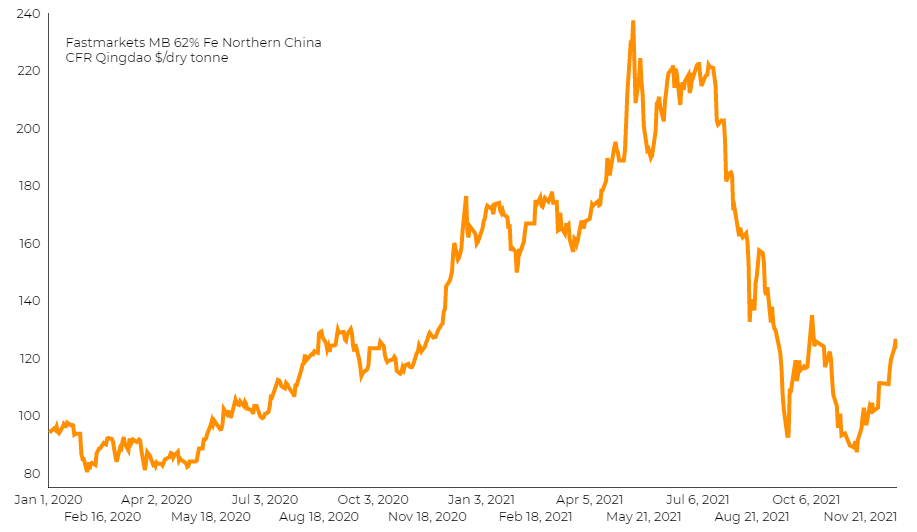

Iron ore price jumps on hopes of recovering steel production in China

Benchmark iron ore futures on the Dalian Commodity Exchange ended up 2.8% to 724 yuan per tonne.

“Domestic stainless steel firms are stepping up maintenance in the first quarter, while affected by the Spring Festival holidays and Beijing Winter Olympics; overall production is expected to be limited,” analysts with Jinrui Futures wrote in a note.

The most-actively traded stainless steel contract on the Shanghai Futures Exchange, for February delivery, jumped as much as 5.3% to 17,920 yuan ($2,812.39) per tonne. They closed up 4.4% at 17,760 yuan a tonne.

The China Iron and Steel Association said on Monday China’s 2021 crude steel output was expected to fall to 1.03 billion tonnes from a record of 1.065 billion tonnes, reaching a “supply and demand balance”.

“There’s still room for profits at long-process steel producers to gain, and expectation on resuming steel production and restocking demand before holidays could shore up iron ore prices,” according to Huatai Futures.

(With files from Reuters)