Why repaying $500 can be harder than repaying $1,000

A version of this post was originally published on TKer.co.

When I was in college, I didn’t make much money at my modest work-study job. It certainly didn’t earn me enough to pay off my credit card bill that one time I hit the $500 spending limit.

Terrified that I would never be able to come back from what looked like imminent financial ruin, I called my older sister for some one-time cash. It was humbling, but thankfully she bailed me out.

Today, as an actual adult with income, savings and a good financial plan, paying off a $1,000 credit card bill is a walk in the park. While the amount of credit card debt I carry may have doubled, my financial situation has completely changed.

Any serious conversation about debt of any nature — consumer debt, corporate debt, government debt — should also address the capacity to finance that debt.

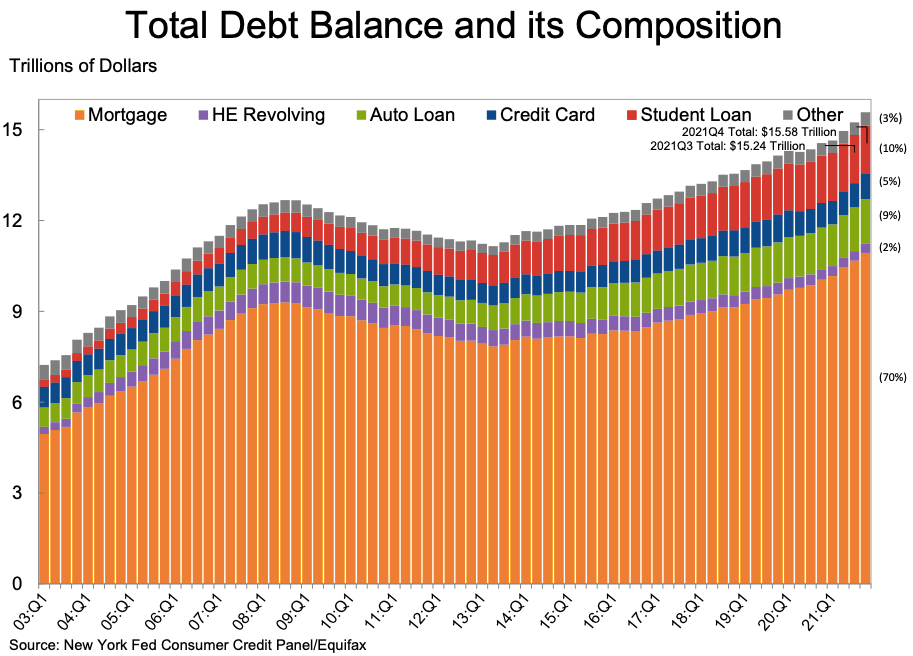

$15.58 trillion of consumer debt

You might’ve seen one of these headlines last week:

-

“U.S. Households Took On $1 Trillion in New Debt in 2021“ – The Wall Street Journal

-

“Consumer debt totals $15.6 trillion in 2021, a record-breaking increase“ – CNBC

-

“Household debt jumped by $1 trillion in 2021, the most since 2007“ – CNN

-

“U.S. household debt increased by $1 trillion in 2021, the most since 2007“ – Reuters

Every one of these headlines is accurate. They each draw from the NY Fed’s new quarterly household debt and credit report.

But if all you did was read the headline, you might think the accumulated debt is worrisome. After all, debt was at the heart of the financial crisis that brought down the economy 15 years ago.

