Apple’s stock peeked briefly into record territory after Wolfe Research boosted rating, price target

Shares of Apple Inc. rallied briefly into record territory before paring gains Wednesday, after Wolfe Research analyst Jeff Kvaal raised his rating, price target and earnings estimates, citing the belief that strong demand for the technology behemoth’s iPhones will continue.

The stock AAPL,

Wolfe’s Kvaal raised his rating to peer perform, after being at underperform for roughly the past year. He also boosted his price target to $155, or just 1.6% Wednesday’s closing price, from $135.

The upgrade follows moves by U.S. wireless telecommunications operators to restore all promotions to existing customers for Apple’s iPhone 12s, which were released last year, Kvaal said. In addition, he believes Apple gained approximately 3% of market share in China at Huawei Technologies’ expense, and also achieved share gains in Europe.

He raised his fiscal 2021 estimate for earnings per share to $5.66 from $5.62, which compares with the FactSet consensus of $5.57, and lifted his fiscal 2022 EPS estimate to $5.85 from $5.79, above expectations of $5.64.

“In our view, healthy domestic operator promos and Huawei share gains drove strong iPhone 12 demand throughout the cycle. We expect both to continue with the iPhone 13,” Kvaal wrote in a note to clients. “Apple’s ability to mitigate supply challenges and elevated [average selling prices] should produce further tailwinds.”

The iPhone 13 is expected to be revealed in the coming weeks.

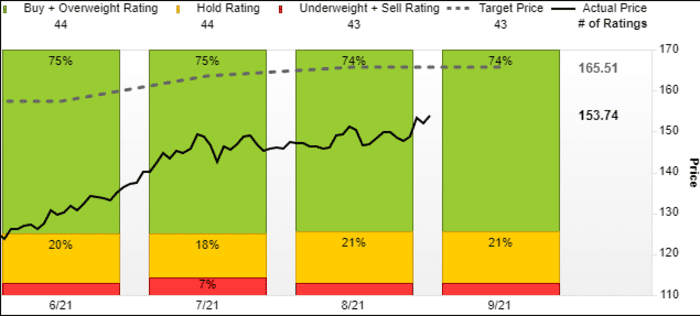

Following Kvaal’s upgrade, only two of the 43 analysts surveyed by FactSet have the equivalent of sell ratings on Apple, while 32 have the equivalent of buy ratings and nine have the equivalent of hold ratings. The average price target is now $165.51.

Also read: Have we reached peak Apple? Some say the company is just getting started.

Despite his bullish outlook on iPhone demand and future earnings, Kvaal stopped short of recommending investors buy the stock, given its recent underperformance.

Over the past 12 months, Apple’s stock has gained 13.7%, while the SPDR Technology Select Sector exchange-traded fund XLK,

And although Apple has profit and revenue expectations over the past four quarters, the stock has declined the day after results were released by an average of 2.6%, according to FactSet data, which Kvaal said indicates “outside beats are no longer translating to the stock.”