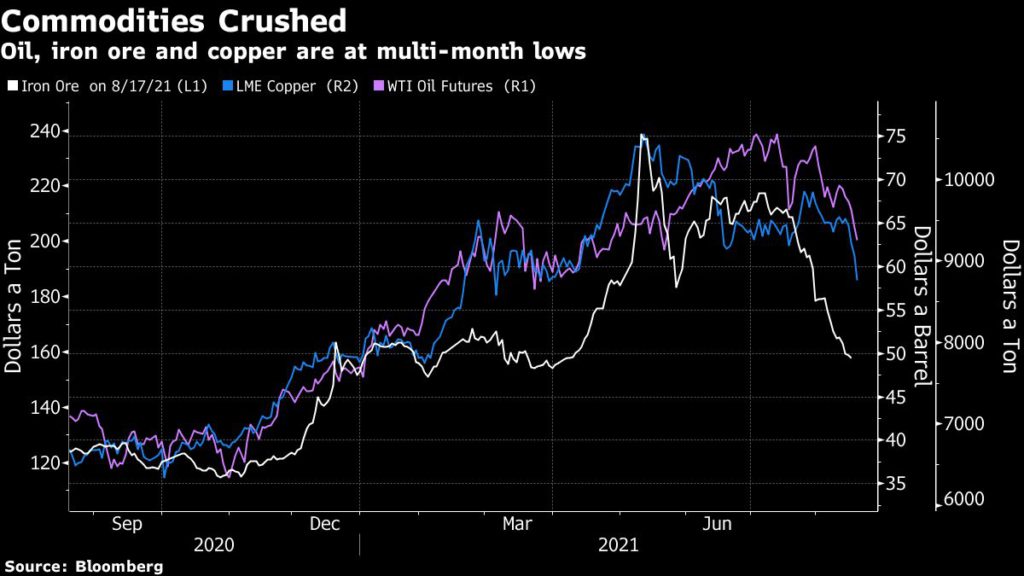

Prices are more than 40% below a record high reached just three months ago. Mining stocks also slid, with BHP Group down more than 18% from the previous week, Rio Tinto Group down 16%, and Vale down 13%. Oil and copper also hit multi-month lows.

China’s steel consumption is expected to soften in the second half, especially in the construction sector, due to tightening property policy, the country’s steel association and analysts said.

“The logic is, the weaker demand is, the stricter steel production curbs will be,” analysts at CITIC Securities said in a note.

“Under the assumption of cooling demand, increase in steel prices will be limited … but pressure on iron ore is significant.”

“Policymakers are clearly concerned about over-investment and concentrated credit risk in the property sector,” Commonwealth Bank of Australia wrote in an emailed note.

“Even if China swings to more pro-growth policies to battle recent weakness, there’s a good chance that the property sector is left out.”

Meanwhile, iron ore supplies are also expected to gain from domestic miners, Brazil, and other non-mainstream countries, according to Li Wentao, an analyst with Tianfeng Futures.

With iron ore inventories at mills relatively low, there could be restocking demand in coming months, Li added.

Fed

Metals markets have also been pressured by worries that the Federal Reserve may soon start curbing massive stimulus that helped drive prices higher over the past year, as well as risks from the fast-spreading delta coronavirus variant.

To cushion the US economy from the blow inflicted by the pandemic, the Fed has been buying $120 billion worth of assets every month, buoying commodities and stocks. The minutes of the bank’s July meeting showed that most participants now judged it could be appropriate to start reducing the pace of stimulus.

“The overall environment was fragile to begin with, so I think the Fed minutes yesterday just added another layer of fragility to that,” said Howie Lee, an economist at Oversea-Chinese Banking Corp.

“It’s just broad risk aversion across markets.”

“What if the Fed can’t taper, let alone hike? This market is wedded to the narrative,” said Kit Juckes, chief foreign-exchange strategist at Societe Generale SA in London.

(With files from Reuters and Bloomberg)