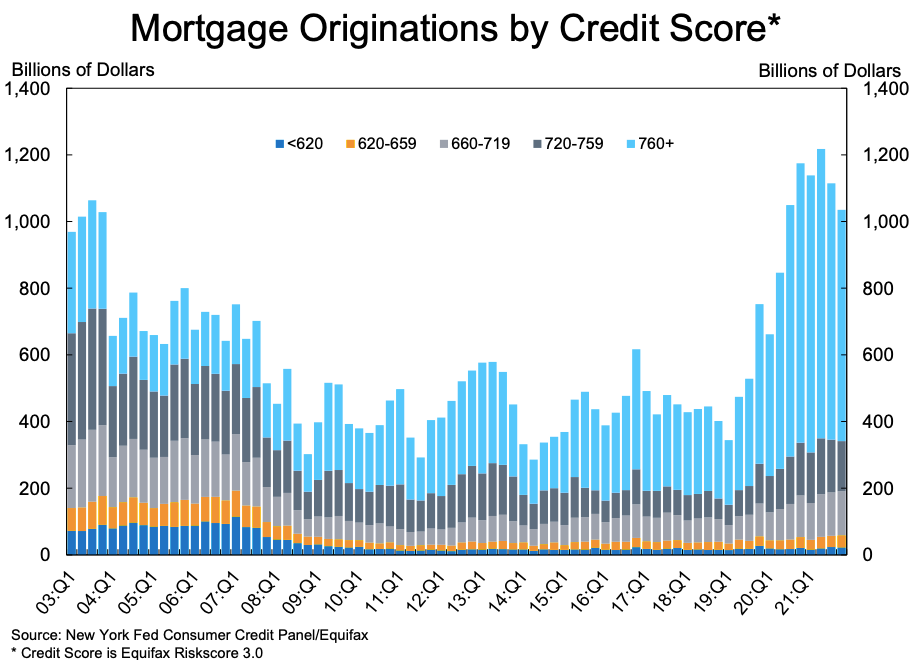

A lot has changed over the years as debt levels have climbed. Consider the largest category of household debt: mortgages.

Mortgage balances increased to $10.93 trillion in the fourth quarter of 2021, up by $258 billion during the period. American households are carrying more mortgage debt today than they were during the height of the housing bubble.

However, there are two important pieces of context to note.

First, an overwhelming majority of new mortgages are going to borrowers with credit scores of 760 or higher, which is very high.

Second, there are indeed subprime mortgages being written (to those with a credit score of 620 or less). But the total value of originations for these borrowers is nowhere near where they were during the housing bubble of the 2000s.

The NY Fed’s report offers a lot of color on each of the categories of borrowing, including stats on delinquency and default rates. But the big takeaway is that borrowers generally have great credit quality and are mostly current on their financial obligations.

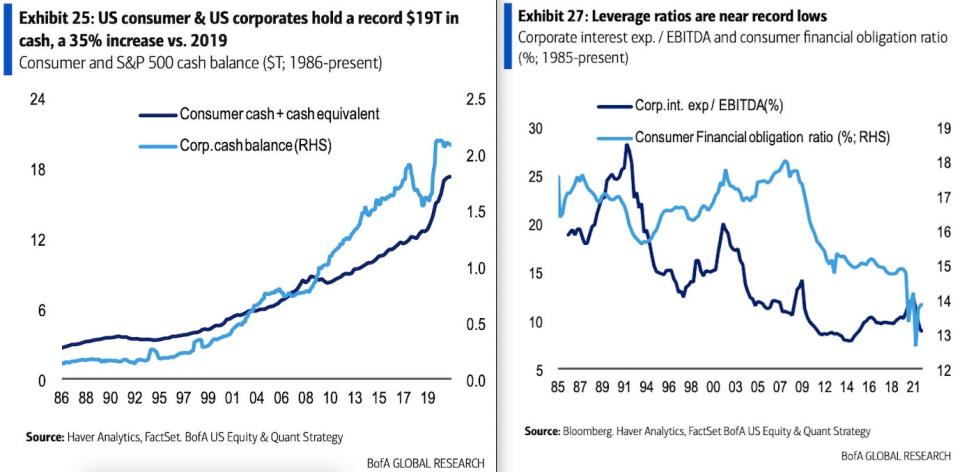

In a report to clients on Monday, Bank of America shared the two charts below showing that consumers (as well as businesses) have record levels of cash while their capacity to meet financial obligations has never been more robust.

Debt carries a negative stigma. But debt also enables people to buy a home 30 years before they have the cash. Debt allows young people to get the education that gets them on track for lifetime of higher earnings. Debt helps workers buy that car they need to get to that higher paying job.

Sure, too much debt can certainly put people (and businesses) at higher risk of going into financial ruin. However, “too much debt” should only be defined when you consider the borrower’s entire financial situation.

Some recent features from TKer:

Rearview ?

? Stock market declines: The S&P 500 fell 1.8% last week. It’s down 7.3% since the beginning of the year but up 12.8% from 12 months ago. For more on market volatility, read this.

