Time to Invest in the UK? Analysts Tap 3 Stocks to Buy

Since 2016’s Brexit referendum, UK equities have been in a slump, underperforming the US market by as much as 50%. Adding to Brexit uncertainty, the country was hit particularly hard by the pandemic in 2020.

What this means is that by now, following a rangebound performance over the past year, UK stocks are at a record discount, at least according to JPMorgan Head of Global and European Equity Strategy Mislav Matejka.

“UK risk-reward is improving in our view given the significant underperformance over the years. UK lagged other regions by 25-50% cumulative, lagging in most recent years… This underperformance has resulted in a significant valuation gap opening,” Matejka noted.

Against this backdrop, Wall Street analysts have pinpointed 3 UK-based stocks which appear ripe for the picking. According to TipRanks database, there’s widespread agreement these names are set for a rally; all are rated as Strong Buys by the analyst consensus and are predicted to generate handsome returns in the year ahead. Let’s take a closer look

Superdry (SDRY.L)

Let’s kick off with Superdry, an operator in the branded fashion space. The company designs and manufactures clothes and accessories which it sells mostly under the Superdry brand but also under several other brands including Original & Vintage, Studios and CODE. The company boasts 231 worldwide Superdry stores, with an additional 475 franchises and licenses in 53 countries. Most of the outlets are concentrated in the UK (33%) followed by Germany (15%), France (10%) and in other EU countries (25%).

Like many in the retail sector, the company suffered badly at the hands of the pandemic, which interrupted a transformative brand reset.

However, as discussed during the company’s earnings for the year ending April 2021 (FY21- announced in September), Superdry believes it is on the cusp of turning a corner. While revenue for the year dropped by 21.1% to £556.1 million as further lockdowns played their part, the company pared back some of the losses, showing a pre-tax loss of £36.7 million vs. the £166.9 million loss a year earlier.

Superdry is set to release its H1 results on January 20 and has already reported H1’s sales. As other retailers tuned up the promotional dial during the summer, the company enacted a more rigid full price stance. As such, RBC’s Manjari Dhar says the top-line performance remains “subdued,” however, the analyst believes the company’s game plan will pay off over the coming year.

“We think that Superdry is progressing well in its brand reset, with an improved product range and a widening demographic appeal… Superdry is now trading at a significant discount to its own history and premium apparel peers. We think that this represents an attractive entry point to a company with an improving topline performance and margin expansion to come,” Dhar opined.

Dhar’s comments back up his Outperform (i.e. Buy) rating, and his 425p price target indicates potential for 71% share appreciation in the next 12 months. (To watch Dhar’s track record, click here)

Are other analysts in agreement? They are. Only Buy ratings, 3, in fact, have been issued in the last three months. Therefore, the message is clear: Superdry is a Strong Buy. Given the $433.33p average price target, shares could soar ~74% in the next year. (See Superdry stock forecast on TipRanks)

Flutter Entertainment (FLTR.L)

Let’s move from the high street fashion store next door to the bookies and roll the dice with Flutter. The company is a gambling stalwart, a global sports betting and gaming operator offering sportsbooks and a plethora of betting products. The company boasts a portfolio of well-known brands such as US daily fantasy sports leader Fanduel, UK and Ireland betting powerhouse Paddy Power, Betfair, and PokerStars, amongst others.

Gambling is a risky business for consumers, but in a case of turning the tables on the house, in November, the company slashed its full-year earnings outlook following a series of customer-friendly sports results. The company now expects to take a hit of around £60 million. Excluding the US, Flutter now sees full-year adjusted EBITDA coming in between £1.24 billion to £1.28 billion, compared to the prior forecast of between £1.27 billion to £1.37 billion.

Nevertheless, looking ahead, Morgan Stanley’s Ed Young sees two major events which could positively shape the coming year.

First off, in February or March, the UK government is expected to publish its White Paper on gambling reform, which could provide an “opportunity for ex-US businesses to re-rate.”

Secondly, Flutter’s arbitration with FOX over US ownership of Fanduel should reach resolution this quarter. This will not only “clarify its US ownership stake, but could potentially lead to a broader rationalisation of the US assets, and lead (should FOX take up the option) to a material cash inflow.”

Both could offer a “significant simplification of the Flutter equity story,” says Young, before adding, “Clarity over UK regulations serves as a clearing event for the sector, valuation is supported by the next wave of US states turning contribution positive, and the resolution of FOX arbitration and FanDuel IPO all lead to significant shareholder returns and M&A to support international expansion.”

