Retail Traders Bailed on the Market Right Before Stocks Rebounded

(Bloomberg) — Wondering what the force was that turned an orderly decline into a full-blown rout this morning? Mom and pop bailing.

Most Read from Bloomberg

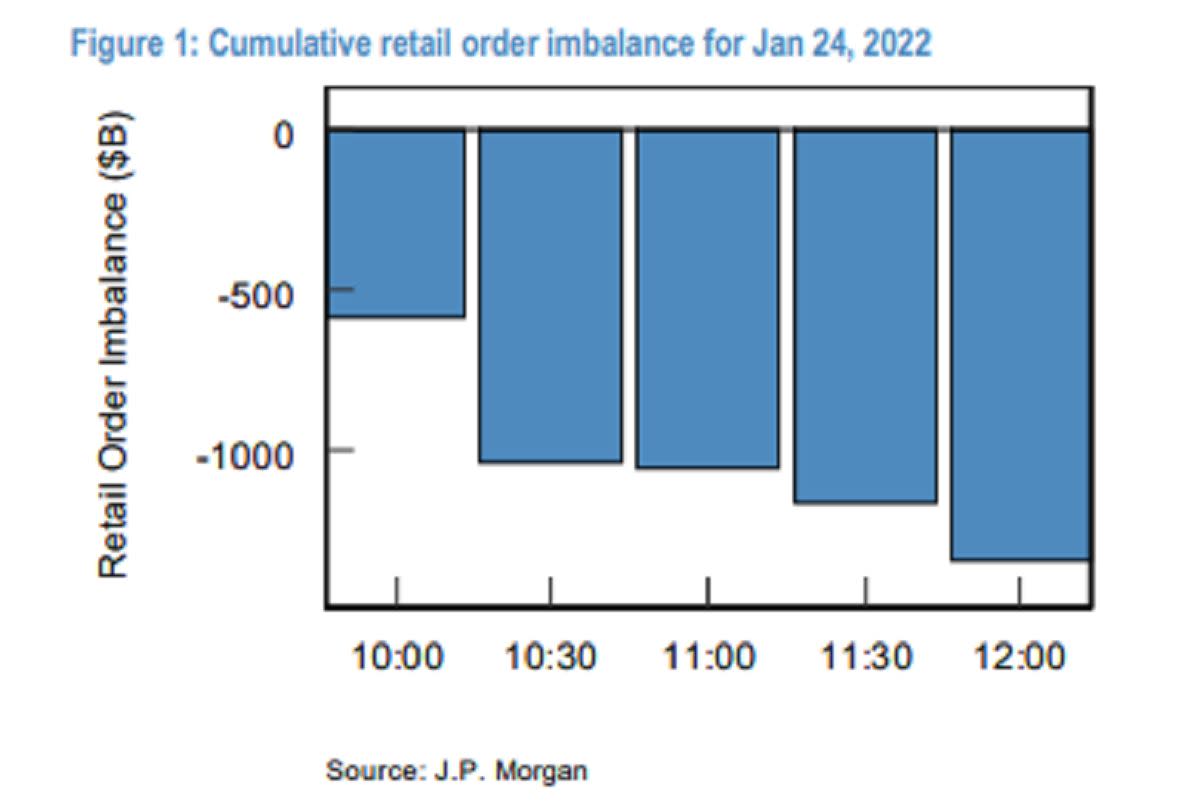

In a spasm of panicked selling early Monday, retail investors offloaded a net $1.36 billion worth of stock by noon, most of it in the first hour, according to data compiled by JPMorgan Chase & Co. strategist Peng Cheng. By his estimate, share disposals were 3.9 standard deviations heavier than the full-day average in the previous 12 months.

The retail morning exodus was a stark about-face from recent sessions, when die-hard day traders snapped up a record $12 billion of equities during the two weeks through last Tuesday.

