Aggressive young investors are helping keep a correction at bay, says JPMorgan

We are almost two days into what has historically been a bummer of a month for stock investors. Given the list of worries piling up, and those include Friday’s jobs data and the shadow of last September’s nasty 10% slide, “the market is likely to be bound for choppiness,” any way you slice it, notes MarketWatch’s Mark DeCambre.

Yet investors are hanging in there, and who can blame them as there just aren’t a ton of alternatives. In a fresh missive, former bond king Bill Gross said Treasuries have joined cash in the “trash” pile, with the yield on the 10-year note TMUBMUSD10Y,

Onto our fear-not call of the day from JPMorgan strategists who say that until retail investors stop charging into stocks, markets probably don’t have too much to worry about.

“What could cause an equity market correction? This question is admittedly difficult to answer. So far this year, retail investors have been buying stocks and equity funds at such a steady and strong pace that makes an equity correction looking rather unlikely,” wrote Nikolaos Panigirtzoglou and a team of strategists in a note late Wednesday.

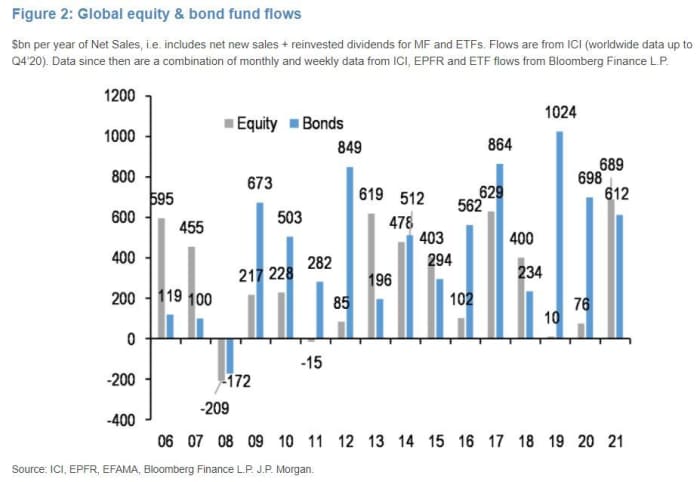

The strategists point to year-to-date equity fund flows of nearly $700 billion, or more than $1 trillion annualized, well above the prior 2017 record high of $629 billion. Those flows have not only pushed stocks higher, but forced other investors into equities, explains Panigirtzoglou and the team. And we’re not talking just any old retail investor. Hello, Robinhood HOOD,

Read: The meme-stock moment turns 1 — unofficially — and welcomes a sophomore class of tickers

“As certain retail investors, most likely the younger cohorts, buy stocks and equity funds aggressively they push the equity market up strongly, making ‘other’ retail investors, i.e. the older cohorts, inadvertently more overweight equities,” he said. And the latter group has been buying bond funds to try and rebalance, which has brought those flows near to a previous record high seen in 2019, said the bank.

But Panigirtzoglou and the team are keeping close watch on one chart in particular — “our most holistic of our equity position indicators, the implied equity allocation of nonbank investors globally. It is indicating an implied equity allocation of 46% at present, which is just below the post-Lehman crisis high of 47.6% in 2018.

“Whether the coming Fed policy change changes retail investors’ attitude toward equities remains to be seen. Monitoring this retail flow on a daily and weekly basis going forward is key to the equity market outlook in our mind,” said the strategists.

Jobless claims and deadly floods in New York City

The remnants of Hurricane Ida flooded streets and subways and disrupted travel in New York, putting it in a state of emergency and resulting in the deaths of eight people so far, while parts of New Jersey were battered by tornadoes. That’s as a Pennsylvania dam is in trouble and Louisiana suffers on.

With one day to go until nonfarm payrolls, data showed weekly jobless claims falling to a pre-pandemic low of 340,000 even amid the delta variant’s surge. Second-quarter productivity data was revised down and the U.S. trade deficit narrowed, while factory orders for July are still ahead.

Moderna MRNA,

Citing concerns about moviegoer attendance amid the ongoing pandemic, ViacomCBS VIAC,

A divided Supreme Court refused to block a restrictive abortion law in Texas that went into effect on Wednesday. But they suggested other challenges can still be brought.

Those waiting to snap up Tesla’s TSLA,

Shares of INmune Bio INMB,

Alibaba BABA,

The markets

Stock futures ES00,

The chart

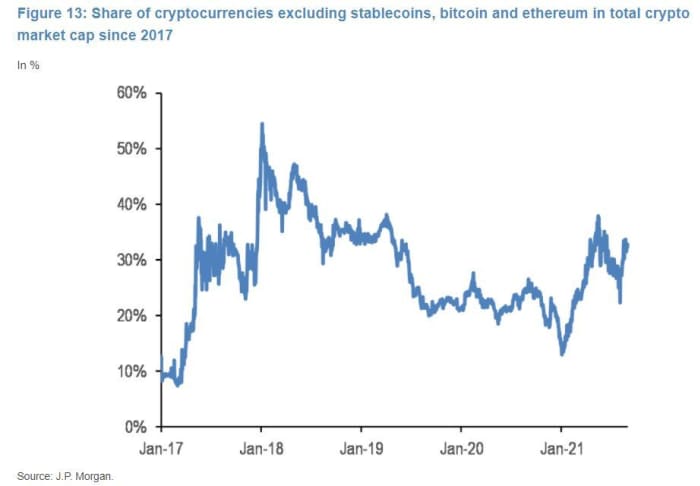

Retail investors also fueled an August revival in cryptocurrencies, but also made them look “frothy” again, cautions our chart of the day, also from strategist Panigirtzoglou and the team at JP Morgan.

“The previous phase of retail investors’ ‘mania’ into cryptocurrency markets was between the beginning of January and mid-May when the share of ‘altcoins’ had risen from 13% to 37.6%. While far from the record high of 55% seen in January 2018, at 32.6% the share of ‘altcoins’ looks rather elevated by historical standards and in our opinion it is more likely to be a reflection of froth and retail investor ‘mania’ rather than a reflection of a structural uptrend,” said the team.

Meanwhile, they note that the share of bitcoin BTCUSD,

Read: Ether ‘on track to potentially breach the $4,000 resistance level’ soon, an analyst says

Random reads

“The Great Big Corrupt Company” and 800 other rejected corporate names .

This year’s finalists for the Comedy Wildife Photo Awards include a giggling seal and dancing bears.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.