Global Bonds Under Siege as Treasuries Selloff Spreads

(Bloomberg) — Global bond markets came under pressure Monday after Treasuries sold off on Friday on increased speculation of a March rate hike by the Federal Reserve.

Most Read from Bloomberg

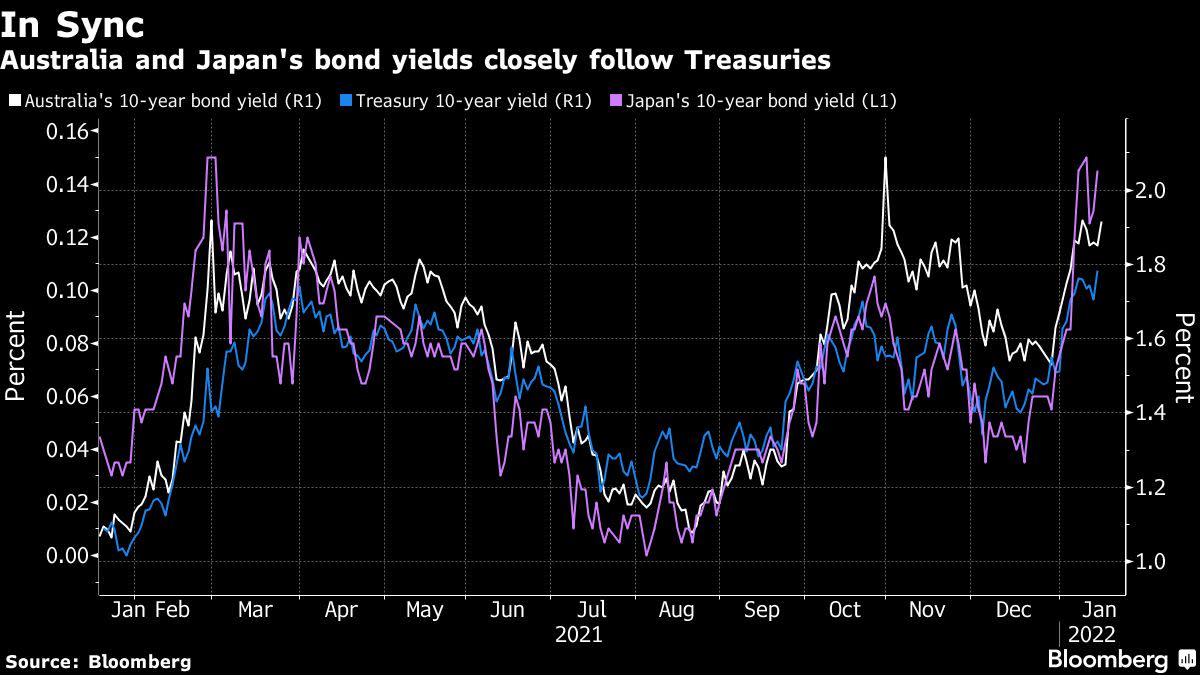

Germany’s 10-year borrowing rates jumped to within three basis points of turning positive for the first time in almost three years, while Australia’s benchmark yield climbed seven basis points to 1.92%. Treasury futures retreated after 10-year yields saw their highest close Friday since January 2020.

Yields are rising as investors increasingly fret that elevated U.S. inflation will prompt the Fed to tighten policy faster than anticipated, with markets now pricing in just over one hike in March. JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said Friday the central bank could raise rates as many as seven times, while billionaire investor Bill Ackman argued for a bigger-than-expected 50 basis points move in March.

Faster policy tightening bets are not confined to the Fed after money markets briefly priced a 10-basis-point rate hike for the European Central Bank as soon as September, while almost 100 basis points of Bank of England rate increases are expected by November.

If global central bankers “normalize policy too quickly, they risk setting off a volatility wave which can generate a market re-pricing in highly algorithmic markets,” Jamieson Coote Bonds Pty wrote in a note. “Central bankers may very well kill inflation by these actions, but they also may kill off the economy in the process in a highly interest rate sensitive world.”

Hedge funds boosted bets last week that Fed policy tightening would accelerate. Their net shorts on eurodollar futures climbed to the highest level since December 2018, according to the latest data from the Commodity Futures Trading Commission.

Japan’s 10-year yield was steady at 0.145% after climbing to as high as 0.155% on Friday. Traders are waiting to hear from the Bank of Japan this week following a report of a debate on future policy.

By contrast China’s bonds gained after the People’s Bank of China cut a key interest rate for the first time in almost two years to bolster an economy that’s losing momentum in the face of repeated virus outbreaks. The yield on the nation’s 10-year debt declined as much as three basis points to 2.77%.

There’s no Treasuries trading in the cash market globally on Monday due to Martin Luther King Jr. Day. The expectations for a March hike are hurting short-dated bonds more, with the spread between two- and 10-year Treasury yields shrinking to 81 basis points on Friday, within 10 basis points of their tightest since December 2020.

“Market participants are concerned that rapid policy normalization will be an overkill for the economy,” Daisuke Karakama, chief market economist at Mizuho Bank Ltd., wrote in a research note.

(Adds German yields in second paragraph, rate pricing in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.