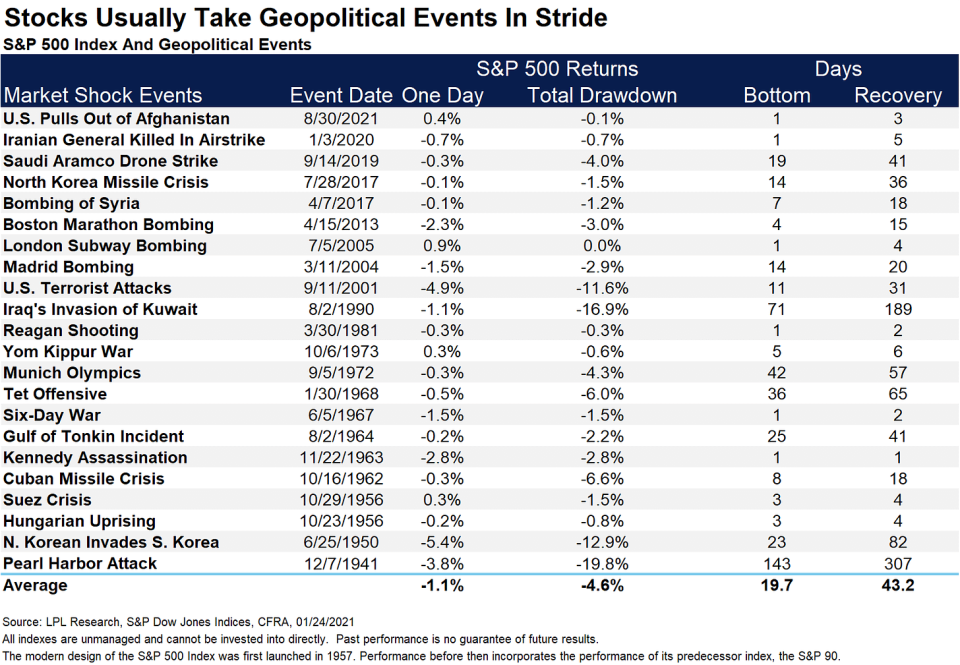

?? ?? Some of last week’s market volatility was attributed to heightened tensions on the border of Ukraine and Russia. LPL Financial’s Ryan Detrick compiled a list of major geopolitical events since 1941 and reviewed how the stock market performed in the days that followed. While every event is unique, the pattern seems to be one of an immediate negative shock to prices followed by a relatively quick recovery. For more on how the stock market moved past geopolitical events, read this.

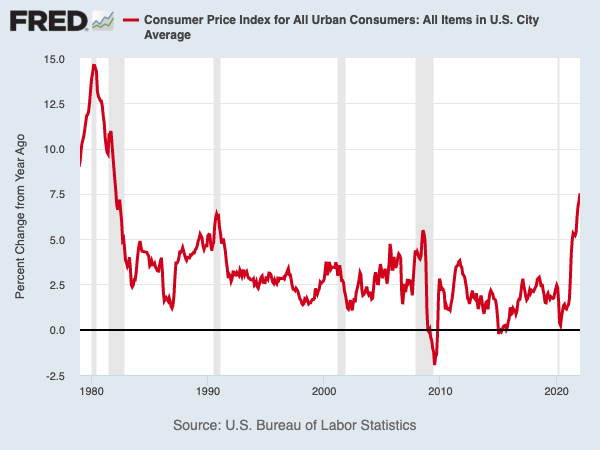

?Inflation continues to be hot: The consumer price index (CPI) increased by 0.6% in January from December. This represents a 7.5% increase from a year ago, the biggest jump since February 1982.

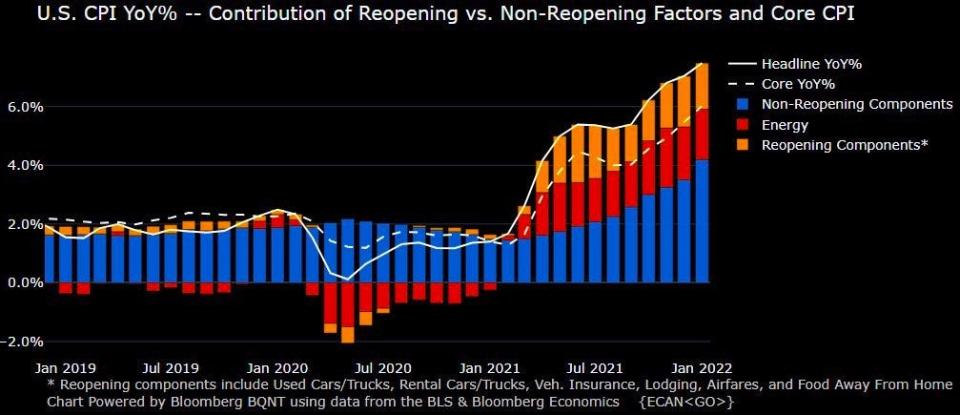

… and prices rise across the board: For a while, inflation was largely driven by the “re-opening” categories. These are the goods and services from industries facing more pronounced shortages as the pandemic continues to hinder labor and supply chains. However, prices in the non-reopening categories have accelerated as demand has broadly outpaced supply. Of note, JPMorgan economist Daniel Silver argues that “there are still reasons to think that a portion of the recent strength will be transitory, particularly if supply chains and inventories normalize.“

