Weekend reads: Inflation fear and opportunities for investors

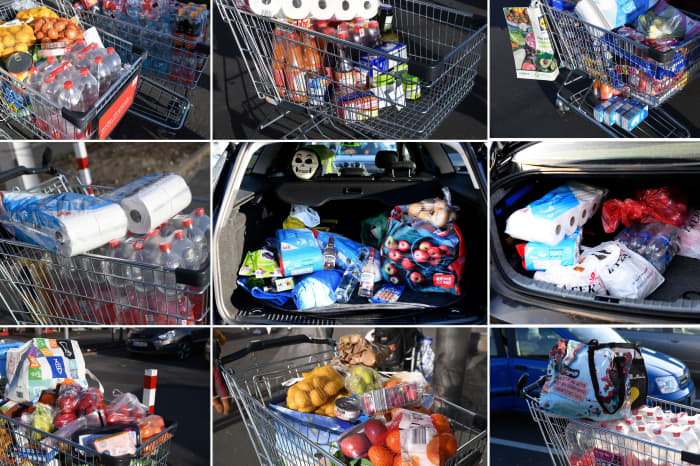

U.S. consumer price inflation rose to a 40-year high of 7.5% in January. That pace is running way ahead of wage growth, and the official figures can mask even more pain, depending on a family’s circumstances. Jeffry Bartash takes a detailed look at the inflation numbers.

More inflation coverage:

- The average household is spending an extra $250 a month, or $3,000 per year, because of high inflation — but middle-aged Americans are paying even more

- Rising inflation will ‘drive increases’ in auto, credit card debt, CFPB Director Chopra warns

How will the stock market react when the Federal Reserve makes a big move?

The Federal Open Market Committee hinted last month that the Federal Reserve would begin raising short-term interest rates in March. Long-term interest rates have already begun to rise, as the central bank has slowed its bond purchases, which will end in March. Rising rates typically pressure the stock market as a whole, because investors become attracted to other asset classes. The question now is how much of the rate increases have already been priced into stocks?

Inflation opportunities for investors

Michael Brush makes the case that whenever stocks turn sharply lower because of high inflation, investors are granted an opportunity to buy. He names three examples of stocks to buy on inflation dips.

A period of strong economic growth, high inflation and resource demand bodes well for oil prices. If you are wondering how to approach oil stocks, here’s a deep dive into three exchange-traded funds that track the industry.

An inflation surprise for investors

Mark Hulbert looks back at how the stock market has performed during previous periods of high inflation and rising interest rates. The results may surprise you.

Hulbert also makes the case that high inflation can benefit companies that have a lot of debt, including International Business Machines Corp. IBM,

Ivermectin, misinformation and the need for hard data

Two years into the coronavirus pandemic, ivermectin, a drug commonly used to treat parasites in some people as well as in livestock, remains a political lightning rod. Jaimy Lee takes a deep look at how misinformation within the medical community was spread so widely and then discovered and retracted. She also looks ahead to rigorous studies that should finally answer the question of how effective ivermectin can be against Covid-19.

Planning a retirement move

A nature walk in Lee County, Fla.

COURTESY THE LEE COUNTY VISITOR & CONVENTION BUREAU

Silvia Ascarelli writes the Where Should I Retire? column. This week she helps a couple doing some long-range planning. They wish to retire and rent in a place near beaches, with mild weather and within easy access to an airport. Here are three possible destinations within their budget.

Try MarketWatch’s retirement location tool for your own custom search. It includes data for more than 3,000 U.S. counties and incorporates climate risk.

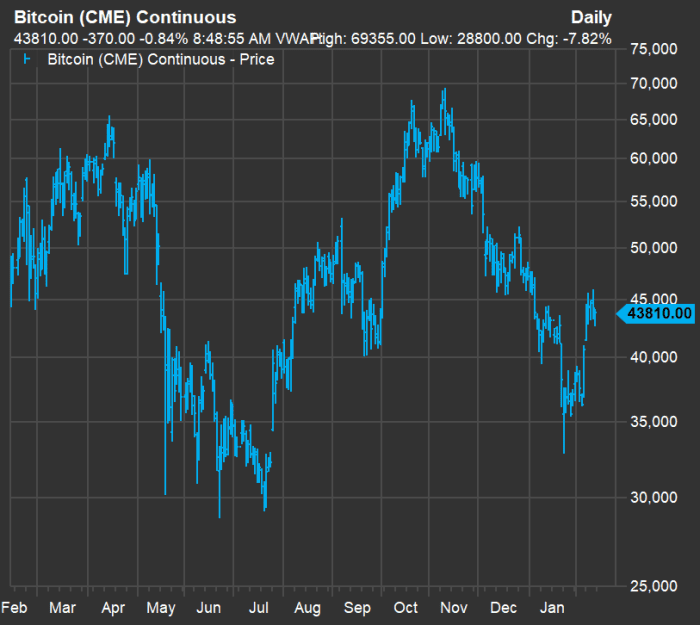

A bitcoin forecaster doubles down on a stock pick

Bitcoin hit its all-time high price of $69,355 on Nov. 10.

FactSet

Barbara Kollmeyer continues her conversation with forecaster Yves Lamoureux, who says he advised clients that bitcoin BTCUSD,

An investment outside the stock market

The beautiful thing about real estate is that it’s real. If financial markets crash, you still own the property. If inflation is high, you might be able to raise the rent. That raises the question — is it worth renting out a home and dealing with tenants, maintenance, repairs and other costs?

Jacob Passy writes The Big Move column and this week helps a reader decide whether to rent out a house or sell it.

How TikTok has taken on Facebook

TikTok has been growing very rapidly, with 78.7 million U.S. users. Jurica Dujmovic explains how TikTok has been able to take business from Instagram and Facebook, which are units of Meta Platforms Inc. FB,

Estate planning — to care for a child who needs help after you are gone

Quentin Fottrell — MarketWatch’s Moneyist — helps a couple weighing how to update a trust to make sure one of their daughters, who suffers from depression, will always be cared for.

Yum Brands…

Investors love to see a company growing rapidly. Shares of Yum Brands Inc. YUM,

… And yummy bugs

InnovaFeed uses a zero-waste vertical farming model to breed black soldier flies.

INNOVAFEED

As an alternative to fast food, maybe eventually you will be eating insects.

For now, InnovaFeed is working with Archer-Daniels-Midland Co. ADM,

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.