Portfolio manager with 50 years of experience shares 1970s bear-market lesson, plus three stocks to buy now

A previous version of this column gave the incorrect date for the Fed policy decision. The story has been corrected.

Investors looking at their screens this morning might feel a bit of relief, with oil prices easing off and stock futures pointing to a rally. That’s tied to fresh hopes talks between Russia and Ukraine will actually get somewhere this week, as the humanitarian disaster only worsens.

These challenging times make it all the more worthwhile to listen to what market veterans have to say. Our call of the day is from Charlie Dreifus, portfolio manager at Royce Investment Partners, who offers bear-market advice from his 54 years of experience (thanks to Hedge Fund Tips).

In a recent interview posted on Royce’s website, he recalled working as a young pension fund manager in 1972-75. “And this was at a time when, much like the FANG stocks of today, there was an anointed group that sold at very high valuations,” said Dreifus.

He was referring to the Nifty Fifty, a group of high growth stocks — McDonald’s MCD,

“And he says to me, ‘Charlie, hold your horses. This is the beginning of a bear market. What you’ve got to do is pace your purchases, dollar cost average. You don’t know how long this is going to take.’”

That led to him learning about the value of pyramids in investing. “What you do is you buy, think of the top of the pyramid, you buy a little. And as the price declines, you buy more. And on days that market goes up, you stop buying, on the presumption it’s going to down tomorrow or the day after,” he said.

The Special Equity fund RYSEX,

He also offered up three stock ideas, as he admitted they weren’t easy to find, with valuations still high even after the recent market pullback.

First up is tax preparer H&R Block HRB,

Dreifus also likes local TV provider Tegna TGNA,

Huntsman HUN,

“We will not buy a stock because it’s in play or there’s activist talks. It must be a good investment first. But we’re finding, as I said, increasing instances of this,” said Dreifus.

The buzz

Talks between Russia and Ukraine resumed on Monday, as violence continued and dozens were killed from a deadly attack on a military training center near the Polish border. And Washington and Beijing security officials will meet in Rome, with allegations that Russia asked China for military help high on the agenda.

Russian prosecutors have warned executives at Western businesses such as McDonald’s MCD,

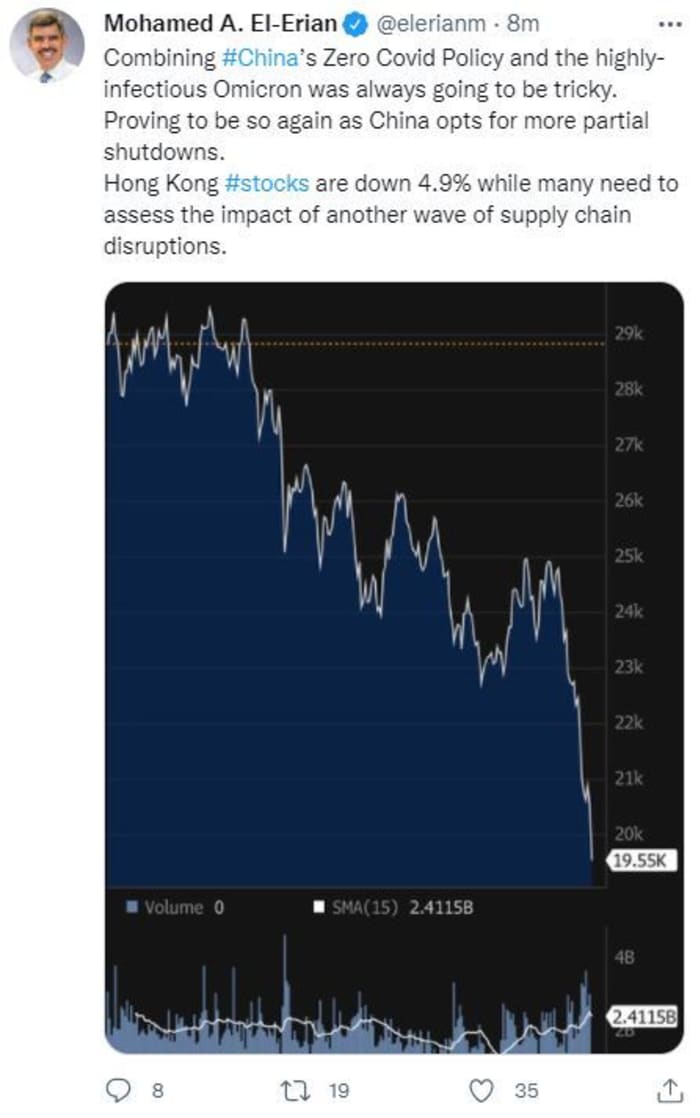

Spreading COVID-19 cases have forced a lockdown of the Chinese tech hub Shenzhen, closing production at Apple AAPL,

And Pfizer’s PFE,

Economic highlights this week include retail sales and a Federal Reserve decision on Wednesday, with the first interest-rate increase expected since late 2018. The Bank of England and Bank of Japan will also meet this week.

Read: ‘Unprecedented territory’: Investors watch for Fed rate hike amid high market volatility

The chart

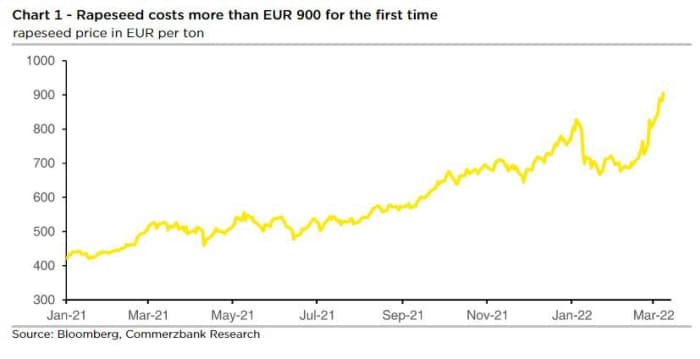

Add rapeseed to the list of commodities whose prices are surging following Russia’s brutal invasion of its neighbor.

“The Ukraine war is driving up the rapeseed price because 80% of the world’s sunflower oil supplies come from the Black Sea region, so demand is now growing for alternative vegetable oils such as rapeseed oil,” notes Commerzbank analyst Carsten Fritsch, who provides this chart:

“Rapeseed is being lent additional tailwind by the sharp rise in oil prices, as this is also pushing up prices of biofuels such as biodiesel, in which rapeseed oil is used,” said the analyst in a note.

Canada and China are big producers, along with several European countries, as well as Ukraine.

The markets

Stock futures ES00,

Top tickers

These were the top-traded tickers on MarketWatch as of 6 a.m. Eastern Time:

Random reads

A global IT army of 400,000 international hackers is joining Ukraine’s battle against the Russian invasion.

The 300-year old “Wizard of Oz” violin is up for auction.

Those looking forward to NFL star Tom Brady’s retirement will be bitterly disappointed.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.