The tech firm could earn a further 5% in the project on refined lithium chemical product from Kachi depending on potential offtake partners.

California-headquartered Lilac will provide clean technology expertise as well as an on-site demonstration plant for a 25% in the project.

Lilac’s backers include Breakthrough Energy Ventures, a non-profit founded by Microsoft’s Bill Gates in 2016, and whose investors include well-known billionaires such as Amazon’s Jeff Bezos and Michael Bloomberg. Lilac said the deal allows the firm to prove its technology will provide a high purity product at scale, potentially allowing it to broaden its customer base.

Kachi, Lake’s flagship project, is expected to produce 25,500 tonnes per annum from 2024 with possible expansion to 50,000 tonnes.

Its current cost estimate is pegged at about $540 million, with $300 million to be funded by Lilac and Lake Resources through debt.

“Disruptive” technology

Currently, lithium extraction from salt brine is a time and labour-intensive process that produces large amounts of waste.

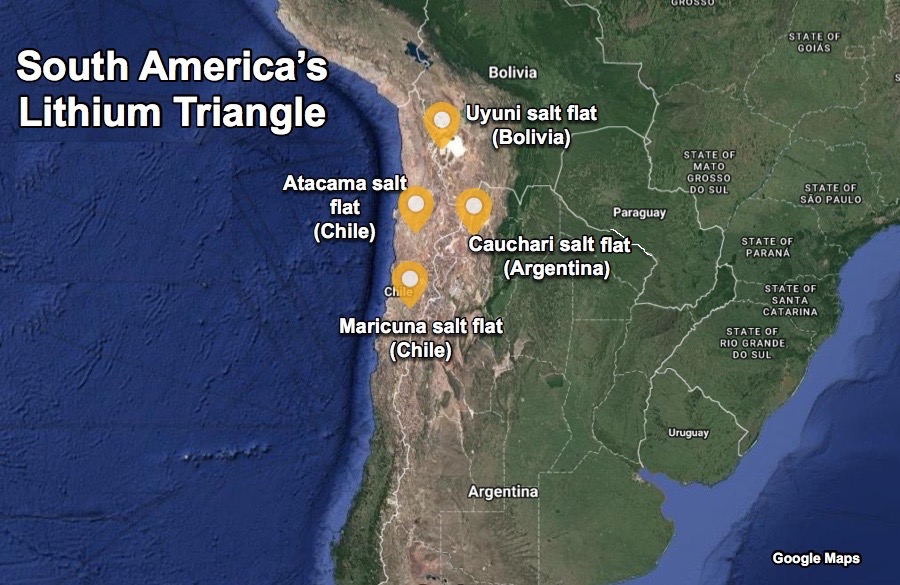

Brine from underground deposits, largely found in the South American area known as the “Lithium Triangle” (Chile-Bolivia- Argentina), is pumped to the surface and moved through a series of massive evaporation ponds with chemical treatments added.

Lilac’s ion-exchange process will allow brine to be returned underground, reducing the project environmental impact.

“Lilac’s technology is truly disruptive as it has taken a non-mining tech solution which cuts operating costs and boosts lithium recovery from our brines,” Lake Resources managing director, Steve Promnitz said in the statement.

Lithium’s price has soared in the past year, recently reaching their highest levels since mid-2018.

Battery-grade lithium carbonate prices have gained more than 20% in the first half of September and are now up 188.9% and 215%, respectively in the Chinese domestic market this year, data from Benchmark Mineral Intelligence shows.

Demand for lithium is expected to jump 26.1% or about 100,000 tonnes of lithium carbonate equivalent to a total of 450,000 tonnes, flipping the market into a deficit of 10,000 tonnes.