If Santa Claus doesn’t come to Wall Street in December, the Grinch hits the stock market in January, history says

There’s much ado about the so-called Santa Claus rally that tends to materialize in the U.S. stock market in the final week of December and the first two trading sessions of the new year, but the importance of the upsurge for market psychology might be underappreciated.

Sign up for our MarketWatch Newsletters here.

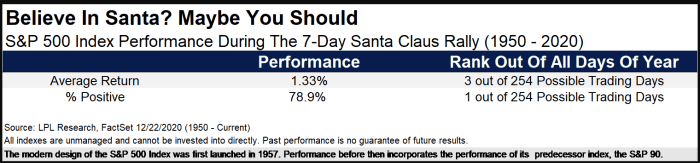

Ryan Detrick, chief market strategist for LPL Financial, notes that the seasonal stretch for markets known popularly as the Santa Claus rally is one of the strongest in the year, with an average return over the seven-sesson period of 1.33%. That performance ranks as the third-best seven-session combination of any time during a calendar year. On top of that, the markets tend to book a gain on 78.9% of the time, which ranks No. 1 of any seven-session combo, according to Detrick.

One point that Detrick notes is that Santa has been a consistent feature of the seasonal dynamic for markets.

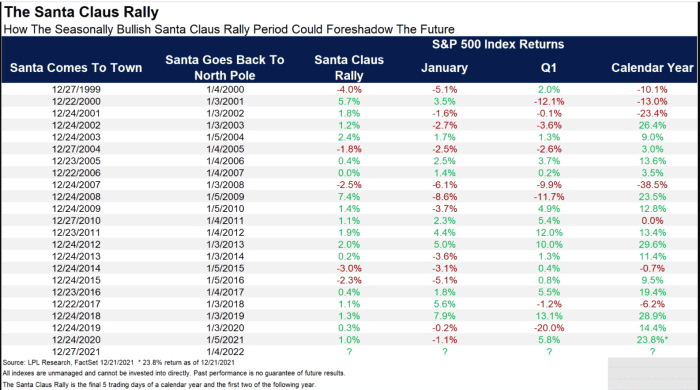

And another important point is that if Santa doesn’t show up, i.e., the market posts a loss during that seven-session period, the month of January has logged a loss since 2000.

Intoning the popular adage by Yale Hirsch, the founder of the Stock Trader’s Almanac, now run by his son Jeff, Detrick notes that “if Santa should fail to call, bears may come to Broad and Wall.”

Losses during the so-called Santa Claus rally starting in 1999, 2005, 2008, 2015 and 2016 have consistently led to monthly declines in January (see chart attached).

The start of the penultimate week in December got off to a glitchy start, with Monday’s ugly declines for the Dow Jones Industrial Average DJIA,

To be sure, past performance is no guarantee of future performance and the statistical trends for the market’s performance post-Santa Claus rally are fairly thin.

MarketWatch columnist Mark Hulbert writes that even with statistics and theory on its side, “the Santa Claus rally doesn’t amount to a guarantee.”