China Growth Stocks Look Like Havens as Markets Confront Omicron

(Bloomberg) — China’s Covid-zero strategy seems to be proving a boon for its equities as global markets fret over the omicron coronavirus strain. Nowhere is this more evident than in the performance of the nation’s growth-heavy Chinext Index.

Most Read from Bloomberg

The gauge dominated by technology and health-care names climbed as much as 1.6% on Monday even as Asian stocks extended losses after Friday’s rout. Renewables and vaccine shares on the Chinext jumped as investors looked for safe bets. In general too, Chinese shares have been more resilient amid the omicron scare: the CSI 300 Index is down less than 1% from its close on Thursday, while the MSCI Asia Pacific Index has lost over 2%.

“From China’s macro perspective, with the continuing Covid restrictions, I think it’s in a better position to handle the new variants,” Kinger Lau, a strategist with Goldman Sachs Group Inc., said in an interview with Bloomberg TV.

Should the omicron variant start a new wave of infections, China will be best able to block it, the state-run Global Times newspaper said in a Sunday editorial. The world’s most populous nation has maintained a Covid-zero approach — taking extreme measures to curb recent outbreaks, including locking down cities — even as other stalwarts of the policy shift toward living with the virus as an endemic.

As for the ChiNext, it continues to benefit from the surge in electric vehicle-battery maker Contemporary Amperex Technology Co., which makes up more than 20% of the gauge. The stock was the biggest point contributor to gains on Monday as well, rising as much as 4%, following news that it will be added to the benchmark CSI 300.

Renewable energy equipment maker Sungrow Power Supply Co. and Covid-19 vaccine producer Chongqing Zhifei Biological Products Co. rallied at least 6.4% each to be the other big boosts.

READ: CATL, SMIC, China Telecom Among Stocks to Be Added to CSI 300

“ChiNext members have a big chunk of biological firms which soared due to the Covid fears,” said Zhang Gang, a strategist at Central China Securities Co. in Shanghai. In addition, firms that have been benefiting from Beijing’s favorable policies on the renewable energy and health-care sectors “are all ChiNext members,” he said.

The index’s performance has also been aided by the fact that it is safely insulated from the immediate impact of the property downturn in China. It has little exposure to banks, developers or related consumer discretionary shares, a cohort which has seen steepening declines amid dimming sales outlook.

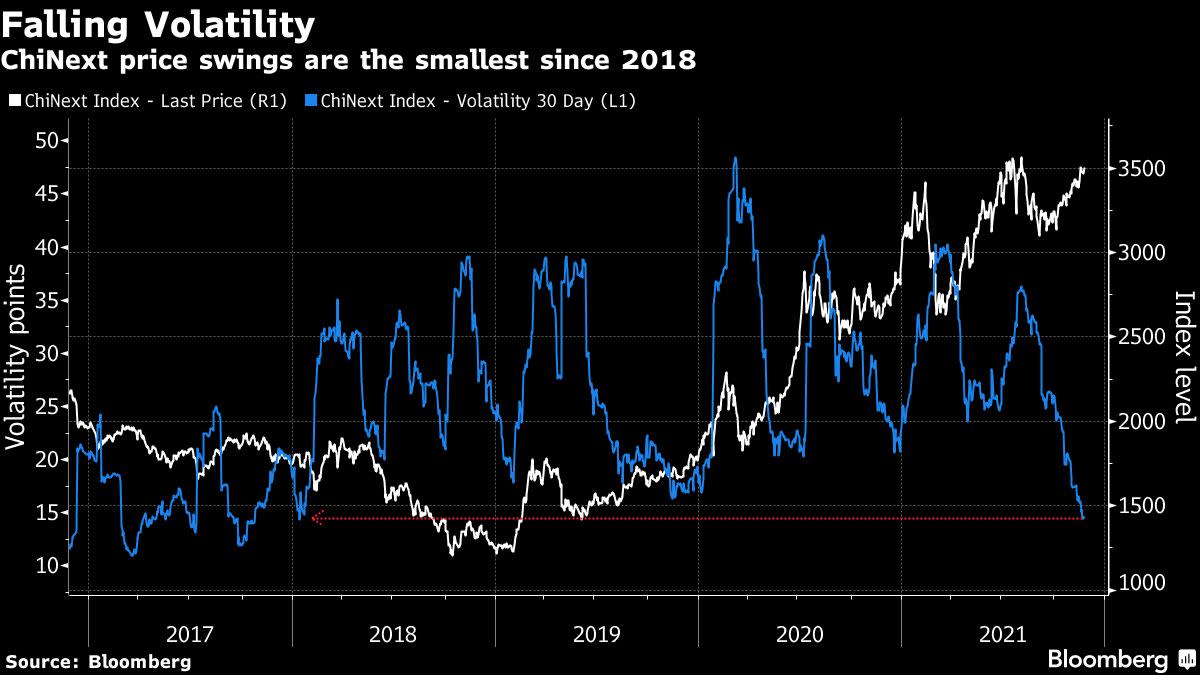

The ChiNext’s 30-day volatility has fallen to the lowest since the start of 2018, which Zhang said is a reflection of “very good” sentiment.

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.