Gas prices hit new high as Russia reverses flows – live updates

Gas prices have surged to a fresh record high after Russia halted flows to Europe via a key pipeline.

The amount of gas entering Germany’s Mallnow compressor station, where the Yamal-Europe pipeline terminates, dropped to zero early on Tuesday and Russian gas began flowing east towards Poland.

The drop in supplies will force European countries to keep withdrawing supplies from their already depleted stockpiles.

This is being compounded by freezing temperatures across the continent, which are driving up demand and inflating prices.

Benchmark European prices jumped as much as 11pc, while the UK equivalent rose 10pc, with both hitting new all-time highs.

01:17 PM

Pubs welcome omicron funding but call for more details

Emma McClarkin, chief executive of the British Beer and Pub Association, says:

This short-term package of support from the Chancellor is welcome at this extremely challenging time for pubs and brewers. It will be a vital lifeline for many and will help compensate businesses for the dramatically reduced trade already being experienced in the run up to Christmas.

It will be absolutely essential that the Government continues to monitor and support our sector for the long-term as we ride out the pandemic and into recovery.

Ensuring our pubs and brewers continue to have the support they need, including further financial support if further restrictions are introduced, along with a clear timeline for the lifting any such measures. Our overwhelming hope is to remain trading and serving our customers and communities.

Patrick Dardis, chief executive of Young’s, strikes a more cautious tone, however:

We will need to see the detail. It is far from clear who is included and much more will be needed to protect jobs and businesses.

01:14 PM

Watch: Can’t rule out further restrictions, warns Rishi Sunak

Unveiling the new funding, Chancellor Rishi Sunak warns further restrictions can’t be ruled out.

He said: “Unfortunately, we’re just dealing with an enormous amount of uncertainty at the moment… we’re reviewing the data day by day, hour by hour, keeping the situation under constant review, but can’t rule anything out.”

01:07 PM

UK Hospitality welcomes ‘generous’ support package

Kate Nicholls, chief executive of industry group UKHospitality, has welcomed the fresh funding:

This is a generous package building on existing hospitality support measures to provide an immediate emergency cash injection for those businesses who, though no fault of their own, have seen their most valuable trading period decimated.

It will help to secure jobs and business viability in the short term, particularly among small businesses in the sector and we particularly welcome the boost to funds for the supply chain and event and business catering companies so badly affected by reintroduction of work from home.

It is a generous top up emergency fund in addition to previous support and with a commitment from ministers to prioritise hospitality and its supply chain in allocation

01:00 PM

Sunak: Businesses facing huge uncertainty at crucial time

Chancellor Rishi Sunak said:

We recognise that the spread of the omicron variant means businesses in the hospitality and leisure sectors are facing huge uncertainty, at a crucial time.

So we’re stepping in with £1bn of support, including a new grant scheme, the reintroduction of the Statutory Sick Pay Rebate Scheme and further funding released through the Culture Recovery Fund.

Ultimately the best thing we can do to support businesses is to get the virus under control, so I urge everyone to get boosted now.

01:00 PM

Rishi Sunak unveils £1bn omicron support for hospitality firms

Chancellor Rishi Sunak has announced a £1bn package of support for businesses hardest hit by the rapid spread of the omicron variant across the UK.

The Government will provide one-off grants of up to £6,000 per premises for businesses in the hospitality and leisure sectors in England.

More than £100m in discretionary funding will also be made available for local authorities to support other businesses.

Other interventions include the Government covering the cost of statutory sick Pay for Covid-related absences for small and medium-sized employers and a further £30m in funding made available through the Culture Recovery Fund.

It comes as many pubs and restaurants have seen cancellations and reduced footfall as people have responded to the rise in cases ahead of Christmas, with Hospitality UK reporting that many businesses have lost between 40pc and 60pc of their December trade — often their most profitable month.

12:51 PM

Retail sales growth slides as omicron hits

Retail sales growth slumped in the first half of December as worries about the omicron variant kept shoppers away from the high street.

The CBI’s gauge of sales volumes slumped to +8 this month compared to +39 in November. That’s well below estimates of +24 and the lowest reading since non-essential retailers were in lockdown in March.

Things are expected to get even worse in January, when the gauge is forecast to fall to just +5.

Ben Jones of the CBI said:

Our December survey confirms what we’ve been hearing anecdotally about omicron’s chilling impact on activity on the high street, with retail sales growth slowing and expectations for the coming month sharply downgraded.

