Surging Bond Yields Send Nasdaq Futures Tumbling: Markets Wrap

(Bloomberg) — Treasury yields surged, Nasdaq 100 Index futures tumbled and global stocks were dragged down by concern that central banks will have to raise rates sooner than expected.

Most Read from Bloomberg

Treasuries dropped across the curve, pushing two-year and 10-year yields up to levels last seen before the pandemic roiled markets. In Europe, benchmark yields on German debt were on the verge of turning positive for the first time since early 2019.

Nasdaq contracts fell about 2% before the market reopens from a holiday. Technology shares also led the retreat in Europe, while energy shares fluctuated and Saudi stocks rallied.

Brent oil surged to the highest level in seven years, underscoring the inflation challenge facing the Federal Reserve. Easing concerns about the impact of the omicron virus strain on demand, together with shrinking inventories and geopolitical risks are contributing to forecasts of $100 per barrel crude later this year.

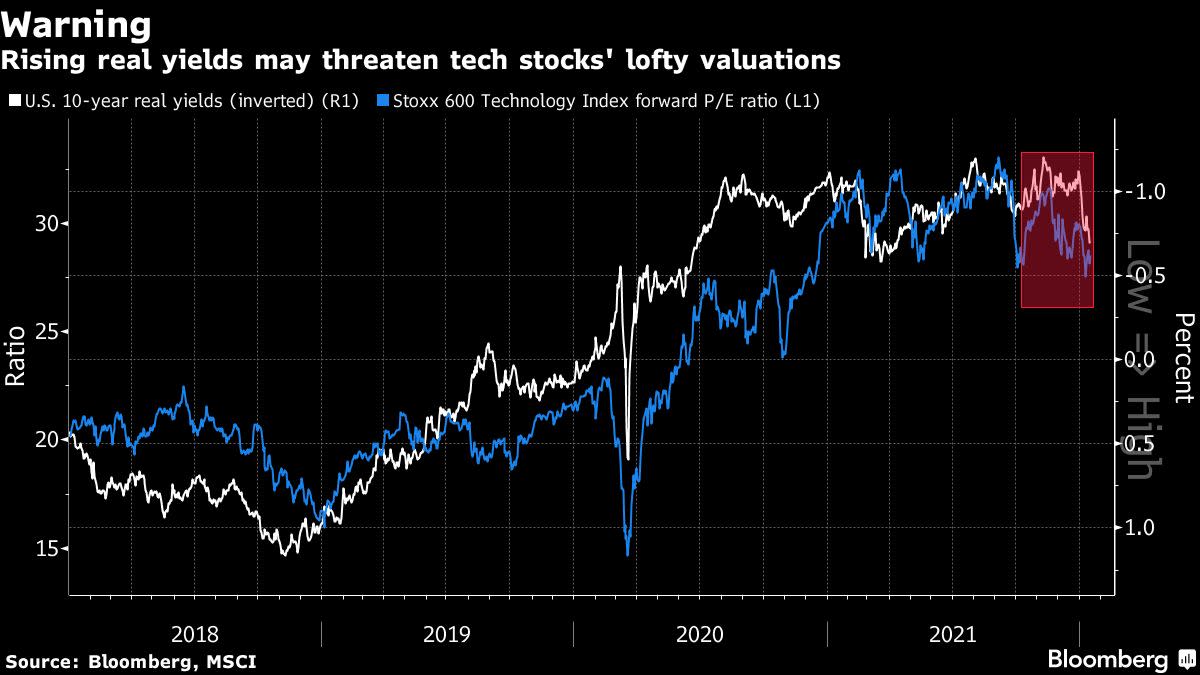

Global equities have had a volatile start of the year as investors have shifted out of more expensive and rates-sensitive sectors such as technology into cheaper, so-called value shares.

Market participants are now waiting for the earnings season to gauge whether companies can continue delivering robust profits despite higher costs and challenges from omicron. JPMorgan Chase & Co. strategists contend that global corporate earnings will deliver significant beats this year.

“With rates biased higher over the coming months, investors should be prepared for parts of the tech sector to again be challenged,” Seema Shah, chief strategist at Principal Global Investors, wrote in a note to investors. “Although rising bond yields are challenging the entire tech sector, investors must distinguish between profitless names that are a long way from demonstrating healthy earning power and mega-cap tech firms that can defend their margins.”

A gauge of the dollar rose. The yen initially declined after the Bank of Japan sat pat on policy while nudging up its inflation projection.

For more market analysis, read our MLIV blog.

What to watch this week:

-

Goldman Sachs, Morgan Stanley, Bank of America, UnitedHealth Group and Netflix are among companies publishing earnings during the week

-

U.S. data includes Empire manufacturing Tuesday, housing starts Wednesday and jobless claims Thursday

-

Interest-rate decisions due from nations including Indonesia, Malaysia, Norway, Turkey and Ukraine, Thursday

-

EIA crude oil inventory report, Thursday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 1% as of 10:28 a.m. London time

-

Futures on the S&P 500 fell 1%

-

Futures on the Nasdaq 100 fell 1.7%

-

Futures on the Dow Jones Industrial Average fell 0.7%

-

The MSCI Asia Pacific Index fell 0.2%

-

The MSCI Emerging Markets Index fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was little changed at $1.1397

-

The Japanese yen was unchanged at 114.63 per dollar

-

The offshore yuan was little changed at 6.3565 per dollar

-

The British pound fell 0.2% to $1.3626

Bonds

-

The yield on 10-year Treasuries advanced four basis points to 1.82%

-

Germany’s 10-year yield advanced one basis point to -0.01%

-

Britain’s 10-year yield advanced one basis point to 1.20%

Commodities

-

Brent crude rose 1.1% to $87.47 a barrel

-

Spot gold fell 0.4% to $1,811.07 an ounce

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.