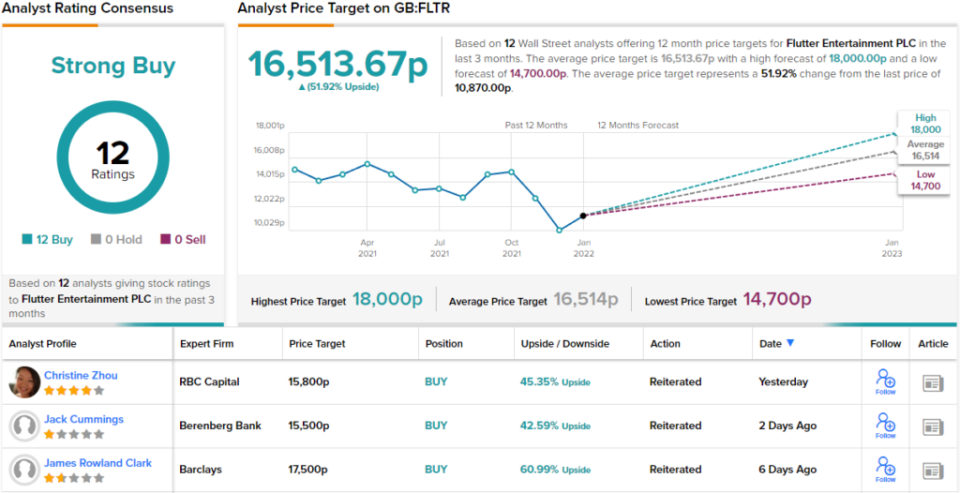

Accordingly, the analyst rates Flutter an Overweight (i.e. Buy) while his 16,900p price target implies upside of ~55% from current levels. (To watch Young’s track record, click here)

It’s not often that the analysts all agree on a stock, so when it does happen, take note. Flutter’s Strong Buy consensus rating is based on a unanimous 12 Buys. The price target is just slightly lower than Young’s; at 16,513.67p, the figure suggests share appreciation of ~52% in the year ahead. (See Flutter stock forecast on TipRanks)

S4 Capital (SFOR.L)

Lastly, from gambling dens we move across to the digital advertising and marketing services segment in the shape of London-based S4 Capital.

Combining digital content, data and programmatic media planning and buying services and digital transformational consulting, the company aims to disrupt the marketing services industry, focusing solely on the digital realm. The company was only formed in 2018 but is already active in 33 countries, and its workforce consisting of 6,000 employees spanning the Americas, Europe, the Middle East & Africa and Asia Pacific.

S4 has benefitted from companies using its digital-only service during the pandemic, and it has also been growing at a fast pace, owing to a series of acquisitions.

The company has been making a habit of exceeding prior targets too; in September, the anniversary of its third birthday was marked by a third raise to its profit forecast in 2021.

And earlier this month, alongside the announcement of a small acquisition of 4 Mile Analytics, the company provided a brief trading update. S4 said that for the first 11 months of 2021 – including its outlook for December – It now expects to deliver net revenue growth far above the prior guidance of 40%. This is nearly double the growth in S4’s addressable markets, which are expected to show 20-30% growth in 2021.

For Morgan Stanley’s Omar Sheikh, S4’s differentiating factor is in being a digital “pure play.” Having a strong foothold in the tech sector helps and so does the runway for future growth.

“50% of S4’s client roster are technology clients, where marketing budgets look well-placed to continue to grow at elevated rates for years to come,” the analyst said. “It is small and growing its market share – in 2021, S4’s gross profit/net revenue represented just 0.4% of the worldwide revenue generated by agency and consulting peers and S4’s digital-only focus and ‘faster, better, cheaper’ offering looks well-placed to disrupt its incumbent peers.”

To this end, Sheikh has an Overweight (i.e. Buy) rating for S4 shares, backed by a 1,050p price target. The implication for investors? Upside potential of an excellent 102%. (To watch Sheikh’s track record, click here)

Once again, we are looking at a stock with a Strong Buy consensus rating, this time based on 3 Buys vs. 1 Hold. The average price target stands at 907.50p, and should it be met, investors will be sitting on 12-month returns of ~75%. (See S4 Capital stock forecast on TipRanks)

To find good ideas for UK stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.