Forecaster who called bitcoin’s ‘skyscraper’ top says this company remains the smartest digital/fintech play

While stocks have been ducking and diving around hawkish talk from central banks, it’s looking like another up day for cryptocurrencies.

“Perhaps the most interesting aspect of the rally in the crypto space is that it has unfolded independently from any move in speculative equities after a long period of seeming tight correlation between the two markets,” said John Hardy, head of foreign-exchange strategy at Saxo Bank.

That brings us to our call of the day, where we continue chatting with president of macroeconomic research firm Lamoureux & Co., Yves Lamoureux. He’s doubling down on bitcoin exchange and digital-asset marketplace Bakkt BKKT,

Read: Forecaster Yves Lamoureux says ‘seller exhaustion’ is creating opportunity in these stocks

He told MarketWatch in April 2021 that Bakkt was a better long-term play than digital exchange Coinbase COIN,

“I like this one, particularly because I think they will [become] custodian to the U.S. dollar digital version. You know the central banks are all going to have their own currency,” Lamoureux said.

Many global central banks, including that of the U.S. and governments are busy researching central bank digital currencies (CBDCs), and India recently said its own will be ready by early 2023.

Bakkt “belongs to the same people that own the New York Stock Exchange. They’re used to protecting stocks and used to having techniques. And I think that at some point, Bakkt becomes the custodian of the U.S. digital dollar…so it was great last year, it’s even better now.”

Owning Bakkt links directly to another space he’s watching closely — post-quantum cybersecurity. “The coming of quantum computers will break the bitcoin encryption and may also create chaos in stocks from malicious actors,” he said, noting that while solutions may arrive, CBDCs may offer better protection.

Lamoureux said this isn’t an issue now but down the road for bitcoin, perhaps in 2027, past the next halving of the crypto due in 2024.

“For me a U.S. digital dollar would have been created with the intent of being quantum unhackable. We think BKKT will fit in this new era where really loyalty points and digital dollars live side by side as currencies,” he said.

As for bitcoin BTCUSD,

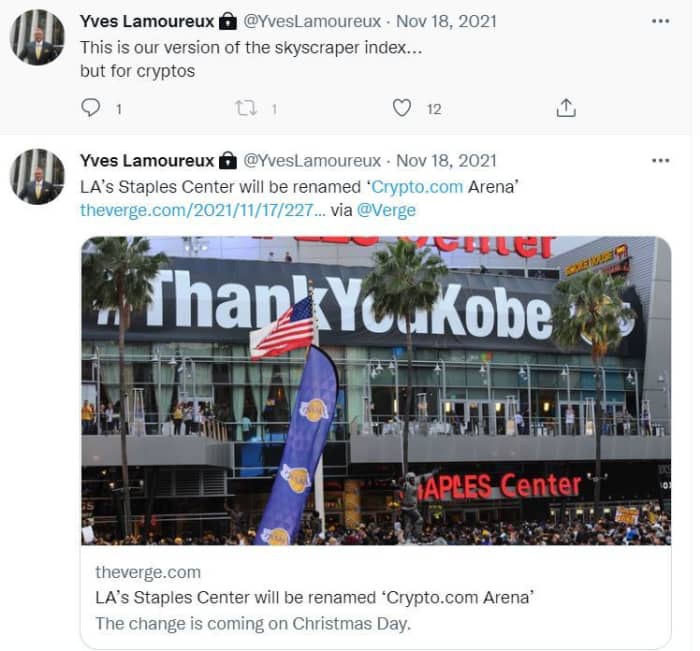

That November call came after the Los Angeles arena was changing its name to crypto.com, and the forecaster tweeted that it looked like a similar take on the so-called skyscraper index theory, developed in 1999 by a property analyst who connected economic downturns with the construction of the world’s tallest buildings.

“So I said, ‘Are we getting into a crypto winter and of course, bitcoin started to drop.’” recalls Lamoureux.

But it isn’t just a skyscraper issue. “Bitcoin is going down because it’s anticipating we have deflation…what is coming next is not inflation, what is coming next is deflation. That’s why people don’t get it right, that’s why they got caught with bitcoin going down because they didn’t anticipate that next big phase of deflation,” he said.

“And when it’s obvious central banks are going to come back and print and then bitcoin will be going up, stocks will be going up,” Lamoureux said.

The buzz

SoftBank 9984,

Peloton PTON,

COVID-19 vaccine maker Pfizer PFE,

Chipotle CMG,

Tilray TLRY,

American Express AXP,

A small-business sentiment optimism index fell, with a record number of companies raising prices. The U.S. trade deficit set a new record of $859 billion in 2021. Quarterly household debt data is due later.

CF Acquisition CFVI,

On that note, rocker Neil Young, who yanked his music from Spotify over concerns about COVID-19 disinformation from Rogan’s podcasts, says employees of the music streamer should quit “before it eats up your soul.”

California plans to end a strict COVID-19 indoor mask mandate by Feb. 15.

The markets

Stocks DJIA,

The chart

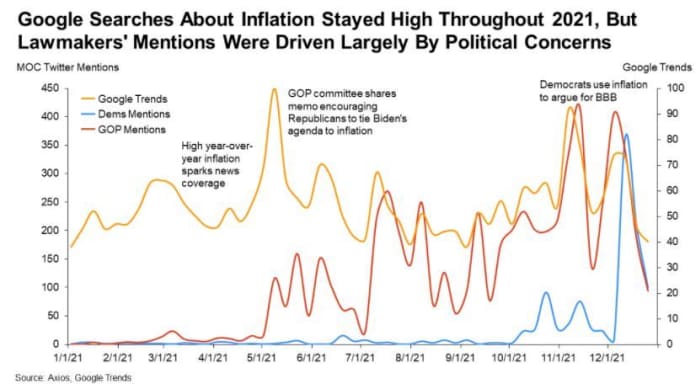

“While consumer interest in inflation has been high all year, Republicans increased their discussion of the topic to try to tie rising prices to President Biden’s agenda in May, while Democrats shifted gears in December, pointing to the need to fight inflation as a reason to pass Build Back Better,” notes analytical public affairs consulting firm, Hamilton Place Strategies, providing this chart of 2021 searches.

The tickers

These were the top stock tickers on MarketWatch as of 6 a.m. Eastern Time.

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| FB, |

Meta Platforms |

| NVDA, |

Nvidia |

| NIO, |

NIO |

| BABA, |

Alibaba |

| AAPL, |

Apple |

| AMZN, |

Amazon |

| PTON, |

Peloton |

Random reads

Troy Kotsur has become the first deaf man to receive an Oscar nominee, for his role in the buzzworthy CODA.

Germany is fuming after suit-violation chaos sees ski jumpers disqualified from the Beijing Winter Olympics.

And everyone relax, comedian Leslie Jones will resume her Olympic tweets.

New York City mayor Eric Adams takes heat for comparing cheese to heroin.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.