Forget crypto! Some ETF providers bet that this $800 billion industry in 2024 is fund investing’s new frontier

Happy Thursday, ETF Wrap readers! It is a been a roller-coaster ride on Wall Street. Stock markets were knocking on the door off a correction just last week, after being jolted lower by the new omicron variant of COVID. Now, the S&P 500 SPX,

We’ll discuss some strategies around dealing with volatile markets. And we’ll also talk about the metaverse trend, which some are proclaiming as a new frontier for the internet and communication. But is it fertile ETF ground?

Send tips, or feedback, and find me on Twitter at @mdecambre or LinkedIn, as some of you are wont to do, to tell me what we need to be jumping on.

Most important, sign up here for ETF Wrap sent fresh to your inbox weekly.

Read: What is an ETF? We’ll explain.

The good…

| Top 5 gainers of the past week | %Performance |

| VanEck Oil Services ETF OIH, |

9.8 |

| U.S. Oil Fund LP USO, |

9.7 |

| U.S. Global Jets ETF JETS, |

9.4 |

| SPDR S&P Oil & Gas Exploration & Production ETF XOP, |

9.0 |

| iShares MSCI Brazil ETF EWZ, |

7.7 |

| Source: FactSet, through Wednesday, Dec. 7, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…and the bad

| Top 5 decliners of the past week | %Performance |

| Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF PDBC, |

-23.4 |

| ProShares Bitcoin Strategy ETF BITO, |

-10.9 |

| Amplify Transformational Data Sharing ETF BLOK, |

-4.3 |

| VanEck Rare Earth/Strategic Metals ETF REMX, |

-3.5 |

| Global X Lithium & Battery Tech ETF LIT, |

-2.3 |

| Source: FactSet |

Grayscale’s brief ETF sojourn

Here’s a fun one to get our readers started off.

Since at least Monday, FactSet System Inc. FDS had listed crypto-focused asset manager Grayscale Investment’s Bitcoin Trust GBTC as Grayscale Bitcoin Trust ETF on its platform, which is used by professional investors and other Wall Street clients, including MarketWatch publisher Dow Jones.

And as all of readers know, the Grayscale fund, the largest bitcoin investment vehicle on the planet, which boasts a roughly $27 billion market value as of Tuesday’s close, isn’t an ETF—far from it. ETFs can be bought and sold like stocks and offer transparent pricing. Grayscale is a closed-end product akin to a mutual fund and it has aspirations to convert to an ETF, but it isn’t there yet.

It isn’t clear what happened on the FactSet data platform but the error has since been fixed but for at least a day or so, Grayscale’s wish of being an ETF became a reality.

No TLC for TLT

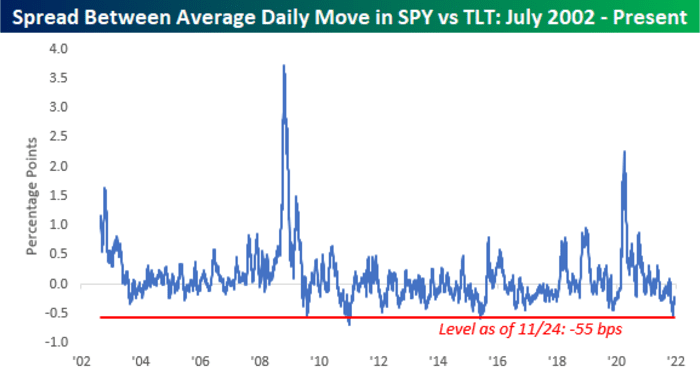

It is no secret that Treasurys, similar to stocks these past few weeks, have had a turbulent ride. However, the folks at Bespoke Investment Group make the case that plain-vanilla bonds are experiencing volatility that one would normally associate with equities, not bonds that promise stability due to their steady cash flows.

Gauged by the popular iShares 20+ Year Treasury Bond ETF TLT,

“When the readings are positive, it indicates that SPY has been more volatile than TLT, while negative readings indicate that TLT has been more volatile than SPY,” Bespoke writes (see attached chart).

That’s so meta

What started as a much-maligned name-change by Facebook Inc. FB,

So far, there is the $830 million Roundhill Ball Metaverse ETF META,

Now, First Trust Advisors LP recently filed to launch the Indxx Metaverse ETF, and Bloomberg estimates, citing industry analysts, that the metaverse market will reach around $800 billion in two years, boasting annual growth of 13%.

