Here are five places to invest for income that Wall Street is overlooking, says Fidelity manager

Well, that was a month to forget, with the 4.8% downturn for the S&P 500 SPX,

It’s been a difficult decade, not just month, for income investors, with interest rates so low. Now, income investors confront not just low rates but high inflation. So it isn’t easy to find places to invest for income streams rather than shooting for the moon.

Adam Kramer, a portfolio manager at Fidelity, says floating-rate preferred stocks and loans are less likely than fixed-income investments to lose value in a higher inflationary and interest-rate environment. In an article on the fund manager’s website, he said master limited partnerships, typically oil and gas pipelines, pay some of the highest yields, and according to Kramer are mispriced by the market. Similarly, clean energy yieldcos tend to operate solar and wind power projects.

Kramer also notes real-estate investment trusts — and mentions casino and shopping mall REITs as having COVID concerns reflected in their prices. Lastly, he mentioned dividend-paying value stocks, like oil producers and gold miners.

While Kramer didn’t mention individual investments, a review of the Fidelity Advisor Multi Asset Income Fund where he’s lead manager shows holdings through the end of September. The fund’s top stock market investments included metals streaming company Wheaton Precious Metals WPM,

The fund invests in wood-fiber-processing master limited partnership Enviva Partners EVA,

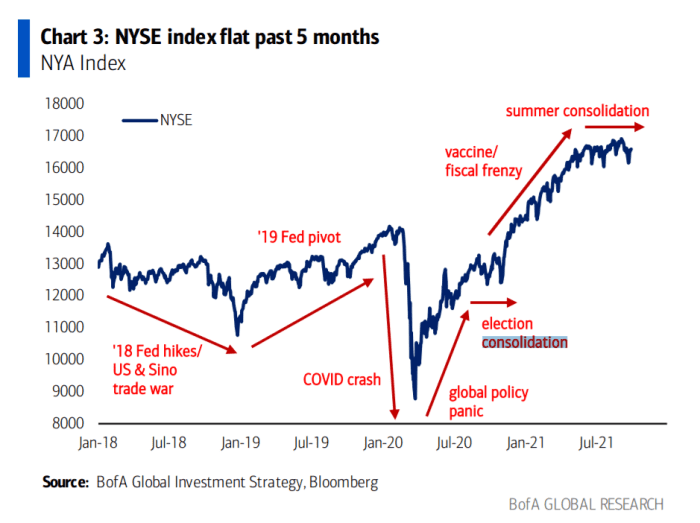

The chart

People don’t really talk about the New York Stock Exchange NYA,

The buzz

Politics continued to take center stage, as House Speaker Nancy Pelosi delayed an infrastructure vote while West Virginia Sen. Joe Manchin called for the social-spending plan’s size to be cut to $1.5 trillion from $3.5 trillion. The debt-ceiling issue still looms as well.

It’s a big day on the economics front, with the Federal Reserve’s preferred inflation measure, the PCE price index, due for release, alongside consumer spending and personal income at 8:30 a.m. Eastern. The closely followed Institute for Supply Management’s manufacturing index is due at 10 a.m., as are construction spending data, as automobile makers release their monthly sales throughout the day.

Merck MRK,

Zoom Video Communications ZM,

The market

Futures on both the S&P 500 ES00,

Random reads

“Seinfeld” reruns have landed on Netflix NFLX,

The pop singer Shakira says she fought off a pair of wild boars.

Talk about a mixed bag — a man died before cashing the winning lottery ticket he was carrying in his wallet.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.