Here’s what history says about stock-market performance during the Thanksgiving week

Will it be gobble, gobble for U.S. stock-market investors during the Thanksgiving week or an overdose of tryptophan?

That’s the question that some may be considering as Wall Street completes the last full week of trading in November and gears up for a holiday period that is typically characterized by some of the lowest volumes of the year.

U.S. financial markets are closed on Thursday, Nov. 26 for the Thanksgiving holiday and beyond Thursday’s closure, since 1992, stock exchanges have adhered to an abbreviated trading schedule the Friday after Thanksgiving in the U.S.

The New York Stock Exchange and the Nasdaq will close at 1 p.m. Eastern time on Friday, while the Securities Industry and Financial Markets Association recommends a 2 p.m. Eastern close for U.S. bond markets.

Against that backdrop, Thanksgiving has become synonymous with low-volume trading, which can sometimes lead to choppy action.

So how has the market performed in this scenerio? Not bad?

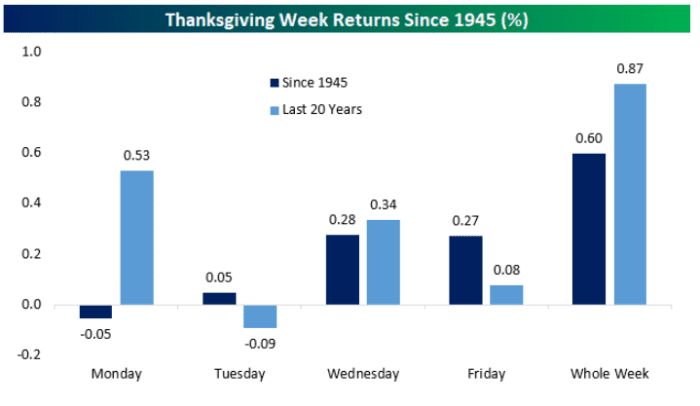

The folks at Bespoke Investment Group say that Thanksgiving week has lent itself to a modest gain for stocks dating back to 1945.

The researchers say that since that point, “the entire week of Thanksgiving has averaged a 60 basis points, or 0.60 percentage point, advance for the S&P 500 SPX,

Bespoke, however, says that more recently, gains have shifted to Mondays in Thanksgiving week, with small declines on Tuesday and rallies on the last two days of the session.

The prospects of gains may be heartening to investors considering the prospect of inflation fears and uncertainty about the leadership of the Federal Reserve, with President Biden expected to decide whether to extend Jerome Powell’s tenure as Fed chairman, which ends in Feburary or possible turn to Fed Gov. Lael Brainard.

Markets closed mostly lower on the Friday before Thanksgiving, with the S&P 500 SPX,