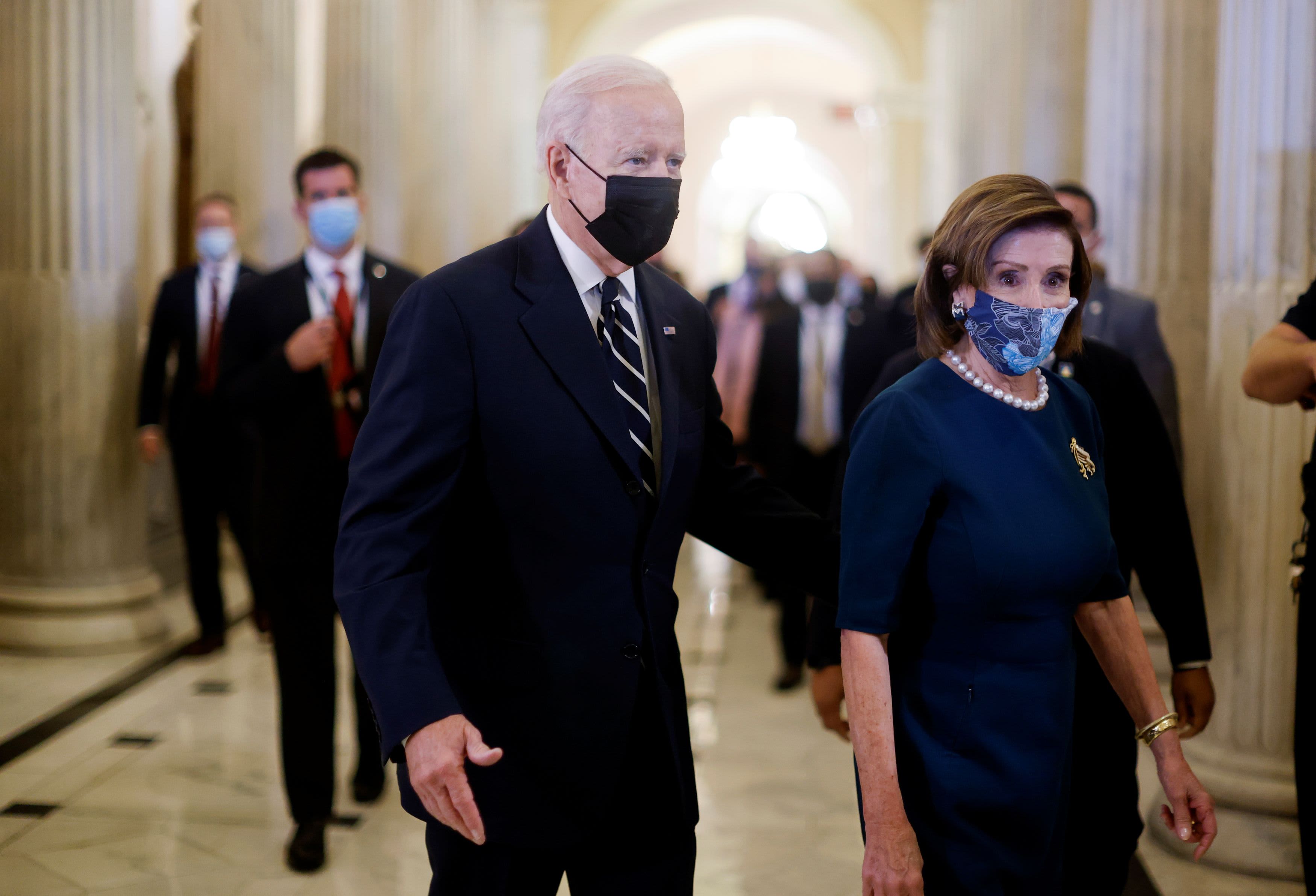

U.S. President Joe Biden departs with House Speaker Nancy Pelosi (D-CA) after speaking to the House Democratic Caucus about the Build Back Better agenda and the bipartisan infrastructure deal at the U.S. Capitol in Washington, October 28, 2021.