12:27 PM

City watchdog urged to rule on investors in £3bn Playtech takeover

The Australian gambling company that has tabled a £2.1bn takeover offer for Playtech has urged regulators to rule whether a group of Asian investors is clubbing together to block the deal.

Sky News reports that Aristocrat and Playtech have contacted the Takeover Panel to seek a determination that the Asian shareholders, who include the owner of Birmingham City Football Club, are acting as a concert party.

The group of investors, which also includes heiress Karen Lo, are believed to own more than 20pc of the British company’s shares and may have a big enough combined stake to block the deal.

Speculation has been mounting that they could be interested in buying Playtech’s unregulated gambling business in Asia.

12:06 PM

‘Painful’ £2,000 energy bills price cap coming for consumers

Here’s some more on how the energy crisis could hurt households from my colleague Matt Oliver:

Millions of households face a “painful” rise of up to £700 in their energy bills when the price cap is updated next spring, analysts have warned.

With gas prices expected to remain high after surging this winter, Investec estimates the average capped bill could rise from £1,277 per year to £2,000 when the limit is reviewed in April.

That represents an increase of 56pc or £723 – roughly £60 per month extra.

“Although well trailed, this will still come as a shock to many,” energy analyst Martin Young wrote.

Rising gas prices and the costs linked to the failure of 25 suppliers this year, which are spread across all consumers, account for the bulk of the increase.

Mr Young said £300 of the new total was made up of taxes or government levies, giving ministers some leeway to cushion the blow.

11:30 AM

Record gas prices could add 1.8 percentage points to inflation, warns Investec

Sustained record UK gas prices will impact consumers in April with a direct impact on inflation, according to analysts at Investec.

They write:

The rise in households’ utility bills will be substantial if the annual dual-fuel utility price cap to rises to £2,000 (a 56pc increase), the aggregate additional bill would come to about £18bn and potentially more given some consumers are still on fixed price deals priced below the tariff cap.

This would equate to about 0.8pc of 2021 GDP, or 1.4pc of total consumer spending and we estimate would add 1.8 percentage points to headline inflation in April 2022.

11:05 AM

Bitcoin will replace the US dollar, says Jack Dorsey

Jack Dorsey has predicted that Bitcoin will replace the US dollar in the boldest statement yet from one of the cryptocurrency’s biggest backers, writes James Titcomb.

The Twitter founder, who recently resigned as the social network’s chief executive, made the prediction in a series of controversial exchanges online, in which he dismissed much of the hype surrounding cryptocurrency and blockchain technology.

However, responding to a question from the rapper Cardi B about whether cryptocurrencies will replace the dollar, Mr Dorsey tweeted:

He has previously suggested that Bitcoin will become a global currency for the internet, but stopped short of predicting it will replace existing major currencies.

10:49 AM

British Airways signs Emma Raducanu as brand ambassador

British Airways has signed British tennis superstar Emma Raducanu as its latest global brand ambassador.

The airline will fly the 19-year-old, who was this week named BBC Sports Personality of the Year, to tournaments and training around the world, including next year’s French and US Opens and the Masters’ events in California and Rome.

BA is the first British brand partner for Ms Raducanu, who is poised for a string of lucrative deals after her victory in the US Open in September.

Tom Stevens at British Airways said:

As we look ahead to the world opening up again, we’re excited to be supporting the very best of British talent, Emma Raducanu.

We couldn’t have been prouder as a nation than when Emma won the US Open. Sport has the power to inspire and unite people all across the globe, so we are delighted to be supporting Emma as she represents Britain and takes on the world.

