Live updates: How Russia-Ukraine crisis is impacting markets, economy

Check here for the latest news

Article content

Russia’s invasion of Ukraine has sparked unprecedented economic and financial retaliation from western nations which are piling on sanctions in what France has called “all-out economic and financial war.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

But the conflict will have consequences for the whole world as it cuts off crucial energy and crop supplies, disrupts businesses and upsets financial markets, already under extreme stress as central banks prepare to tighten.

There is a lot going on out there so check here for the latest news on how the conflict is affecting markets, businesses and the economy.

10:15 a.m.

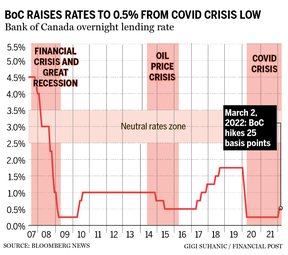

The Bank of Canada raised interest rates by 25 basis points to 0.50 per cent this morning, citing high inflation as one of the main factors behind its decision.

Prices were already under pressure and rising, but the conflict in Ukraine is adding to inflationary pressures, policy makers said in today’s statement. The bank now expects inflation rates, now at 5.1 per cent, to stay higher for longer.

“Price increases have become more pervasive, and measures of core inflation have all risen. Poor harvests and higher transportation costs have pushed up food prices. The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities. All told, inflation is now expected to be higher in the near term than projected in January,” the statement said.

The bank reiterated its commitment to using its policy tools to bring the inflation rate back down to its 2 per cent target.

— Victoria Wells

9:48 a.m.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

9:45 a.m.

The list of companies exiting or refusing to do business with Russia grows.

Boeing has suspended technical support for Russian airlines and Apple Inc has stopped selling iPhones and other products in Russia.

U.S. energy firm Exxon Mobil said it would exit Russia

9:36 a.m.

North American stocks open higher after a rough week so far as Federal Reserve Chair Jerome Powell signaled the central bank would start raising rates this month despite uncertainties stemming from the Ukraine crisis.

The Dow Jones Industrial Average rose 84.56 points, or 0.25 per cent, at the open to 33,379.51.

The S&P 500 opened higher by 16.30 points, or 0.38 per cent, at 4,322.56, while the Nasdaq Composite gained 65.07 points, or 0.48 per cent, to 13,597.53 at the opening bell.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The Toronto Stock Exchange’s S&P/TSX composite index was up 117.07 points, or 0.56 per cent, at 21,121.58.

8:26 a.m.

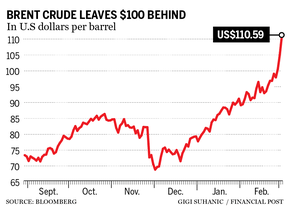

Whoa, oil prices are getting crazy.

Brent crude spiked higher this morning touching $113.02 – its highest since 2014 — and U.S. crude came close to passing its 2013 peak as traders scrambled to find alternatives to Russian oil in an already tight market.

But according to some economists, it’s possible we ain’t seen nothing yet.

If the conflict escalates and Russian exports are choked off altogether, oil could rise to a range of US$120 to US$140, says Capital Economics.

Capital also had a few thoughts on gold, which it expects will climb higher in coming weeks and months because of safe-haven demand. It forecasts that gold will remain firmly above US$2,000 an ounce in the first half of this year, but if there is an escalation in the conflict the yellow metal could soar to US$2,500.

Gold was down this morning, pressured by a higher U.S. dollar and yields, at US$1,924.00 per ounce.

Additional reporting by Reuters and Bloomberg

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.