Stocks are soaring again but here’s why you should look out below

“Happy days are here again” is what bullish investors would have you believe after Thursday’s huge U.S. stock market rally. The Dow Jones Industrial Average DJIA,

Yet there’s something too convenient about this refrain. The market’s decline over the past couple of weeks has failed to ease investors’ exuberance. Contrarians therefore are skeptical that this rally will last.

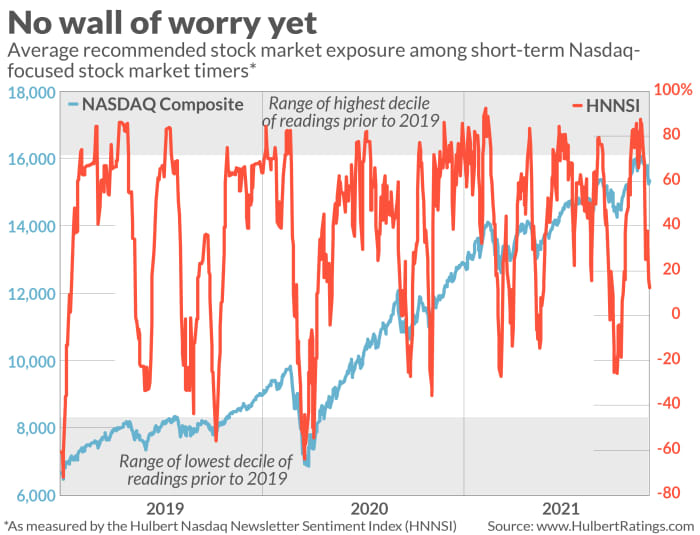

Consider the average recommended equity exposure level among a subset of Nasdaq-focused stock market timers that my firm monitors on a daily basis. (This average is what’s reflected in the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI.)

Since the Nasdaq COMP,

At its lowest point earlier this week, the HNNSI was still higher than 37% of all other daily readings back to 2000. In other words, the typical Nasdaq-focused market timer became only barely more pessimistic than neutral. That does not constitute the veritable “wall of worry” that the market likes to climb.

This is illustrated in the chart below. The most sustainable rallies of the past were launched when the HNNSI was in the bottom decile of its historical distribution (the shaded region at the bottom of the chart). In contrast, rallies that began when the HNNSI was well above that bottom decile were, on balance, more anemic.

It’s especially important currently for the HNNSI to drop into that bottom decile because of how much bullish exuberance existed until recently. As I pointed out in a column a week ago, the HNNSI as recently as Nov. 17 was higher than 97.7% of all daily readings since 2000. A drop to the 37th percentile of the historical distribution isn’t far enough to wring extreme optimism out of the market.

The best thing that could happen to the stock market’s shorter-term prospects, from a contrarian point of view, would be for the decline to resume in fairly short order and sentiment, in turn, to become extremely pessimistic. In that case, contrarians could envision a rally that propels the market averages to significant new all-time highs.

If this scenario doesn’t play out, look for the market’s strength to last no more than a couple of weeks and for the market averages to make it no further than back to the vicinity of its previous highs. While it’s too early to know which path the market will take, contrarians feel no need to guess, since they are willing to let the market tell its story in its own time.

Contrarians nevertheless already know enough to conclude that Thursday’s rally is built on a flimsy sentiment foundation.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Sign up here to get MarketWatch’s best mutual funds and ETF stories emailed to you weekly!