Jonathan Ernst | Reuters

Congress is on the verge of passing legislation to implement critical parts of President Joe Biden’s Build Back Better initiative. Many core provisions, like expanded child care and universal pre-K, would help Americans make real progress on easing the pathway to work and expanding opportunity, now and in the future. Investments in education, health, housing, and the care economy are crucial both to address the damage that inequality does to our society and to lessen the economic costs of the current imbalance.

However, some question the scope of Build Back Better and take issue with its price tag. I am sympathetic to concerns being raised about whether we can afford this spending but I am confident that we can.

As the Congressional Budget Office scores this legislation in the coming days, lawmakers may find it necessary to make some adjustments at the margins. But some would raise the bar higher, by making speculative projections that assume a future Congress will extend temporary policies without raising additional revenue or cutting spending. That would be a mistake.

I spent much of my career trying to ensure the United States budget worked for those struggling to make ends meet in a fiscally responsible way, and that often meant finding compromises to moderate spending or raise additional revenue. When I was Director of the Office of Management and Budget in the 1990s, we balanced the budget — not for one year, but for three in a row — while expanding health-care coverage to millions of kids as part of the Balanced Budget Agreement.

Since then, our nation has followed a different fiscal path. Successive tax cuts for the wealthiest individuals added to our deficits, and so too did spending on crisis response — appropriately so — and other priorities. During the most difficult days of the Covid-19 economic crisis, I supported efforts to increase the debt to provide emergency relief to vulnerable families and businesses and spur a recovery. The economic bounce and significant reductions in poverty that followed show that was the right decision.

In contrast, long-term investments like those in the Build Back Better Act should be paid for. And that is just what the pending legislation does, raising revenue through modest tax changes and by funding the Internal Revenue Service to enforce our tax laws and requiring everyone, including many wealthy Americans, to play by the same rules as working men and women and report all their income when they pay their taxes. If all reportable income was included in tax returns, we would collect some $600 billion in additional revenue annually. This “tax gap” is both expensive and unfair. Experts at the IRS and Treasury Department agree that with vital investments to restore historically underfunded enforcement efforts, new revenue is likely to exceed the conservative estimates of congressional scorekeepers. Just as importantly, it will restore a level playing field so those who comply with tax laws are not at a competitive disadvantage compared to those who cheat.

At the same time, even over the past year, we have seen Congress allow temporary programs to lapse, even though many members would have supported extensions. And throughout the debate on these new spending initiatives, the focus has been to pay for any new spending. There is every likelihood that with demographic and fiscal pressures in the future, the pendulum will continue to swing back in the direction of at least paying for new spending.

If, as I hope, important policies like child care are extended, they should also be paid for, and I believe they will be. There remains ample low-hanging fruit in the tax policies proposed by the administration that are not included in the pending legislation — from modestly raising individual, corporate, or capital gains rates to preventing capital gains from being passed from generation to generation without ever being taxed. A future Congress will have many options when looking to extend these policies that will make our economy stronger and more fair.

President Biden ran for office and is now governing as someone who is willing to go against the tide and set a standard that, after emergency spending ends, new initiatives should be paid for. If that standard had been applied to tax cuts just a few years ago, our country would have some $2 trillion of fiscal space available, which would have been especially significant during the Covid recession. In contrast, today the administration and Congress are working hard to pay for policies that are badly needed.

As this package has been pared back over the course of negotiations, both spending and revenue have been reduced, but it remains the case, as it was with the original proposal, that beyond the 10 years CBO examines, deficits will be smaller, not larger.

It is right to ask if current spending under Build Back Better is paid for. When a future Congress considers whether to extend provisions, it will again need to find either revenues or savings to offset that additional spending. But for now, Build Back Better should be considered on its own merits: will it advance a more equitable and dynamic economy and is it paid for? And the answer in my view is yes on both.

—Jacob J. Lew served as U.S. Treasury Secretary from 2013 to 2017.