Russia-Ukraine: U.S. stock-market bounce shows investors care ‘not about war but sanctions,’ analyst says

Investors were still trying to make sense of the breakneck reversal in financial markets that followed Russia’s launch Thursday of a full-scale invasion of Ukraine, with U.S. stocks erasing a plunge to end solidly higher.

But a look at the S&P 500 SPX,

“Some take the unwind as a sign a full Russian invasion of Ukraine had already been ‘priced in’ by markets. We disagree — from the start, markets have cared not about war but sanctions — and any Russian response to those,” Lignos said.

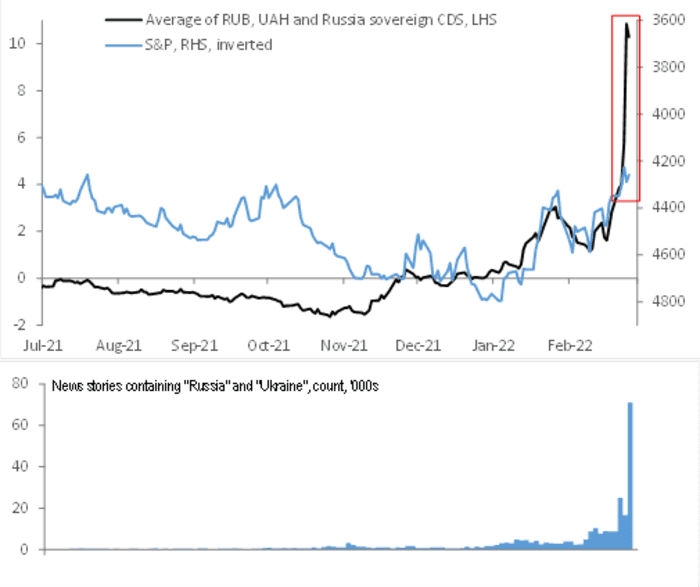

RBC has been tracking the average of the U.S. dollar/Russian ruble USDRUB,

Since the Russia-Ukraine crisis started to dominate the news (as tracked in the lower panel) the relationship had been extremely tight. And it intensified further between Russian President Vladimir Putin’s Monday speech and late Wednesday. But, as the chart shows, that relationship broke down Thursday afternoon after the latest round of sanctions against Moscow were announced.

The relationship had intensified, Lignos said, only because Western leaders had said an invasion would trigger “severe” sanctions. The moves that were announced by U.S. President Joe Biden on Thursday included added restrictions on Russian banks, take aim at a majority of the country’s financial sector, but Western allies balked at cutting Russia off from Swift, the financial-messaging system that links the world’s banks. Energy exports were also, as expected, left untargeted.

Analysts said the moves reflected fears about further pushing up oil and natural-gas prices as the global economy deals with surging inflation. Oil futures BRN00,

Meanwhile, the S&P 500 built on Thursday’s bounce, jumping 1.9% to turn positive for the week. The Dow Jones Industrial Average DJIA,

It’s been a brutal week for Russian assets despite a late bounce. The ruble remained down more than 7% versus the dollar after hitting a record low earlier in the week, while the VanEck Russia ETF RSX,

The takeaway, Lignos said, is that when the “politician’s definition of ‘severe’ turns out to be milder than the market’s, global risk rallies, even if Russian/Ukrainian financial assets struggle to match the gains.”