“Asset managers are increasingly looking to long-term thematic strategies where they can provide a unique approach and often charge a premium to more traditional index based ETFs,” said CFRA’s head of mutual fund and ETF research Todd Rosenbluth.

“There are more than 200 thematic ETFs managing $135 billion in assets,” he notes.

To be sure, the metaverse remains an industry that is nascent and whose potentially isn’t completely understood.

BlackRock spreads the love

The Wall Street Journal reports that asset management behemoth BlackRock BLK,

BlackRock is doing this to reduce its reliance on a small number of parties and lower the fees it pays for back-office work. Some of the administrative work that State Street handled is being shifted to Citigroup C,

ETFs to help you sleep?

Choppy markets come with the territory on Wall Street. However, not everyone enjoys the type of stomach-churning moves in stocks that markets experienced at the end of November and into the early part of December, amid the emergence of omicron.

Luckily, there are ETFs for that — but they are not for everyone.

We talked to Jay Pestrichelli, CEO of ZEGA Financial, which looks after $600 million, and kicked off a low-volatility ETF about five months ago that has drawn about $100 million in assets thus far.

The ZEGA Buy & Hedge ETF ZHDG,

Pestrichelli said that typical low-vol strategies involve buying a stock and purchasing a put as a hedge, or buying a put-spread as a hedge.

“We don’t do that,” he said.

Instead, Pestrichelli said that ZEGA Buy & Hedge ETF aims to buy call [options] and those options represent “the notional value but also embed protection,” for an investor in the ETF.

An option is a derivative security that allows the buyer to buy or sell a security at a particular price within a set time frame. That price is known as the strike price. Call options allow the purchaser to buy, while a put option allows the purchaser to sell at specified price and time. When you purchase a put, you will profit when a stock drops in value and when you purchase a call you will profit when the stock rises above a specified level. Because options can be bought for a fraction of the underlying stocks value it is often implemented as a strategy to express a directional view on an asset or to mitigate swings in value.

“Using long calls as exposure to the market, the most I could lose is 8% to 10% from a stock market perspective,” the ZEGA CEO said. The ETF buys calls on SPY, aka SPDR S&P 500 ETF Trust. The ideal candidate for this ETF is someone nearing retirement who wants to limit losses, the fund provider said. The fund also invests in companies like American Airlines AAL,

“The portion of the portfolio invested in equity options provides long-term exposure to the equity markets, seeking upside potential while mitigating downside risk. The portion of the portfolio invested for income seeks cash generation to help purchase the equity options,” the folks at ZEGA write in a statement.

In the month to date, the ETF is up 2.2%, compared with a 2.6% gain for the S&P 500, a 3.6% rise for the Dow Jones Industrial Average DJIA,

Pestrichelli said that if your “goal is to beat the stock market, this is not aggressive enough” for you, but if you’re aim is to sleep at night, ZDHG may be worth a look.

Low-Vol options

Competitors include Amplify BlackSwan Growth & Treasury Core ETF SWAN,

One of the largest ETFs aiming to mitigate market gyrations, the iShares MSCI USA Min Vol Factor ETF USMV,

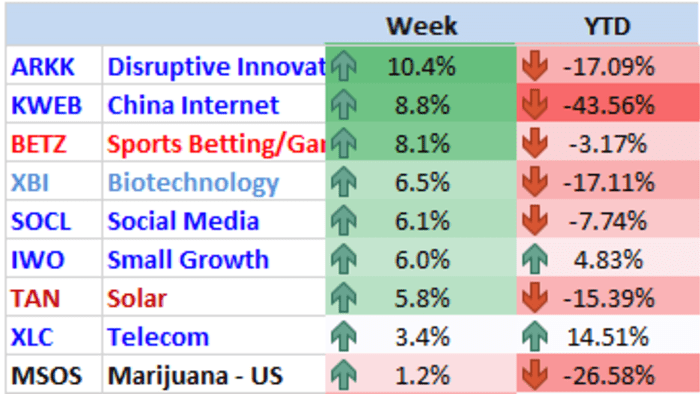

Visual of the week?

Is it time to catch some falling knives? That’s one question that Instinet’s Frank Cappelleri has us pondering as he highlights a batch of ETFs that have had a nice weekly run but have been otherwise in the doghouse. Those include Cathie Wood’s Ark Innovation ETF ARKK,

Let us know if you think it’s time to dive back into any of these names.