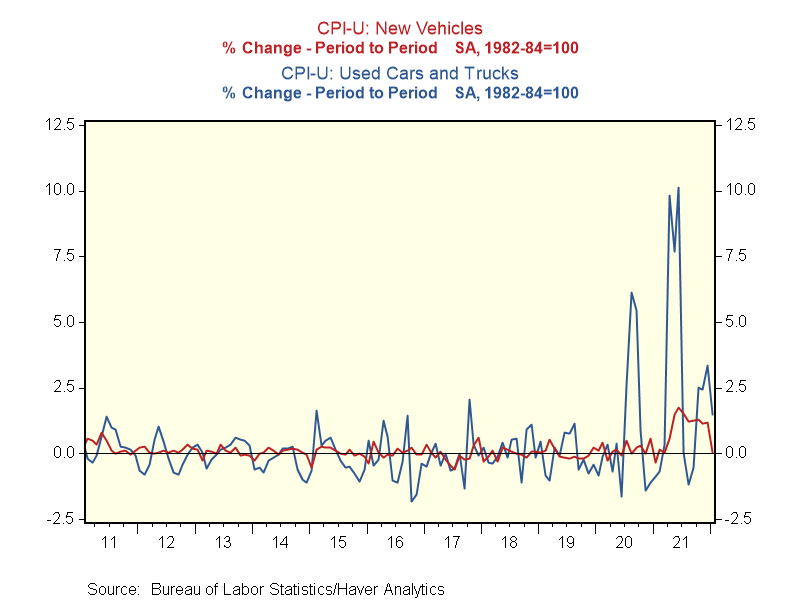

? But car prices decelerate: For months, one of the biggest drivers of inflation was the price of new and used cars, which faced all sorts of challenges including a global chip shortage. But as Renaissance Macro highlighted, “The prices for both new and used cars moderated sharply relative to prior months.“

From Pantheon Macroeconomics (via CNBC’s Carl Quintanilla): “The good news in this report – really – is that new vehicle prices were unchanged, after eight straight monthly increases of more than 1% per month. This is a significant development. We expect new vehicle prices to fall outright over the next few months.“

? What to make of all this: The matter of inflation being high has been in focus for months. Similarly, concerns that high inflation would prompt aggressive action from the Fed has been on traders’ and investors’ radars for months. And so, while an inflation report that’s a bit hotter than expected and a Fed that’s looking a bit more aggressive than expected may be surprises, they’re not the types of developments that were totally out of mind. This may explain why we didn’t see even more volatility in markets last week. For more on this, read this.

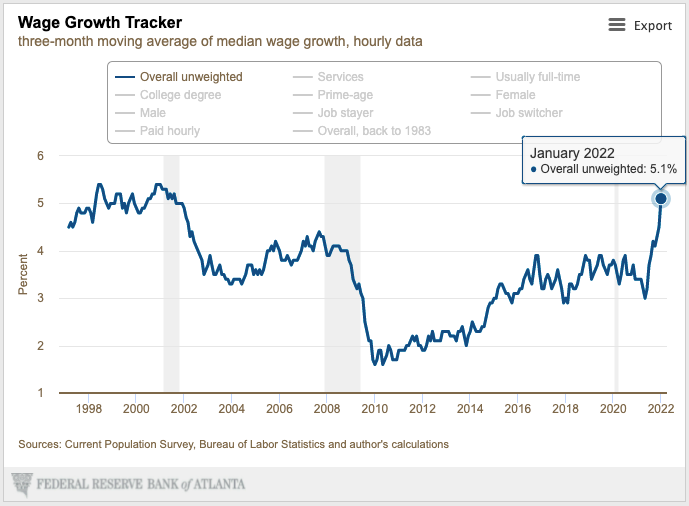

? People are getting paid more: Wages jumped by 5.1% in January, according to the Atlanta Fed’s Wage Tracker. This is up from 4.5% in December.

