Gold price rallies as bond yields, dollar retreat

Other precious metals followed along, with spot silver rising 2.7% to $23.17 per ounce, platinum gaining 1.1% to $1,023.50 and palladium adding 3.2% to $2,116.50.

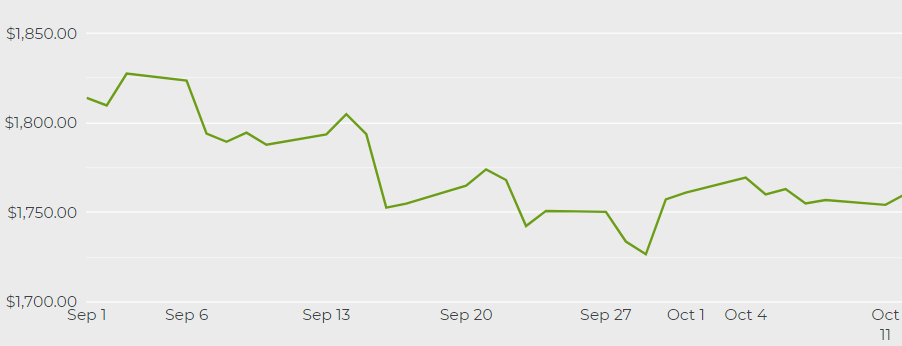

[Click here for an interactive chart of gold prices]

“Gold is just following yields at the moment. The initial reaction after CPI (consumer price index) data was a big spike in yields, which is now starting to fade away,” Daniel Pavilonis, senior market strategist at RJO Futures, commented in a Reuters report.

Gold initially pared gains as benchmark 10-year Treasury yields rose above 1.6% after data showed a solid increase in US consumer prices for September, with further price jumps expected in the coming months.

However, a subsequent pullback in yields, which reduced the opportunity cost of holding non-interest-bearing gold, drove a strong rally in the precious metals market.

“It’s a situation where gold is an inflationary metal, which should be going up, but initial rate shocks capped its upside potential,” Pavilonis added.

Bullion also drew support from a slide in the US dollar and worries that high inflation could hit global economic growth prospects.

“Given how the stagflation talks continue to drain global sentiment and promote risk aversion, this could support gold bugs,” said FXTM analyst Lukman Otunuga.

Investors now await the release of minutes from the US central bank’s September meeting amid expectations for tapering of economic support as soon as next month.

Meanwhile, a group of banks that partnered with the London Metal Exchange to launch gold and silver futures in 2017 is preparing to abandon the project after hoped-for volumes did not materialize.

(With files from Reuters)