Unprofitable tech trades are off to an ugly 2022. Here are the ETFs to consider as Cathie Wood’s Ark sinks.

Happy Thursday! In mythology, Janus is a god of transitions who is often depicted as a two-faced deity. A mere three sessions into the month of January, and some investors already may be feeling whiplash from a month that started out solidly enough, despite the buoyancy of Treasury yields, only to abruptly be reminded that the accommodative monetary-policy regime enjoyed for the past several years might give way soon to a less-easy period. And large-capitalization growth stocks, which have reigned supreme during the pandemic, finally may give substantial ground to value plays.

But with less than a week into 2022, let’s not get ahead of ourselves. Three sessions…even a whole month…doesn’t make a trend, as we enter the sophomoric phase of the coronavirus pandemic.

As per usual, send tips, or feedback, and find me on Twitter at @mdecambre or LinkedIn, to tell me what we need to cover.

Most important, sign up here for ETF Wrap sent fresh to your inbox weekly.

The good

| Top 5 gainers of the past week | %Performance |

| VanEck Oil Services ETF OIH, |

11.0 |

| NorthShore Global Uranium Mining URNM, |

9.3 |

| Alerian MLP ETF AMLP, |

7.1 |

| Global X MLP ETF MLPA, |

6.9 |

| SPDR S&P Oil & Gas Exploration & Production ETF XOP, |

6.8 |

| Source: FactSet, through Wednesday, Jan. 5, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…and the bad

| Top 5 decliners of the past week | %Performance |

| Global X Fintech ETF FINX, |

-7.0 |

| Global X Cybersecurity ETF BUG, |

-6.0 |

| Global X Cloud Computing ETF CLOU, |

-5.6 |

| WisdomTree Cloud Computing Fund WCLD, |

-5.5 |

| First Trust Nasdaq Cybersecurity ETF CIBR, |

-4.5 |

| Source: FactSet |

Traders of the lost ARK

This probably isn’t the start to a year that Cathie Wood’s was looking for in her suite of ETFs. The flagship Ark Innovation ARKK,

It isn’t surprising though, right? The basket of unprofitable tech and innovation-themed investments that make up her ETFs are withering in an environment that looks destined for higher rates that impact future borrowing costs, which investors should rightly discount. Wood did not immediately respond to a request for comment.

It isn’t just Wood, it’s the entire complex of information technology where assets need to be repriced for richer interest rates. If the Federal Reserve’s December meeting minutes are any indication, we likely will see a range of tightening schemes, including the reduction of the U.S. central bank’s nearly $9 trillion balance sheet, interest-rate increases, with at least three hikes in 2022, in addition to the wind down of asset purchases.

In some ways, this isn’t tightening as much as it is normalizing policy that has included holding policy rates at a range between 0% and 0.25% for nearly two years, a regime the Fed soon plans to adjust to tackle COVID-fueled inflation spike.

ARK Invest is in the eye of the storm. Wood has advised investors to maintain a long-term mind-set, as far out as five years.

Are there other options to ARK funds? Sure. That said, ARK investments surged an average of 150% in 2020 and alternatives might not perform so parabolically, even if they are less stomach-churning on the downside.

“ARK investors are being reminded that what is inside the fund and not just a strong prior record will be the driver of ETF returns in 2022, Todd Rosenbluth, head of ETF and mutual fund research at CFRA told MarketWatch.

“Higher risk companies tend to be shunned in a rising rate environment where investors prefer more profitable companies,” the researcher said.

Quality picks

The CFRA analyst recommends a few names that might interest investors eager to identify “quality” picks.

Fidelity Quality Factor ETF FQAL,

Invesco Quality Factor ETF SPHQ,

ETF.com compares that fund with First Trust Capital Strength ETF FTCS,

Finally, iShares MSCI USA Quality Factor ETF QUAL,

The BOAT that floats?

Let’s give a shout to the SonicShares Global Shipping ETF BOAT,

BOAT kicked off in August and is a passively managed ETF focused on water transportation. It is tiny at around $14 million in assets but is up 2.2% on the year and 12% over the past three months. Its expense ratio is 0.69%.

Paul Somma, founder of SonicShares ETFs, thinks that shipping issues won’t be resolved soon, a benefit for the global shipping companies that make up BOAT.

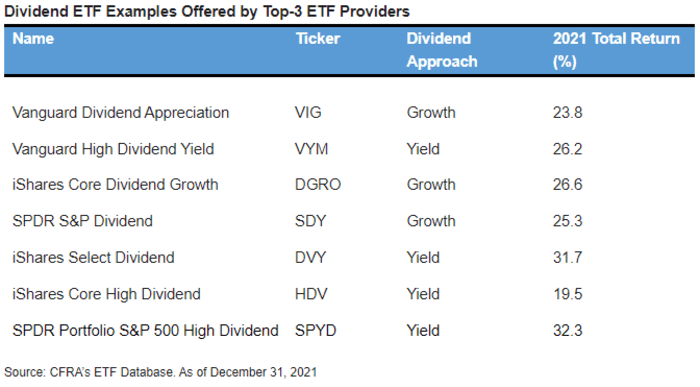

Visual of the week

Hunting for yield? Choose wisely says CFRA. Here are some of the varying performances from dividend-oriented ETFs of 2021.

Popular ETF reads

—That’s a Wrap