Market corrections are good buying opportunities, says Goldman Sachs — but only when this happens

A January that is set to be the worst in more than a decade is nearly in the books. So what now?

Strategists at Goldman Sachs led by David Kostin ran the numbers.

The first point is that corrections are not uncommon. Since 1928, there have been corrections greater than 10% during 62% of years. 2021 was unusual since the biggest drawdown was just 5%.

The bad news is the S&P 500 SPX,

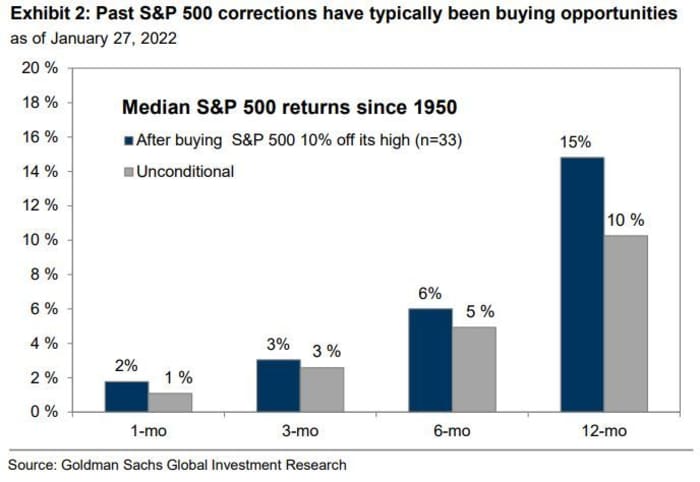

The good news is that S&P 500 corrections are typically good buying opportunities. Of the 33 corrections of at least 10% since 1950, the median episode has lasted about five months, and encompassed a peak-to-trough decline of 18% — but an investor buying the S&P 500 10% below its high would’ve gained a median return of 15% during the subsequent 12 months.

The key issue, they say, is whether the U.S. economy enters a recession. “Corrections rarely turn into bear markets unless the economy is heading into a recession,” the strategists say.

Fundamentally, say the strategists, rising interest rates are entirely the reason for the S&P 500 decline. The 60 basis point rise in Treasury inflation-protected securities was matched by a similar rise in the S&P 500 forward earnings per share yield, which is another way to say that price-to-earnings expectations fell. If real rates rise by another 60 basis points, the S&P 500 would fall to 4000, and would drop to 3800 if real rates rise by 100 basis points, all else being equal.

There’s three key factors investors should watch to see if a rebound can develop — positioning, monetary policy and earnings. None of these factors at the moment are working in favor of buyers. For example, its equity sentiment indicator typically is 2+ standard deviations below average near the bottoms of correction since the global financial crisis, but right now it’s just 0.4 deviation away from average

Goldman and other major brokers including Bank of America and Deutsche Bank are busy ratcheting up interest-rate expectations. “Investors have had to adjust expectations dramatically since September, when markets priced just one 2022 hike and a more gradual QE taper. Clarity that expectations are appropriately calibrated would allow investors to increase equity risk,” they say.

Earnings is the final potential support. While fourth-quarter results have beaten estimates, the outlook has been mixed, with 52% providing guidance above expectations and 48% guiding below. That’s led to the bottom-up consensus estimate for 2022 EPS being unchanged.

For now, the strategists said investors should focus on quality stocks that often are rewarded as financial conditions tighten. They ran a screen for Russell 3000 stocks with strong balance sheets, high margins and reasonable valuations that includes Moderna MRNA,

They also are overweight S&P 500 energy companies on a bullish outlook for oil prices, as well as being a hedge for inflation surprises and geopolitical conflict, while they downgraded financials to neutral.