24 software stocks, including Microsoft, expected to rise by double digits over the next year

During this period of sharp declines for technology stocks, valuations to earnings estimates have fallen more quickly than share prices have. This “re-rating” of the industry underlines the growth that continues as the stock prices fall.

In a note to clients on Jan. 25, Jefferies analyst Brent Thill wrote that forward price-to-earnings valuations for software companies had “contracted 23% [this year] after contracting 10% in ’21 and expanding 80% in ’20.”

He added that, following previous interest-rate increases by the Federal Reserve, “software valuations have contracted 24% on average.”

The stock market looks ahead — the declines from the highs of 2021 have anticipated increases in the federal funds rate, which is still in a target range of zero to 0.25%. But long-term interest rates have already begun to rise as the Fed tapers its bond purchases. The yield on 10-year U.S. Treasury notes TMUBMUSD10Y,

The actual cycle of official rate increases may begin Wednesday afternoon when the Federal Open Market Committee releases its policy statement.

Thill wrote “there is still room for multiples to contract,” which means he doesn’t think software stocks have bottomed yet. But for investors who wish to begin considering software stocks for the eventual rebound, a screen showing expected price increases and sales-growth rates is below.

Software P/E declines

In the midst of an earnings season during which stock prices have been falling, price-to-earnings ratios may decline more quickly than the stocks themselves, because forward earnings estimates have been increasing.

For example, shares of Microsoft Corp. MSFT,

Microsoft’s current forward P/E of 28.6 compares to forward P/E ratios of 24.9 for the S&P 500 information technology sector and 19.7 for the full S&P 500 Index SPX,

| Forward P/E | Avg. forward P/E – 5 years | Sales CAGR – 5 years | EPS CAGR – 5 years | |

| Microsoft Corp. | 28.6 | 26.8 | 16.8% | 34.7% |

| S&P 500 information technology sector | 24.9 | 21.1 | 10.2% | 19.4% |

| S&P 500 Index | 19.7 | 18.9 | 6.6% | 13.9% |

| Source: FactSet | ||||

The compound annual growth rates (CAGR) are based on calendar years through 2021 as calculated by FactSet for Microsoft (because the company’s fiscal year ends June 30) and as estimated by FactSet for the S&P 500 information technology sector and the full index.

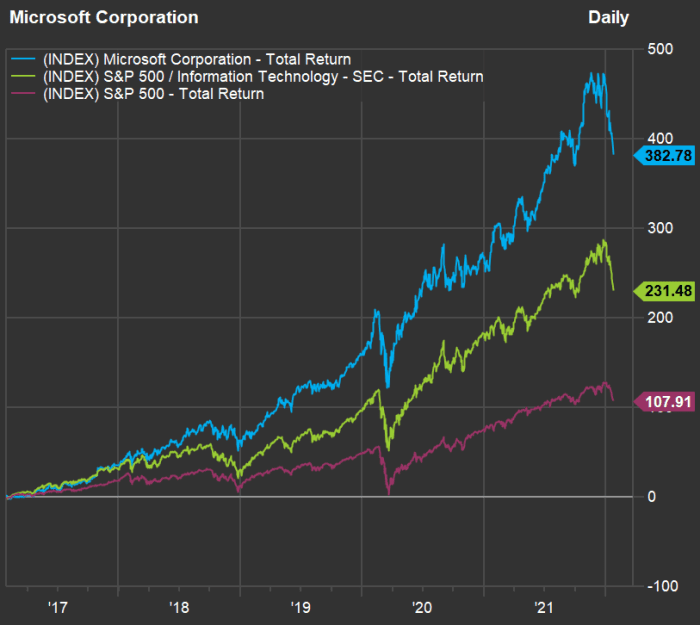

Now check out a comparison of five-year total returns:

So a high P/E itself doesn’t mean you shouldn’t consider a stock, especially one of a company that has been increasing its sales and earnings so rapidly.

Software ETF and a stock screen

Thill pointed to the $5 billion iShares Expanded Tech-Software Sector ETF IGV,

IGV holds 129 stocks and, through a modified market-cap-weighted strategy, “redistributes its portfolio away from tech giants into smaller, more growth-oriented software companies.” Among the 129, 90 are covered by at least 10 analysts polled by FactSet.

