Wall Street Gets Increasingly Bullish on China

(Bloomberg) — China’s battered stocks present a buying opportunity, as most of the headwinds facing the country’s economy are now priced in, according to Goldman Sachs Group Inc.

Most Read from Bloomberg

“Although risks around the Chinese growth outlook remain due to the zero-tolerance Covid-19 policies and regulatory tightening, Chinese equity markets already reflect some of those risks, offer attractive valuations and continue to be underinvested,” Goldman Sachs strategists led by Christian Mueller-Glissmann wrote in a note dated Monday.

Their overweight call echoes that of JPMorgan Chase & Co. strategists, who upgraded China’s stocks this week, saying they expect a “major” rebound in offshore Chinese equities next year.

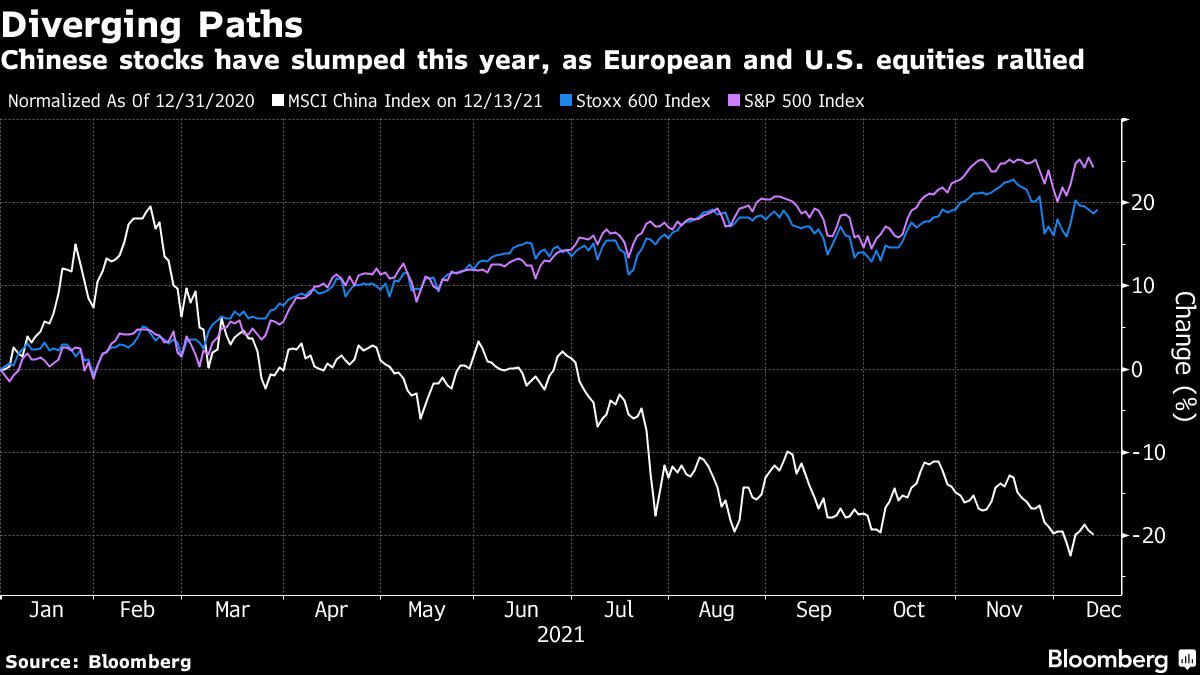

The MSCI China index has slumped 21% this year, missing out on a rally that pushed U.S. and European benchmarks to records, amid a regulatory crackdown on technology giants, woes in the real estate sector and a slowing economy. A Bloomberg index of property stocks fell again on Tuesday, closing at the lowest since early 2017, after a deal between two units of Shimao Group Holdings Ltd. heightened corporate governance concerns in an industry already dealing with a liquidity crisis.

Now, some of Wall Street’s biggest names say the rout is overdone, and low valuations may make Chinese stocks a bargain.

“We still see a lot of opportunity and have an underlying view that there’s space for successful, profitable private sector enterprise in China,” Luke Barrs, head of fundamental equity client portfolio management in EMEA for Goldman Sachs Asset Management, said in an interview last week. “You’re paying roughly a bottom-third multiple relative to history, so that feels like quite a good entry point.”

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.