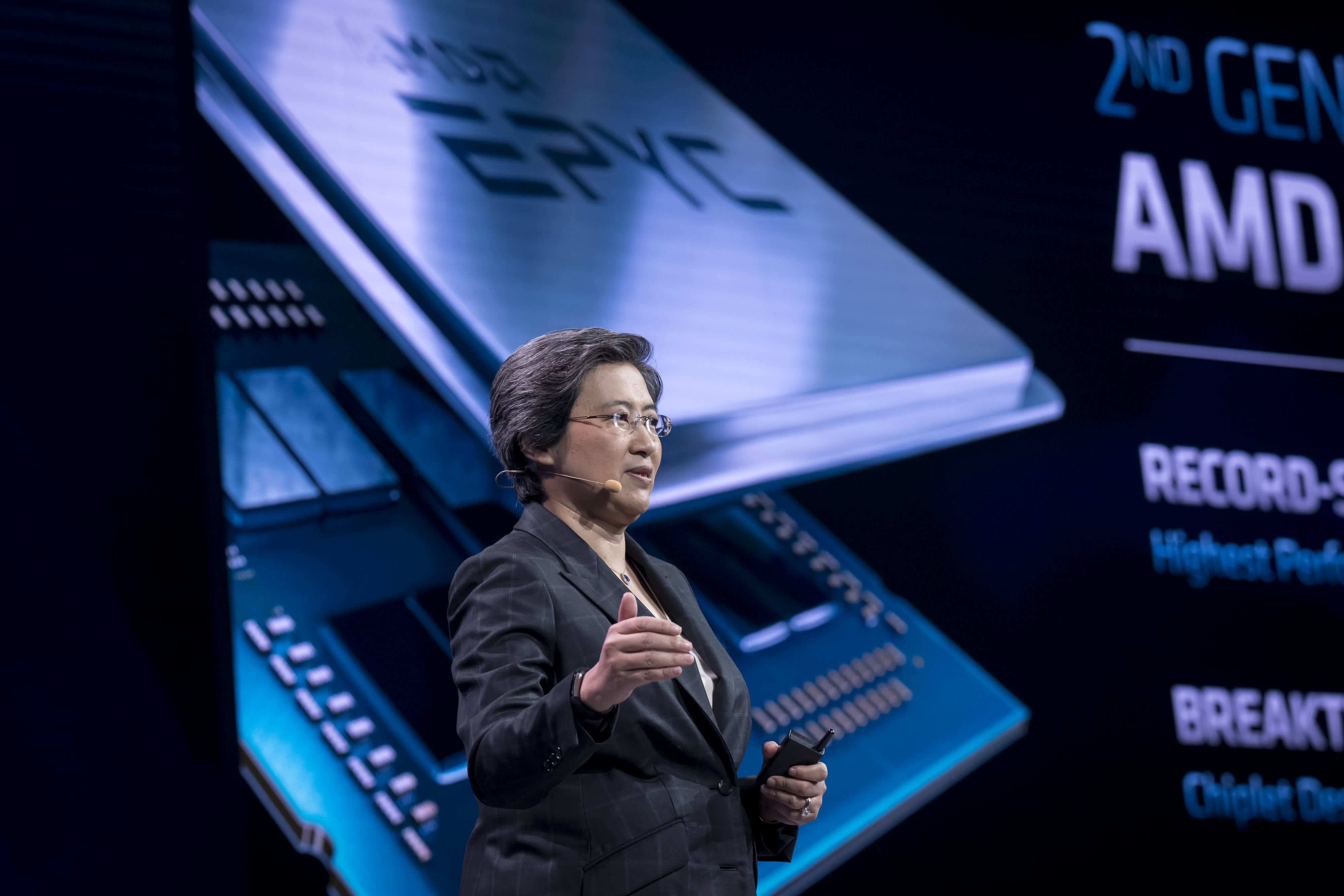

Lisa Su, president and chief executive officer of Advanced Micro Devices Inc. (AMD), speaks during a launch event in San Francisco, California, U.S., on Wednesday, Aug. 7, 2019.

David Paul Morris | Bloomberg | Getty Images

(This article was sent first to members of the CNBC Investing Club with Jim Cramer. To get the real-time updates in your inbox, subscribe here.)

After you receive this email, we will be buying 50 shares of Advanced Micro Devices (AMD) at roughly $130.62. Following the trade, the Charitable Trust will own 750 shares of AMD. This buy will increase AMD’s weight in the portfolio from about 2.15% to about 2.3%.

We are making a second buy in a beaten-down semiconductor stock Monday to ensure that we have put some money to work at these lower prices. The broader market action was pretty rough a couple of hours ago, but there have been some bounces in the time since that look encouraging.

Take Adobe (ADBE) for example. Adobe led the tech sector lower last month after it reported a disappointing quarter, but if today is supposed to be so bad for tech with the yield on the 10-year Treasury up again, then why did ADBE reverse from negative to positive territory? The cue we are taking from this action is a lot of names in tech have gotten oversold and are due for a bounce.

So why buy AMD? Like Marvell Tech (MRVL) from earlier, we trimmed our AMD position back at much higher levels, and we think the price levels are right to buy back those shares. To put some numbers around our trades, our most-recent AMD trim came on December 1st, when the stock traded around $160. Today, AMD shares trade at around $130, representing a decline of about 18% from our sale.

Loading chart…

The only real news that has taken place between December and today is the delay of the Xilinx (XLNX) acquisition. The pushback of the XLNX closing date may have created some unwanted uncertainty for AMD shareholders, but we still think this deal will go through, and we have complete faith in CEO Dr. Lisa Su. The Xilinx deal should act as a catalyst for AMD, as it will give AMD even more exposure to the data center industry and diversify its product portfolio from rival Intel.

In a market struggling to find its footing to start 2022, we like the idea of buying high-quality growth names with a catalyst at a steep discount to our last sale.

The CNBC Investing Club is now the official home to my Charitable Trust. It’s the place where you can see every move we make for the portfolio and get my market insight before anyone else. The Charitable Trust and my writings are no longer affiliated with Action Alerts Plus in any way.

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. See here for the investing disclaimer.

(Jim Cramer’s Charitable Trust is long AMD, MRVL.)