10:32 AM

Expert reaction: Pent-up demand lingers despite doom and gloom

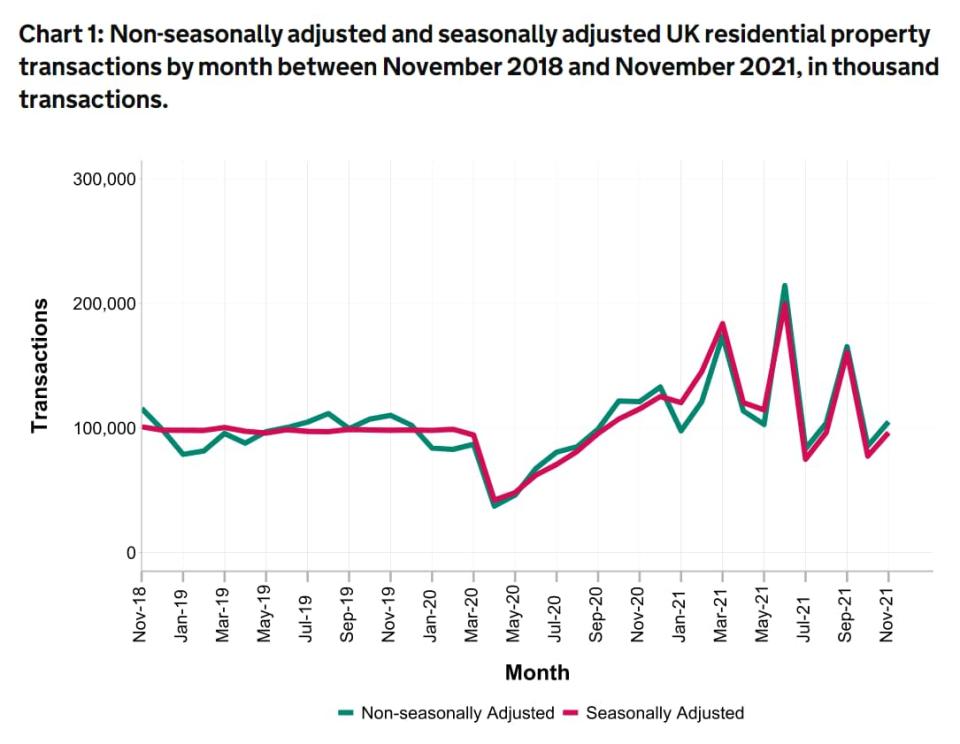

Gareth Lewis, commercial director of property lender MT Finance, says:

Naturally, the housing market took a breath in October, taking stock after the end of the stamp duty holiday with transaction numbers down, as you would expect. But November saw a return to positivity and an uptick in transactional flow. There is still a pent-up desire to transact and buy property, despite all the doom and gloom out there.

It is also encouraging to see diversity in the market, with non-residential transactions peaking again. In 2020 these were down because of the significant amount of caution towards commercial assets thanks to the move to work from home.

But provisional figures for this year show a good volume of non-residential transactions coming through. This may be partly down to speculation on permitted development and moving property into residential, or investors looking to diversify income streams because they see the benefit of owning a different type of stock.

What will be really interesting is what next year’s figures will show and whether the omicron variant will squeeze the market. Another lockdown may reduce buyer confidence, although so far it’s been remarkably resilient.

10:26 AM

House sales rebound in November

House sales rebounded in November as the market picked up pace again following a drop-off in activity caused by the end of the stamp duty holiday.

Residential transactions stood at 96,290 last month, according to the latest figures from HMRC. That’s 16.4pc lower than in November 2020, but 24.3pc higher than the previous month.

10:03 AM

Oil nudges higher after Monday’s sell-off

Oil prices have edged higher after a wider market sell-off on Monday as traders continue to asses the impact of the omicron variant on demand.

Benchmark Brent crude climbed close to $72 a barrel after shedding almost 5pc over the last two days. West Texas Intermediate ticked up 0.4pc.

While the rapid spread of the omicron strain is yet to have an impact, there are fears renewed lockdowns could hammer demand in the coming months.

There are also signs of over-supply in the market, which could prompt producer cartel Opec to act at its meeting next month.

09:39 AM

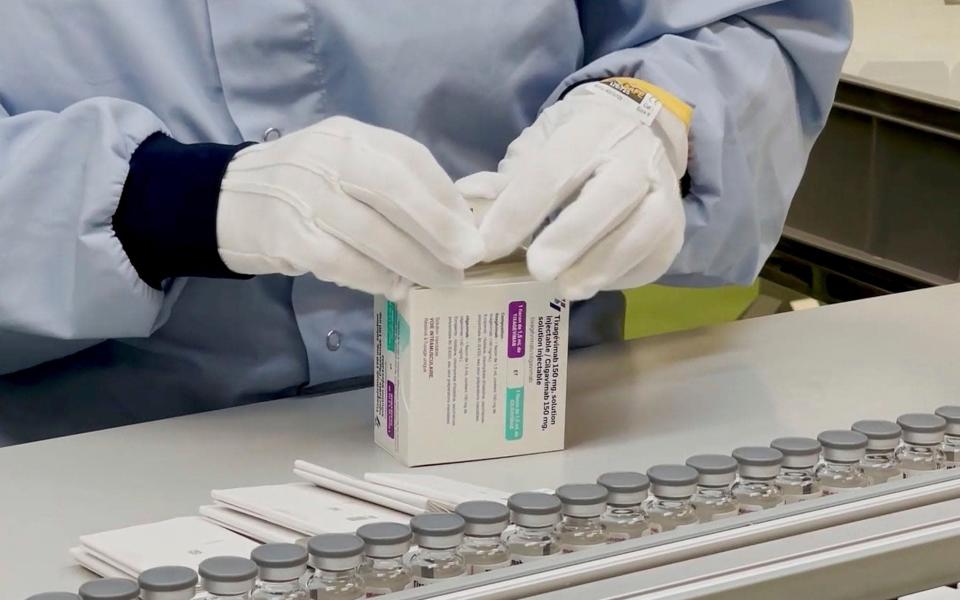

Study: AstraZeneca jab protection wanes after three months

Protection from severe illness following two doses of AstraZeneca’s Covid vaccine starts to decline after about three months, according to a study that underlines the need for boosters.

Researchers found protection against hospitalisation and death began to wane three months after the second dose. They didn’t analyse the efficacy of the jab against the omicron variant, which wasn’t circulating at the time.

The study highlighted the need for booster shots for people who received a primary course of AstraZeneca’s vaccine, which was developed with the university of Oxford.

The UK, which relied on the Astra jab for the first vaccination programme of over 40s, is ramping up the rollout of booster jabs using vaccines made by Pfizer and Moderna.

09:28 AM

Schroders takes £358m majority stake in Greencoat Capital

Asset manager Schroders has confirmed a £358m deal to take control of renewables investor Greencoat Capital.

The FTSE 100 firm said it had inked an agreement to take a 75pc stake. Shares rose 2.3pc.

Greencoat is one of Europe’s largest renewable infrastructure managers, with £6.7bn worth of assets under its management at the end of last month. Schroders said it has a shared ambition to be a global leader in the green investment sector.

Peter Harrison, chief executive of Schroders, said:

Greencoat is a market-leading, high growth business, with an outstanding management team, which provides access to a large and fast-growing market in high demand among our clients.

Its culture is an excellent fit with ours and Greencoat’s focus aligns very closely to our strategy, continuing our approach of adding capabilities in the most attractive growth segments we can provide to our clients.

09:17 AM

Pound rallies as traders weigh lockdown risk

Sterling has pushed higher, wiping out Monday’s losses against the dollar as fears about an imminent lockdown eased.

The pound fell to its lowest level in a year yesterday amid expectations Boris Johnson would plunge the country back into a full lockdown.

The Prime Minister has delayed a decision, improving sentiment slightly, though focus remains on the likelihood of tighter restrictions in the coming weeks.

The pound gained 0.3pc against the dollar to $1.3247. Against the euro it slipped 0.1pc to 85.28p.

08:57 AM

Rishi Sunak to say more about Covid support ‘shortly’

Chancellor Rishi Sunak will say more about potential economic support for businesses “shortly”, Cabinet Office Minister Steve Barclay has said.

Mr Barclay told the BBC the Chancellor was engaging “closely” with business leaders, adding that the Government was “acutely aware” that companies were suffering as Britons changed their behaviour due to the outbreak of omicron.

He added: “These are finely balanced judgements between protecting lives and livelihoods.”

Calls have been growing on Mr Sunak to bring back support for Covid-hit businesses, but the latest ONS stats highlight the challenges the Chancellor faces in balancing public finances amid surging inflation.

08:50 AM

Gas prices surge as Russia cuts supplies to Europe

Gas prices jumped to their highest since reaching a record in October as Russia halted flows to Europe via a key pipeline.

Benchmark European prices rose as much as 5.5pc after the amount of gas entering Germany’s Mallnow compressor station, where the Yamal-Europe pipeline terminates, dropped to zero early on Tuesday, Bloomberg reports.

Lower supplies are piling further pressure on energy markets as freezing temperatures spread across Europe, boosting demand for gas and power. Renewable sources are also struggling to fill the gap.

08:37 AM

FTSE risers and fallers

In a sign of just how fickle the FTSE can be, traders have shrugged off yesterday’s omicron jitters and driven the blue-chip index higher.

After dropping 1pc on Monday amid fears of a fresh lockdown, the FTSE 100 is now trading up around 0.8pc. It’s likely in part because the Government delayed any decision on new restrictions, although thin trading over the festive period can also fuel volatility.