? Consumers are spending: According to the New York Fed report cited in my featured commentary above, “Credit card balances increased by $52 billion [in Q4 2021], representing the largest quarterly increase observed in the 22-year history of the data.“

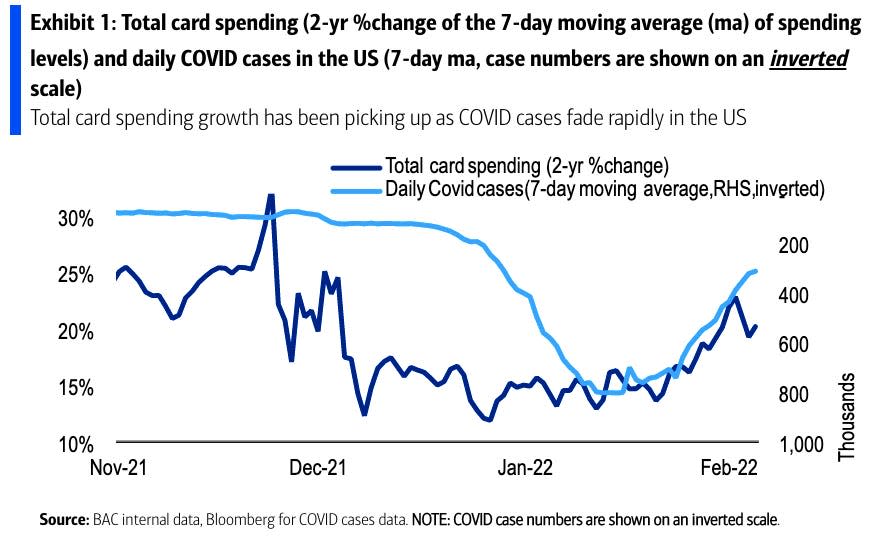

According to recent credit and debit card data from the Bureau of Economic Analysis and Bank of America, consumers have continued to spend at a healthy clip in January and February so far.

? The connection between inflation and wages: Keep in mind, one of the reasons why we currently have high inflation is because of all the people who’ve gone back to work who have also gotten higher pay. They are spending in an economy that’s struggling to keep with the demand. For more on wages and inflation, read this.

? Boston Fed welcomes Susan Collins: The Boston Fed announced economist Susan Collins will be its new president, filling a seat vacated by Eric Rosengren. From Yahoo Finance’s Brian Cheung: “As one of 12 regional heads that vote on the direction of the Fed’s powerful economic policies, Collins will assume a critical role as high levels of inflation and concerns over the ongoing pandemic weigh on the U.S. economy. Collins will be the first Black woman to helm a Federal Reserve Bank, and is only the second Black person to do so (after Raphael Bostic, who began running the Atlanta Fed in 2017).“

✈️ Merger in the sky: Low-fare carriers Spirit and Frontier Airlines announced plans to combine businesses in a $6.6 billion merger deal. Management expects the new business to generate $500 million in annual cost savings. Management also expects the new company to create 10,000 jobs by 2026.

?♀️ Peloton cuts: Exercise bike company Peloton announced it was replacing its CEO and cutting 20% of its corporate workforce, which amounts to about 2,800 jobs.

Up the road ?

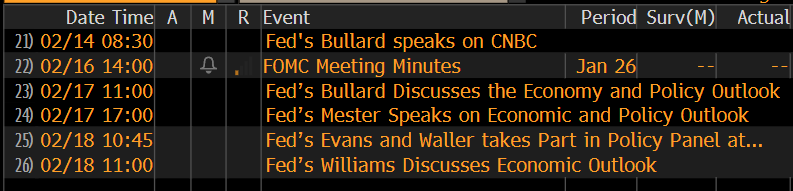

Interest in the Federal Reserve is very high lately as inflation reports continue to run hot, potentially impacting the central bank’s plans for tightening monetary policy. Currently, traders expect the Fed to raise those short-term rates to 1.75% to 2.00% by the end of the year, which would imply seven quarter-point rate hikes.

Below is next week’s schedule of speaking engagements with top Fed officials, courtesy of eToros’ Callie Cox. All times are ET.

The January retail sales report is also of interest as investors continue to assess the impact of the Omicron variant on consumer spending. Economists estimate that sales climbed by 1.8% during the month. The report will be released at 8:30 a.m. ET on Wednesday.

Meanwhile, there are a lot of big companies scheduled to announce their quarterly earnings. Check out the calendar below, courtesy of The Transcript.

A version of this post was originally published on TKer.co.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube