These are the best-performing S&P 500 and Nasdaq-100 stocks of 2021

The performance of the stock market in 2021 has been nothing short of remarkable, surprising many investors after the dramatic crash-and-recovery cycle of 2020.

A continuing recovery for the world economy meant increased demand and shortages in various industries, including semiconductors and energy. Some of the best-performing stocks were oil and gas producers, as the price of West Texas Crude oil CL00 rose 58%.

The following are lists of the best-performing stocks among the benchmark S&P 500 index SPX, the the S&P 400 Mid Cap Index MID, the S&P Small Cap 600 Index SML and the Nasdaq-100 Index NDX. Then there’s a list showing how all 30 components of the Dow Jones Industrial Average DJIA have performed in 2021.

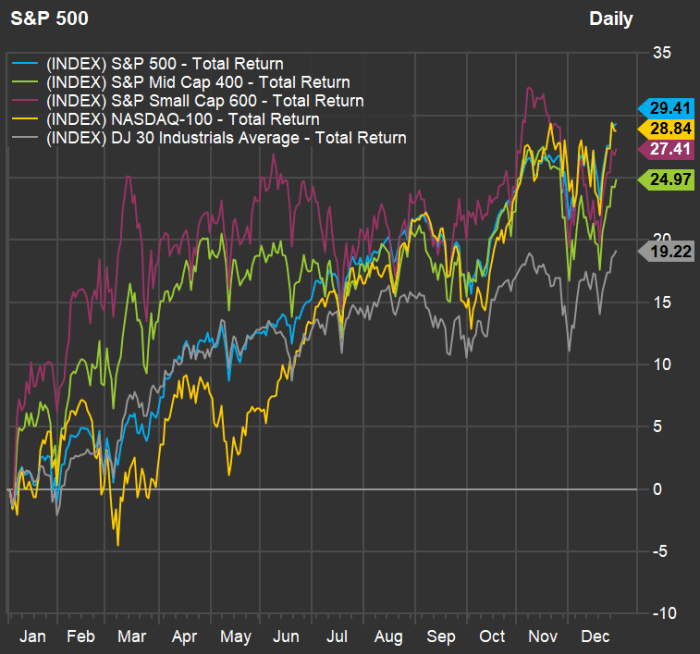

All performance figures in this article include reinvested dividends. For starters, here’s a chart showing total returns for all the indexes in 2021 through Dec. 29:

The S&P 500 had the top spot with a 29.4% return through Dec. 29, although it had pulled back from its high on Nov. 9, when it was up 32% for 2021.

Best-performing S&P 500 stocks of 2021

The S&P 500 is weighted by market capitalization, which means the largest five companies — Apple Inc. AAPL, Microsoft Corp. MSFT, Amazon.com Inc. AMZN, Alphabet Inc GOOGL GOOG and Tesla Inc. TSLA — made up 23% of the SPDR S&P 500 ETF SPY as of the close on Dec. 29.

The gains in 2021 were broad, with 88% of the S&P 500 showing positive returns. Here are its 20 best performers in 2021:

| Company | Ticker | Industry | Total Return – 2021 through Dec. 29 |

| Devon Energy Corp. | DVN | Oil & Gas Production | 197.1% |

| Marathon Oil Corp. | MRO | Oil & Gas Production | 152.0% |

| Fortinet Inc. | FTNT | Computer Communications | 146.9% |

| Signature Bank | SBNY | Regional Banks | 139.6% |

| Moderna Inc. | MRNA | Biotechnology | 137.3% |

| Ford Motor Co. | F | Motor Vehicles | 135.1% |

| Bath & Body Works Inc. | BBWI | Retail | 132.7% |

| Nvidia Corp. | NVDA | Semiconductors | 130.0% |

| Diamondback Energy Inc. | FANG | Oil & Gas Production | 129.3% |

| Nucor Corp. | NUE | Steel | 118.9% |

| Gartner Inc. | IT | Internet Software, Services | 109.9% |

| Arista Networks Inc. | ANET | Computer Communications | 100.6% |

| Extra Space Storage Inc. | EXR | Real Estate Investment Trusts | 99.8% |

| APA Corp. | APA | Integrated Oil | 98.0% |

| CF Industries Holdings Inc. | CF | Chemicals: Agricultural | 95.0% |

| Simon Property Group Inc. | SPG | Real Estate Investment Trusts | 94.5% |

| Seagate Technology Holdings PLC | STX | Computer Peripherals | 90.9% |

| EOG Resources Inc. | EOG | Oil & Gas Production | 90.9% |

| Iron Mountain Inc. | IRM | Real Estate Investment Trusts | 89.3% |

| EPAM Systems Inc. | EPAM | Information Technology Services | 89.2% |

| Source: FactSet | |||

You can click the tickers for more about each company. Click here for Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.

To make any of the lists, a stock had to be traded publicly for all of 2021.

Among the top 20 performers in the S&P 500, five were oil producers.

Ford Motor Co. F was up 135%, ranking sixth on the list, with a low valuation to expected earnings helping justify investors’ approval of at the early stage of its switch to electric cars. Ford’s rival General Motors Co. GM didn’t make the list, as its stock was up “only” 37.4% in 2021 through Dec. 29 (ranking 186th among the S&P 500), while shares of Tesla were up 53.9% for 2021 following their 743% increase in 2020.

Read: Ford Is More Valuable Than GM for the First Time Since 2016

Best-performing midcap stocks

Remember the meme stocks? Of course you do. GameStop Corp GME. led this craze, as traders banded together through the wallstreetbets Reddit channel in early 2021 to bid up the prices of heavily shorted stocks.

Through Jan. 27, shares of GameStop were up 1,744.5% for 2021. Some traders who got in late were burned, as the stock took a dive through Feb. 22. But through Dec. 29, it was up 717% for the year, leading this list of the top 20 performers in the S&P 400 Mid Cap Index:

| Company | Ticker | Industry | Total Return – 2021 through Dec. 29. |

| GameStop Corp. Class A | GME | Electronics/ Appliance Stores | 717.0% |

| Avis Budget Group Inc. | CAR | Finance, Rental, Leasing | 453.8% |

| Synaptics Inc. | SYNA | Semiconductors | 203.4% |

| Alcoa Corp. | AA | Aluminum | 159.3% |

| SiTime Corp. | SITM | Semiconductors | 157.3% |

| Macy’s Inc. | M | Department Stores | 142.9% |

| Olin Corp. | OLN | Industrial Specialties | 141.6% |

| Navient Corp | NAVI | Finance, Rental, Leasing | 124.6% |

| Murphy Oil Corp. | MUR | Oil & Gas Production | 122.2% |

| Louisiana-Pacific Corp. | LPX | Forest Products | 114.3% |

| Dick’s Sporting Goods Inc. | DKS | Specialty Stores | 110.4% |

| Builders FirstSource Inc. | BLDR | Building Products | 108.4% |

| Crocs Inc. | CROX | Apparel/Footwear | 107.4% |

| Tenet Healthcare Corp. | THC | Hospital, Nursing Management | 101.4% |

| Targa Resources Corp. | TRGP | Oil Refining, Marketing | 99.0% |

| National Storage Affiliates Trust | NSA | Real Estate Investment Trusts | 97.6% |

| American Financial Group Inc. | AFG | Property/ Casualty Insurance | 97.2% |

| Goodyear Tire & Rubber Co. | GT | Automotive Aftermarket | 96.2% |

| Life Storage Inc. | LSI | Real Estate Investment Trusts | 95.3% |

| Teradata Corp. | TDC | Software | 95.1% |

| Source: FactSet | |||

Small-cap stocks

A broad small-cap index, such as the Russell 2000 RUT, includes companies that haven’t yet turned profits and even some “pre-revenue” companies counting positive outcomes for binary events, such as regulatory approval of medication.

This list of the year’s 20 best-performing small-cap stocks instead relies on the S&P 600 Small Cap Index, which has a tougher selection criteria for initial inclusion. That includes positive earnings for the most recent quarter and for the sum of the most recent four quarters.

| Company | Ticker | Industry | Total Return – 2021 through Dec. 29 |

| Veritiv Corp. | VRTV | Wholesale Distributors | 483.9% |

| SM Energy Co. | SM | Oil & Gas Production | 403.1% |

| Apollo Medical Holdings Inc. | AMEH | Services to the Health Industry | 305.6% |

| Callon Petroleum Co. | CPE | Oil & Gas Production | 284.6% |

| Customers Bancorp Inc. | CUBI | Regional Banks | 261.4% |

| TimkenSteel Corp | TMST | Steel | 256.3% |

| Consol Energy Inc | CEIX | Coal | 229.5% |

| Laredo Petroleum Inc. | LPI | Oil & Gas Production | 227.2% |

| United Natural Foods Inc. | UNFI | Food Distributors | 219.9% |

| Cross Country Healthcare Inc. | CCRN | Personnel Services | 218.2% |

| Chico’s FAS Inc. | CHS | Apparel, Footwear Retail | 217.0% |

| Matador Resources Co. | MTDR | Oil & Gas Production | 216.4% |

| Signet Jewelers Ltd. | SIG | Specialty Stores | 215.4% |

| Thryv Holdings Inc. | THRY | Advertising, Marketing Services | 204.6% |

| Boot Barn Holdings Inc. | BOOT | Apparel, Footwear Retail | 189.0% |

| ArcBest Corp. | ARCB | Trucking | 186.7% |

| Range Resources Corp. | RRC | Oil & Gas Production | 183.7% |

| Perficient Inc. | PRFT | Personnel Services | 179.8% |

| Ranger Oil Corp. Class A | ROCC | Oil & Gas Production | 177.8% |

| Donnelley Financial Solutions Inc. | DFIN | Software | 177.7% |

| Source: FactSet | |||

Turning more to tech: Nasdaq-100

The Nadaq-100 Index includes the largest 100 non-financial stocks by market cap in the full Nasdaq Composite Index COMP. It includes Chinese companies that aren’t included in the S&P 500.

Here are the top 20 performers among the Nasdaq-100 in 2021, including Tesla:

| Company | Ticker | Industry | Total Return – 2021 through Dec. 29 |

| Lucid Group Inc. | LCID | Motor Vehicles | 269.3% |

| Fortinet Inc. | FTNT | Computer Communications | 146.9% |

| Moderna Inc. | MRNA | Biotechnology | 137.3% |

| Nvidia Corp. | NVDA | Semiconductors | 130.0% |

| Applied Materials Inc. | AMAT | Industrial Machinery | 87.8% |

| Marvell Technology Inc. | MRVL | Semiconductors | 86.8% |

| Datadog Inc Class A | DDOG | Packaged Software | 82.6% |

| Intuit Inc. | INTU | Packaged Software | 71.5% |

| KLA Corp. | KLAC | Semiconductors | 70.0% |

| Alphabet Inc. Class A | GOOGL | Internet Software/Services | 67.4% |

| Atlassian Corp. PLC Class A | TEAM | Software | 63.7% |

| Zscaler Inc. | ZS | Software | 61.8% |

| Advanced Micro Devices Inc. | AMD | Semiconductors | 61.7% |

| Palo Alto Networks Inc. | PANW | Computer Communications | 58.6% |

| Broadcom Inc. | AVGO | Semiconductors | 58.1% |

| O’Reilly Automotive Inc. | ORLY | Specialty Stores | 56.5% |

| Lam Research Corp. | LRCX | Electronic Production Equipment | 55.3% |

| Microsoft Corp. | MSFT | Packaged Software | 55.0% |

| Tesla Inc | TSLA | Motor Vehicles | 53.9% |

| Xilinx Inc. | XLNX | Semiconductors | 53.8% |

| Source: FactSet | |||

The Dow 30

The Dow Jones Industrial Average brought up the rear in the chart at the top of this article. Home Depot Inc. HD took the top stop in the Dow through Dec. 29, with a 57.9% return for 2021, while Walt Disney Co. DIS was the worst performer, with a 14.5% decline:

| Company | Ticker | Industry | Total Return – 2021 through Dec. 29 |

| Home Depot Inc. | HD | Home Improvement Chains | 57.9% |

| Microsoft Corp. | MSFT | Packaged Software | 55.0% |

| Goldman Sachs Group Inc. | GS | Investment Banks, Brokers | 49.0% |

| Cisco Systems Inc. | CSCO | Information Technology Services | 47.1% |

| Chevron Corp. | CVX | Integrated Oil | 47.1% |

| UnitedHealth Group Inc. | UNH | Managed Health Care | 46.2% |

| American Express Co. | AXP | Finance, Rental, Leasing | 37.1% |

| Walgreens Boots Alliance Inc. | WBA | Drugstore Chains | 36.0% |

| Apple Inc. | AAPL | Telecommunications Equipment | 36.0% |

| McDonald’s Corp. | MCD | Restaurants | 28.0% |

| JPMorgan Chase & Co. | JPM | Major Banks | 27.9% |

| Procter & Gamble Co. | PG | Household, Personal Care | 21.0% |

| Nike Inc. Class B | NKE | Apparel, Footwear | 20.2% |

| International Business Machines Corp. | IBM | Information Technology Services | 16.5% |

| Caterpillar Inc. | CAT | Trucks, Construction, Farm Machinery | 16.3% |

| Travelers Companies Inc. | TRV | Multi-Line Insurance | 14.8% |

| Salesforce.com Inc. | CRM | Packaged Software | 14.4% |

| Johnson & Johnson | JNJ | Pharmaceuticals: Major | 11.8% |

| Coca-Cola Co. | KO | Beverages: Non-Alcoholic | 10.9% |

| Dow Inc. | DOW | Chemicals: Specialty | 7.5% |

| Intel Corp. | INTC | Semiconductors | 6.7% |

| 3M Co. | MMM | Industrial Conglomerates | 5.3% |

| Merck & Co. Inc. | MRK | Pharmaceuticals: Major | 2.2% |

| Amgen Inc. | AMGN | Biotechnology | 2.1% |

| Walmart Inc. | WMT | Food Retail | 0.6% |

| Visa Inc. Class A | V | Finance, Rental, Leasing | 0.4% |

| Honeywell International Inc. | HON | Industrial Conglomerates | -0.8% |

| Boeing Co. | BA | Aerospace & Defense | -4.9% |

| Verizon Communications Inc. | VZ | Major Telecommunications | -6.8% |

| Walt Disney Co. | DIS | Cable, Satellite TV | -14.5% |

| Source: FactSet | |||

More year-end stock-market coverage: