Here’s why Santa may skip Wall Street this year

Everyone knows about the Santa rally effect, and it’s particularly pronounced in a bull market. According to Bank of America, the November-to-January period is the strongest three-month period of the year for S&P 500 returns, and even more so when August-to-October is above-average, which it was this year with a 4.8% gain.

But the market isn’t showing a lot of festive cheer, particularly if you look at the bottom 495 stocks of the S&P 500 and small-caps. The S&P 500 equal weight index SP500EW,

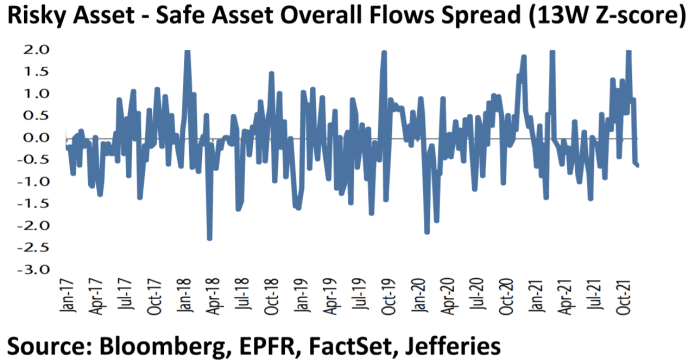

Markets don’t appear to be in a mood for risk.

Sean Darby, global equity strategist at Jefferies, says an extended period of flows into risky assets has crested as the dollar firms, LIBOR cuts through its moving average, currency volatility breaks out, and the yield curve is “unnervingly flat” while inflation expectations remain elevated.

Soon-to-be-outgoing Fed Vice Chair Richard Clarida has opened the door to speeding up the tapering process in December, just as it’s commenced. “The dollar is beginning to reprice all global asset classes and this ought to be accompanied by higher volatility as expected returns become more uncertain,” said Darby in a note to clients.

Speaking to CNBC in an interview that aired Monday, he elaborated on that pessimism. “My fear is that you only have to have small changes in expectations of growth, or indeed policy tightening, and you could have quite a significant change in sentiment,” he said. That doesn’t mean there will be an unhappy fourth quarter, Darby said, but “a pretty difficult time for the first quarter 2022.”

The buzz

A highly anticipated decision is in: President Joe Biden has renominated Jerome Powell to serve as Fed Chairman, with Lael Brainard appointed Vice Chair.

The People’s Bank of China removed several phrases about policy restraint in a report, which economists said could be a sign of easing steps to come.

Protests erupted throughout Europe in response to new coronavirus-related restrictions as infections spike.

At least five died and more than 40 were injured after a vehicle sped through a Christmas parade in suburban Milwaukee.

Zoom Video Communications ZM,

Telecom Italia TIT,

The market

U.S. stocks DJIA,

Listen to the Best New Ideas in Money podcast

Random reads

El Salvador is planning a bitcoin BTCUSD,

Russia and the U.S. are planning a joint mission to Venus, says the CEO of the Russian state space agency.

An Australian TV host flew to London to interview Adele, but didn’t bother listening to her new album first.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.