The following stock screen starts with that group of 90 companies, but doesn’t consider earnings, because some rapidly growing — and highly regarded — software companies haven’t yet turned profits.

To err on the side of caution, the following screen from the IGV list includes 24 companies covered by at least 10 analysts, with at least 85% “buy” or equivalent ratings. The list is sorted by implied 12-month upside, based on consensus price targets and includes expected sales CAGR through calendar 2023:

| Company | Ticker | Share “buy” ratings | Closing price – Jan. 25 | Cons. price target | Implied 12-month upside potential | Estimated sales CAGR from 2021 through 2023 | Market cap. ($mil) |

| Sprout Social Inc. Class A | SPT, |

91% | $60.54 | $142.00 | 135% | 30.9% | $2,759 |

| CS Disco Inc. | LAW, |

100% | $29.64 | $64.00 | 116% | 31.5% | $1,708 |

| Avalara Inc. | AVLR, |

100% | $99.50 | $206.23 | 107% | 22.9% | $8,648 |

| RingCentral Inc. Class A | RNG, |

86% | $159.47 | $329.88 | 107% | 25.1% | $13,095 |

| Bill.com Holdings Inc. | BILL, |

88% | $158.00 | $324.47 | 105% | 49.2% | $16,203 |

| Qualtrics International Inc. Class A | XM, |

88% | $24.55 | $49.19 | 100% | 25.2% | $3,616 |

| Varonis Systems Inc. | VRNS, |

86% | $34.25 | $66.90 | 95% | 22.9% | $3,676 |

| Cerence Inc. | CRNC, |

92% | $61.25 | $114.67 | 87% | 18.4% | $2,399 |

| Docebo Inc. | DCBO, |

91% | $65.03 | $116.16 | 79% | 38.4% | $1,691 |

| CrowdStrike Holdings Inc. Class A | CRWD, |

90% | $158.59 | $281.04 | 77% | 37.2% | $33,020 |

| SailPoint Technologies Holdings Inc. | SAIL, |

88% | $36.65 | $63.50 | 73% | 18.4% | $3,418 |

| Unity Software Inc. | U, |

86% | $104.07 | $174.15 | 67% | 29.6% | $29,765 |

| Dynatrace Inc. | DT, |

86% | $48.37 | $80.74 | 67% | 25.1% | $13,789 |

| Smartsheet Inc. Class A | SMAR, |

88% | $56.22 | $92.73 | 65% | 33.9% | $7,126 |

| Five9 Inc. | FIVN, |

94% | $119.46 | $196.44 | 64% | 24.2% | $8,129 |

| Pegasystems Inc. | PEGA, |

92% | $95.32 | $155.90 | 64% | 19.4% | $7,785 |

| Duck Creek Technologies Inc. | DCT, |

91% | $23.64 | $38.60 | 63% | 15.3% | $3,123 |

| Rapid7 Inc. | RPD, |

88% | $88.72 | $141.93 | 60% | 22.0% | $5,072 |

| Tenable Holdings Inc. | TENB, |

100% | $45.81 | $66.33 | 45% | 19.2% | $4,922 |

| ServiceNow Inc. | NOW, |

92% | $495.08 | $714.81 | 44% | 24.8% | $98,521 |

| Workday Inc. Class A | WDAY, |

88% | $236.11 | $327.23 | 39% | 19.6% | $45,569 |

| Synopsys Inc. | SNPS, |

88% | $291.66 | $401.13 | 38% | 11.6% | $44,752 |

| Palo Alto Networks Inc. | PANW, |

92% | $475.47 | $619.26 | 30% | 22.7% | $46,913 |

| Microsoft Corp. | MSFT, |

93% | $288.49 | $370.56 | 28% | 14.6% | $2,162,771 |

| Source: FactSet | |||||||

A stock screen doesn’t include enough information for an investment decision. You can begin your own research by clicking on the tickers for more about each company. Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Don’t miss: You can still find a haven in tech stocks: These 20 offer the safety net of highly stable profits