While the rush for the exits helped drive the Nasdaq 100 down almost 5% in Monday morning trading, it’s possible the news wasn’t entirely bad for bulls on the lookout for signs of seller exhaustion. Major averages staged a breathtaking reversal in the hours after the wave of sell orders landed — one of several such turnaround in recent weeks. Stocks ended higher, erasing a 4% plunge in the S&P 500, while measures of share volume and severe price action in certain trading vehicles suggested to some that that the worst of the selling — at least this round of it — was reached.

“In the short term, it’s a good indicator that retail investors are capitulating, which is leading to perhaps a temporary bottom,” said Chad Morganlander, senior money manager at Washington Crossing Advisors. “But with that — buyer beware — there’s a convergence of material risks from a more restrictive Federal Reserve, to a fiscal drag, to geopolitical concerns, all of which can dampen market sentiment even further.”

Before Monday, there were signs that monolithic buying by amateur traders — a bulwark against losses during the pandemic period — was beginning to crumble.

“The bid from retail investors completely evaporated” on Thursday and Friday, only the sixth time since the outbreak they’d sold on consecutive days, a note from Morgan Stanley said. “This is a tremendous change form earlier in the week when rolling 1-week average daily flow hit an all-time high pace.”

Read: Morgan Stanley Data Show How Retail Meme Fixation Became a Curse

The question of who is driving volatility is an urgent one with the S&P 500 plumbing a 10% correction Monday morning and risk assets generally in free fall amid geopolitical tensions and concerns the Federal Reserve is serious about stamping out inflation. While retail traders are at last showing signs of resisting the dip, another investor class at the center of the turmoil has yet to capitulate.

That’s hedge funds, professional speculators whose crowded bets got burned during the rate-fomented selloff. While their equity exposure and leverage have fallen, JPMorgan Chase & Co. analysts who follow the industry found that the decline was in much in line with the market’s drawdown. In other words, fund managers have yet to actively unwind their positions, according to data compiled by the firm’s prime brokerage.

“Unlike in early December, we have not seen a significant decline in net leverage most recently, which has historically been a good tactical indicator,” JPMorgan analysts including John Schlegel wrote in a note. “The recent levels of leverage do not suggest a very risk-off tone yet.”

A separate analysis by Goldman Sachs Group, Inc. showed a similar view. The firm studied past episodes where hedge funds were forced to cut leverage amid market turbulence, and found the current bout of risk reduction has yet to reach the average during the past decade. Specifically, the current run saw a decrease in leverage of 10.3 percentage points, compared with 17.5 percentage points in previous instances.

On Monday, a basket of popular stocks among retail investors, including AMC Entertainment Holdings Inc. and Airbnb Inc., plunged as much as 12%. The gauge, created by Goldman Sachs Group Inc. to track most mentioned stocks on r/WallStreetBets, has shed almost half its value since its November peak. That’s brutal for many retail investors, who just started investing in stocks after zero-commission trading lured them during the pandemic boredom.

“It shows anxiety and individuals deciding that they got to reduce their exposures, they just can’t take this,” said Jim Paulsen, chief investment strategist at Leuthold Group. “Because moves that are this sharp, this quick, that creates fear among rusty old guys like me, let alone someone for whom this is their first experience of the stock market actually going down by a sizable amount.”

Meme stocks, many of which are richly valued and have yet make profits, have been caught in a volatile selloff that was triggered by concerns that the Fed’s plan to hike interest rates to tame inflation would crimp market liquidity and slow the economy.

The rush for exit sparked a spike in trading. More than 18 billion shares changed hands Monday, the busiest session since early 2021. Brian Reynolds, chief market strategist at Reynolds Strategy LLC, says should the market’s intraday low hold in place in coming days, stocks are poised to start a bottoming process over the next months or so.

“We had been hoping for a high-volume blowoff low to establish a turning point in the correction,” Reynolds said. “While the volume is in place for such an event, stocks have not yet had the upward reversal in prices.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.