Rivian is the one that could disrupt Tesla, analysts say

A flurry of Wall Street ratings boosted Rivian Automotive Inc. stock on Monday, nearly a month after the company went public, with analysts giving the Amazon-backed electric-vehicle maker mostly bullish endorsements.

Of the 13 analysts surveyed by FactSet, eight set ratings on Rivian that were the equivalent of buy, while the other five rated it the equivalent of hold. There are so far no bears.

The average price target on the stock was $134.42, which was about 28% above Friday’s stock closing price of $104.67, and about 72% above the $78 initial public offering price.

Don’t miss: Rivian Automotive stock soars in trading debut, in the largest IPO of the year.

The stock RIVN,

Baird analyst George Gianarikas initiated Rivian at outperform with a $150 stock price target, saying he believes the company can “formidably challenge” Tesla Inc.’s TSLA,

“Vertical integration, however, requires scale to extract benefits, and, as such, Rivian needs to ramp quickly and effectively to materialize as a serious long-term contender,” Gianarikas wrote in a note to clients. “That is, Clark Kent ([Chairman and Chief Executive] RJ Scaringe) needs to emerge from the phone booth as Superman soon to scale Rivian and save the planet.”

Wedbush’s Dan Ives also started Rivian with a bullish outperform rating, and set a $130 stock price target, saying the “stalwart EV startup” is looking to strategically launch itself into an untapped market as SUV and pickup truck EVs are currently virtually nonexistent in the EV market.

He said Rivian’s debut R1T and R1S EVs are expected to launch in early 2022, competing with General Motors Co.’s GM,

“With the popularity and consumer demand for EVs on the trucking/SUV market, we believe Rivian is in the catbird’s seat to take considerable market share in the EV arms race under its visionary CEO and founder, R.J. Scaringe,” Ives wrote.

Meanwhile, analyst Ryan Brinkman at J.P. Morgan, which was one of the lead underwriters of Rivian’s IPO, started the company at neutral with a stock price target of $104, which was 0.6% below Friday’s closing price.

Brinkman was generally upbeat on the company’s prospects, saying the company’s “caliber” as an organization was made clear given it beat Tesla, Ford Motor Co. F,

He said the company also differentiated itself from its peers by its strong strategic partners, its simultaneous focus on both light and commercial vehicles and by its substantial capital base.

Brinkman had some reservations, however, regarding costs to reach its goals, and valuation.

“Our neutral rating balances — on the one hand — extremely compelling top-line growth prospects, surprisingly world class products for a new manufacturer, and structural industry tailwinds, with — on the other hand — equally heavy investments anticipated to fund that growth and valuation which is clearly already pricing in a lot after the recent sharp rise in the shares (at one point more than doubling since the company’s recent IPO),” Brinkman wrote.

But then again, Brinkman said the stock’s high valuation increases his confidence in the company’s ability to fund its growth ambitions.

John Murphy at B. of A. Securities started their coverage on Rivian with a buy rating and a $170 price target.

Rivian’s “key competitive advantage” among several legacy and start-up EV makers is “an extremely comprehensive and well-constructed business strategy, in addition to solid/innovative technology and interesting/attractive product, validated by a key anchor customer (Amazon.com Inc.),” Murphy said.

“Although this does not mean complete avoidance of the obstacles many EV start-ups have endured from concept to commercialization, we assign much more credibility to RIVN’s success in this endeavor,” the analyst said. He cautioned, however, that Rivian and other “auto tech” startups are “inherently very risky stocks.”

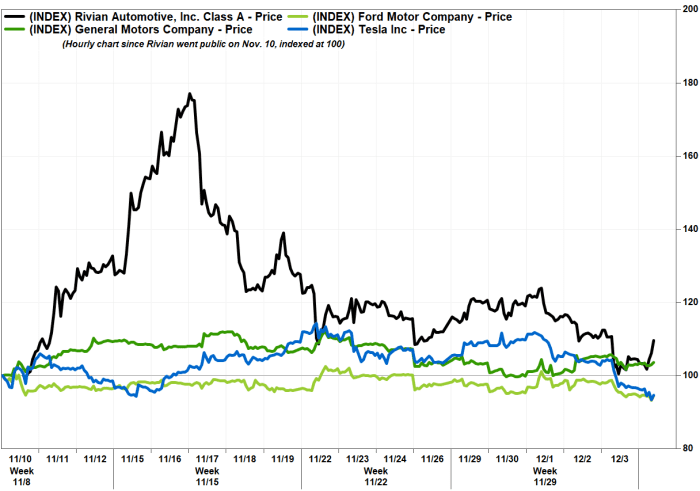

Rivian stock has gained 7.9% since it closed its first day of trading at $100.73 on Nov. 10, while the Renaissance IPO exchange-traded fund IPO,

Subscribe: Want intel on all the news moving markets? Sign up for our daily Need to Know newsletter.