Oil majors BP and Shell added nearly 1.4pc each, tracking crude prices, while miners including Rio Tinto, Anglo American and BHP helped drive up the index.

The domestically-focused FTSE 250 also gained 0.7pc. Schroders gained 1.8pc after confirming a deal to buy 75pc of Greencoat Capital for £358m.

08:16 AM

Debt costs surge at fastest pace since 2010

The Government’s debt costs are rising at the fastest pace since the aftermath of the financial crisis, providing another headache for Rishi Sunak as he weighs up fresh emergency support.

The ONS data shows interest payments made by the Treasury jumped by £15bn — or 54pc — to £42.9bn in November. That’s the biggest rise for the period since 2010.

Costs are ballooning because a quarter of government debt is linked to retail prices, which have risen sharply this year. The numbers don’t take into account the latest increase in the retail price index to 7.1pc — a three-decade high — meaning debt costs are set to climb even further.

The Bank of England’s decision to raise interest rates last week will also result in higher payments for the Government..

08:01 AM

FTSE 100 opens higher

The FTSE 100 has gained ground at the open, erasing much of yesterday’s losses amid uncertainty over fresh Covid restricitions.

The blue-chip index rose 0.9pc to 7,260 points.

07:55 AM

Expert reaction: Borrowing figures are ‘sign of things to come’

Bethany Beckett, UK economist at Capital Economics, says the latest data is “unwelcome news for the Chancellor, who is once again facing the prospect of tighter Covid-19 restrictions and renewed government support to affected sectors”.

But that all seems like old news now. These data predate the recent surge in coronavirus infections caused by the omicron variant, with a near-term tightening of virus restrictions once again a possibility.

Although the economy has got better at coping with restrictions with each new wave, we still suspect it would prompt a deterioration in the public finances via lower tax revenues and the potential reintroduction of government support schemes.

07:52 AM

Chart: UK borrowing remains elevated

Public sector borrowing may have fallen back from the highs seen last year, but it’s still £11.8bn more than in November 2019.

Lower tax receipts and hefty pandemic spending have forced the Government to borrow huge sums of cash.

In the year to March 2021, the public sector is estimated to have borrowed £321.9bn. At 15pc of UK GDP, that’s the highest ratio since the end of the First World War in 1946.

07:46 AM

UK borrowing high ahead of omicron surge

Good morning.

Fresh figures out from the ONS this morning show UK borrowing remained high in November — even before the omicron variant began to wreak havoc.

Public sector borrowing excluding banks stood at £17.4bn last month. While this was down from November 2020, it’s still ahead of forecasts and the second highest level for the month on record.

The figure doesn’t bode well for the state of public finances as Chancellor Rishi Sunak braces for possible new Covid restrictions, which would likely require more Government support for individuals and businesses.

5 things to start your day

1) ‘Painful’ £2,000 energy bills price cap coming for consumers Rising gas prices and the costs linked to suppliers’ collapses are expected to pile pressure on households

2) Three and EE first to strike deal to roll out mobile coverage on London Underground The new Elizabeth Line will be among the first to benefit from 4G connectivity when it opens next year

3) Give single earner families a £2,500 tax break, says Tory think tank Onward The non-working parent would benefit from a full £12,570 tax allowance according to the proposal

4) SFO director faces fresh battle as second Unaoil bribery convict launches appeal Paul Bond was one of four men jailed in the Unaoil case alongside Ziad Akle, Stephen Whiteley and Basil Al Jarah

5) Maduro suffers legal blow over claim for gold held at Bank of England Supreme Court rules that the UK Government does not recognise Maduro as Venezuela’s president

What happened overnight

Asian shares advanced on Tuesday, shrugging off a bruising Wall Street session, as Chinese markets cheered Beijing’s move to help troubled property firms, although surging cases of the omicron coronavirus variant remain a worry for investors.

MSCI’s broadest index of Asia-Pacific shares outside Japan climbed 0.8pc after declining on Monday to the lowest in a year.

Japan’s Nikkei rose 2pc after two sessions of decline with chip-related Tokyo Electron and Advantest leading the pack, as investors bought into Monday’s heavy selloff. Australian stocks were up 0.9pc.

Coming up today

-

Corporate: Cheerios, Haagen-Dazs, General Mills (Interim results); Go-Ahead (AGM)

-

Economics: Government borrowing (UK), consumer confidence (EU), HMRC house sales (UK), CBI Monthly Distributive Trades Survey (UK)